Answered step by step

Verified Expert Solution

Question

1 Approved Answer

**Solve all four otherwise don't solve. If you provide wrong solution then i will dislike and report you. No more information is needed** ** Don't

**Solve all four otherwise don't solve. If you provide wrong solution then i will dislike and report you. No more information is needed**

** Don't waste my question. Don't solve if you don't know .*

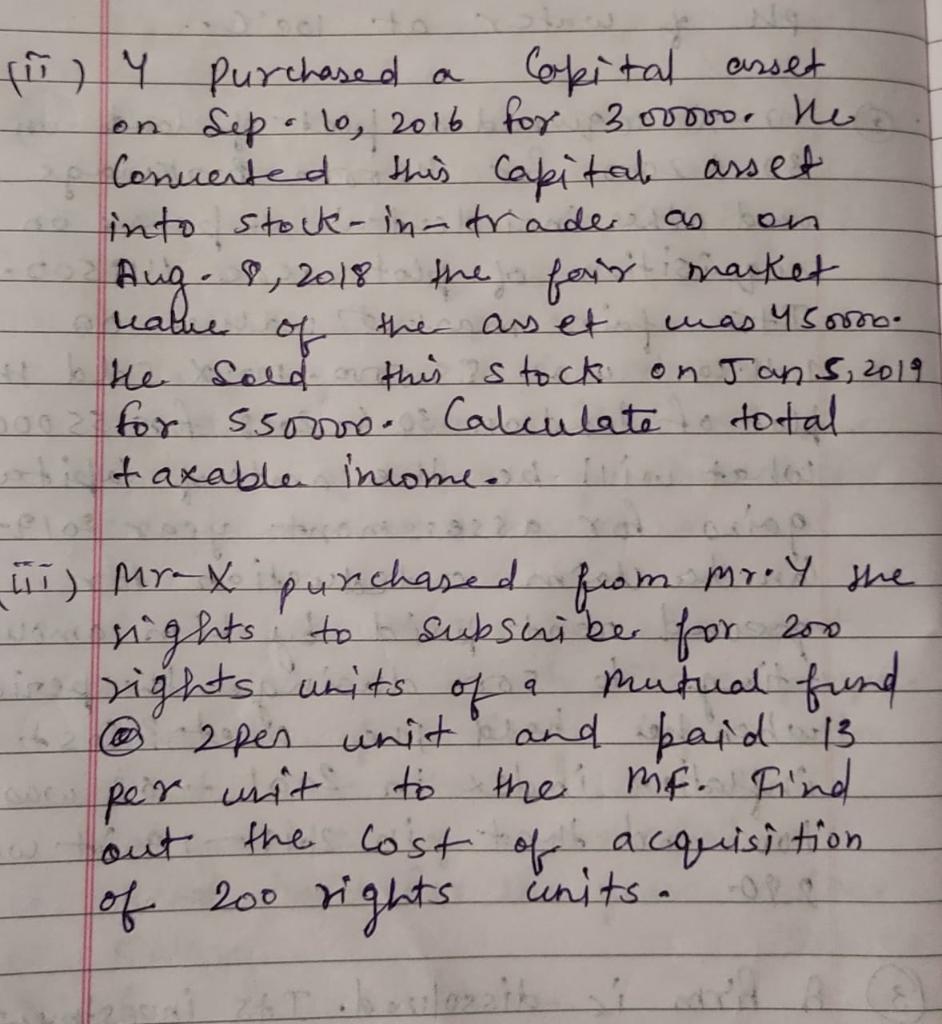

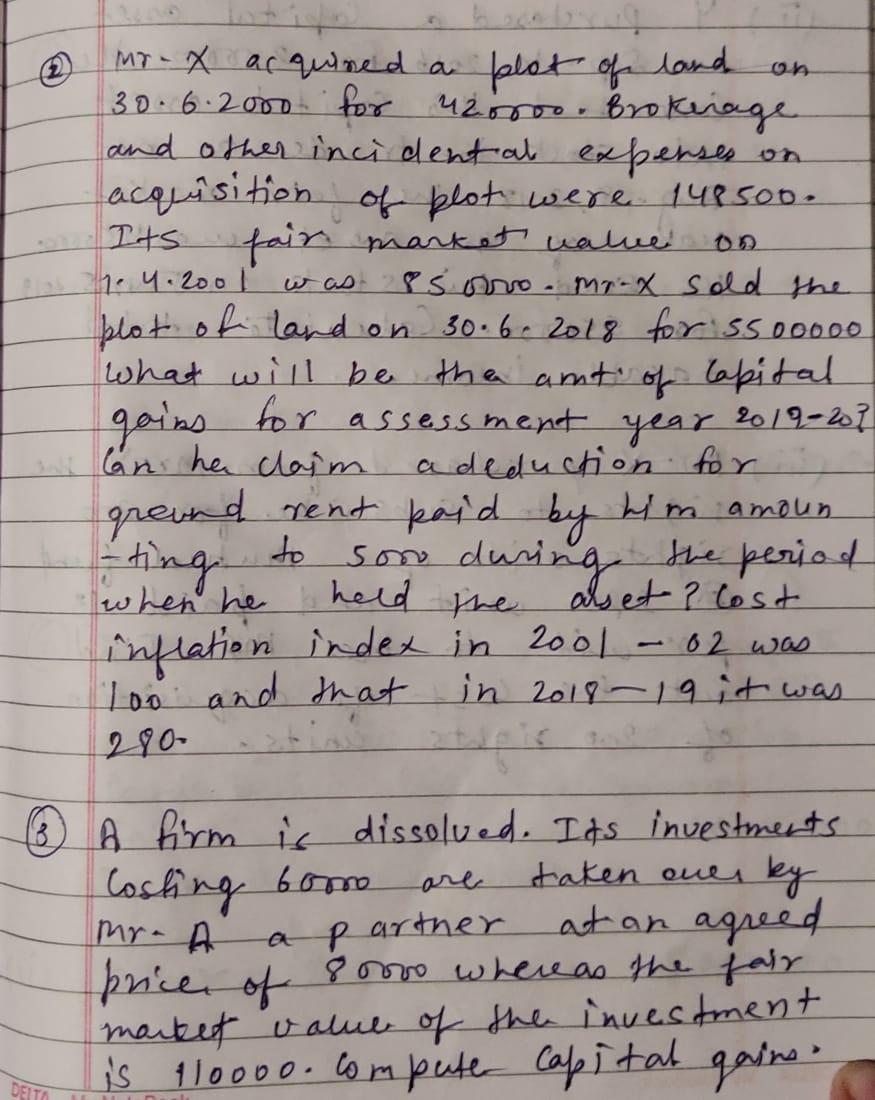

(n) y purchased Capital asset on Sep. 1o, 2016 for 3 orroo, the Conuerted this Capital asset into stock-in-trader the faring market ualue the as et was usor. the Sold this stock on Jans, 2019 2002 for ssor Calculate total orbi taxable income. i llin Aug. 8, 2018 ii) Mrax purchased from mr. Y the nights to subsuiker for 200 in rights units of a mutual fund . 2pn unit and paid 13 ar per unit to the mf. Find out the cost of acquisition of 200 rights units. plot of land 148500. was . mr-x acquired a 30.6.2000 for 420000. Brokerage and other incident at expenses acquisition of plot were. Its fair market value 1.4.2001 8 sono mo-x sold the plot of land on 30.6.2018 for ss00000 What will be the amt of capital goins for assessment year 2012-20? lan he claim a deduction for greund rent paid by him amoun to son during the period when he held the als et ? Cost inflation index in 2001 - 02 was 100 and that in 2018-19 it was 290- -ting to Mr. A 6 A firm is dissolved. Its investments taken over by at an agreed price of 8 orro whereas the fair market value of the investment is 110000.compute capital gains Costing bomo a partner . DELTAStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started