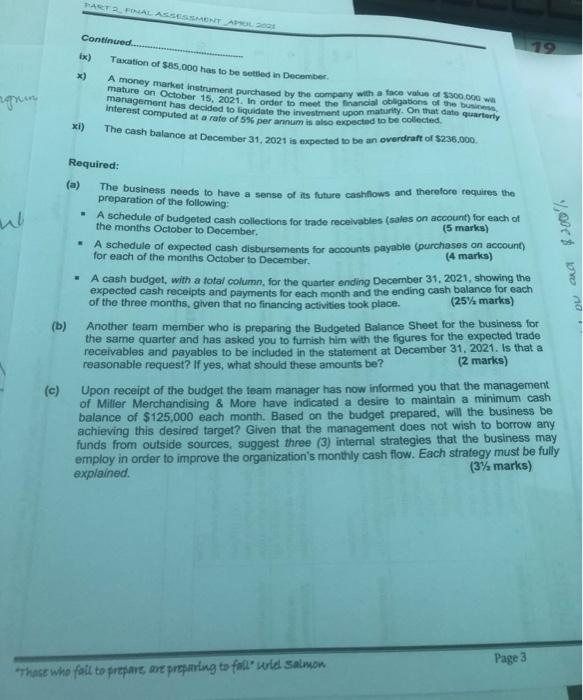

HARTRIAL ASSESSMENT AL 200 Continued... ix) Taxation of $85,000 has to be settled in December grim A money market instrument purchased by the company with a face value of $300.000 will management has decided to liquidate the investment upon maturity. On that date quarterly interest computed at a rate of 5% per annum is also expected to be collected xi) The cash balance at December 31, 2021 is expected to be an overdraft of $236.000 Required: 2,00 DUA (a) The business needs to have a sense of its future cashflows and therefore requires the preparation of the following: * Aschedule of budgeted cash collections for trade receivables (sales on account for each of the months October to December ) - A schedule of expected cash disbursements for accounts payable (purchases on account) for each of the months October to December (4 marks) - A cash budget, with a total column, for the quarter ending December 31, 2021, showing the expected cash receipts and payments for each month and the ending cash balance for each of the three months, given that no financing activities took place. (25% marks) (b) Another team member who is preparing the Budgeted Balance Sheet for the business for the same quarter and has asked you to furnish him with the figures for the expected trade receivables and payables to be included in the statement at December 31, 2021. Is that a reasonable request? If yes, what should these amounts be? (2 marks) (c) Upon receipt of the budget the team manager has now informed you that the management of Miller Merchandising & More have indicated a desire to maintain a minimum cash balance of $125,000 each month. Based on the budget prepared, will the business be achieving this desired target? Given that the management does not wish to borrow any funds from outside sources, suggest three (3) internal strategies that the business may employ in order to improve the organization's monthly cash flow. Each strategy must be fully explained (3% marks) Page 3 "Thace who fell to prepare, are preparing to fall wld Salmon HARTRIAL ASSESSMENT AL 200 Continued... ix) Taxation of $85,000 has to be settled in December grim A money market instrument purchased by the company with a face value of $300.000 will management has decided to liquidate the investment upon maturity. On that date quarterly interest computed at a rate of 5% per annum is also expected to be collected xi) The cash balance at December 31, 2021 is expected to be an overdraft of $236.000 Required: 2,00 DUA (a) The business needs to have a sense of its future cashflows and therefore requires the preparation of the following: * Aschedule of budgeted cash collections for trade receivables (sales on account for each of the months October to December ) - A schedule of expected cash disbursements for accounts payable (purchases on account) for each of the months October to December (4 marks) - A cash budget, with a total column, for the quarter ending December 31, 2021, showing the expected cash receipts and payments for each month and the ending cash balance for each of the three months, given that no financing activities took place. (25% marks) (b) Another team member who is preparing the Budgeted Balance Sheet for the business for the same quarter and has asked you to furnish him with the figures for the expected trade receivables and payables to be included in the statement at December 31, 2021. Is that a reasonable request? If yes, what should these amounts be? (2 marks) (c) Upon receipt of the budget the team manager has now informed you that the management of Miller Merchandising & More have indicated a desire to maintain a minimum cash balance of $125,000 each month. Based on the budget prepared, will the business be achieving this desired target? Given that the management does not wish to borrow any funds from outside sources, suggest three (3) internal strategies that the business may employ in order to improve the organization's monthly cash flow. Each strategy must be fully explained (3% marks) Page 3 "Thace who fell to prepare, are preparing to fall wld Salmon