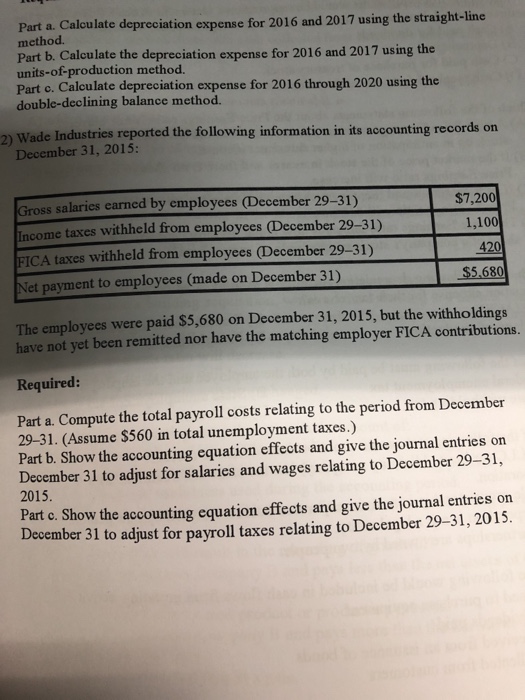

Part a. Calcu late depreciation expense for 2016 and 2017 using the straight-line method. Part b. Calculate the depreciation expense for 2016 and 2017 using the units-of-production method. Part c. Calculate depreciation expense for 2016 through 2020 using the double-declining balance method. 2) Wade Industries reported the following information in its accounting records on December 31, 2015: Gross salaries earned by employees (December 29-31) ncome taxes withheld from employees (December 29-31) FICA taxes withheld from employees (December 29-31) Net payment to employees (made on December 31) $7,200 1,100 420 $5.680 The employees were paid $5,680 on December 31, 2015, but the withholdings have not yet been remitted nor have the matching employer FICA contributions. Required: Part a. Compute the total payroll costs relating to the period from December 29-31. (Assume $560 in total unemployment taxes.) Part b. Show the accounting equation effects and give the journal entries on December 31 to adjust for salaries and wages relating to December 29-31, 2015. Part c. Show the accounting equation effects and give the journal entries on December 31 to adjust for payroll taxes relating to December 29-31, 2015 Part a. Calcu late depreciation expense for 2016 and 2017 using the straight-line method. Part b. Calculate the depreciation expense for 2016 and 2017 using the units-of-production method. Part c. Calculate depreciation expense for 2016 through 2020 using the double-declining balance method. 2) Wade Industries reported the following information in its accounting records on December 31, 2015: Gross salaries earned by employees (December 29-31) ncome taxes withheld from employees (December 29-31) FICA taxes withheld from employees (December 29-31) Net payment to employees (made on December 31) $7,200 1,100 420 $5.680 The employees were paid $5,680 on December 31, 2015, but the withholdings have not yet been remitted nor have the matching employer FICA contributions. Required: Part a. Compute the total payroll costs relating to the period from December 29-31. (Assume $560 in total unemployment taxes.) Part b. Show the accounting equation effects and give the journal entries on December 31 to adjust for salaries and wages relating to December 29-31, 2015. Part c. Show the accounting equation effects and give the journal entries on December 31 to adjust for payroll taxes relating to December 29-31, 2015