Answered step by step

Verified Expert Solution

Question

1 Approved Answer

has a debt equity ratio of 31 . b. Both properties have more debt than equity. The creditors generally will not be happy, but they

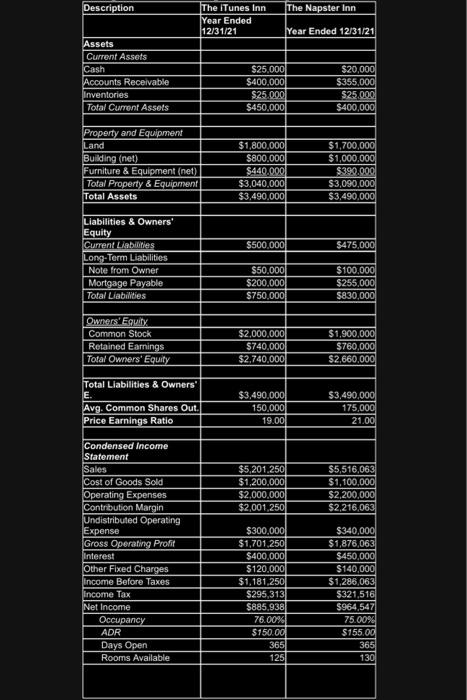

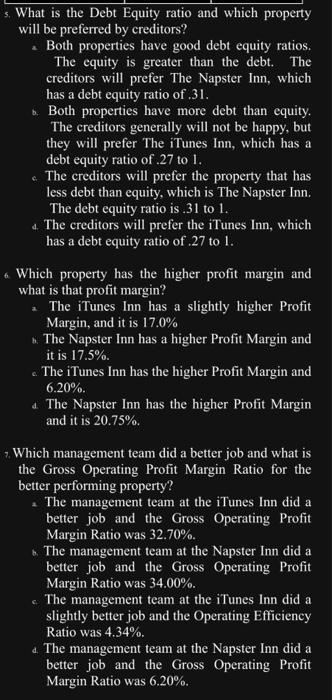

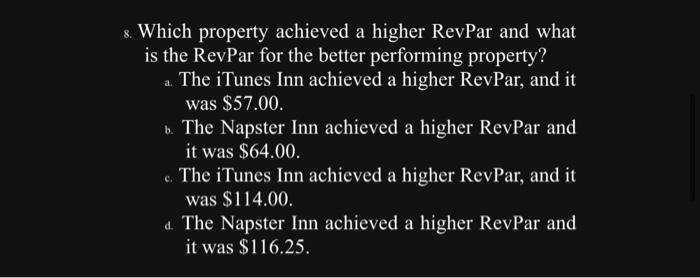

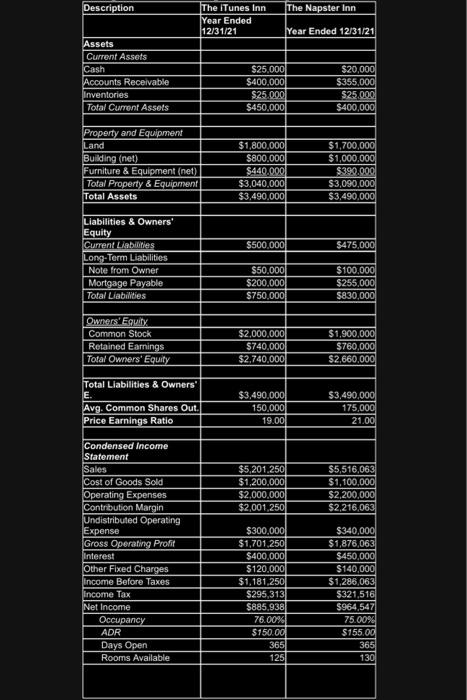

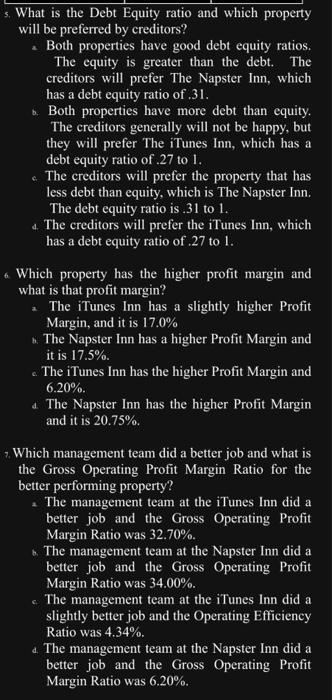

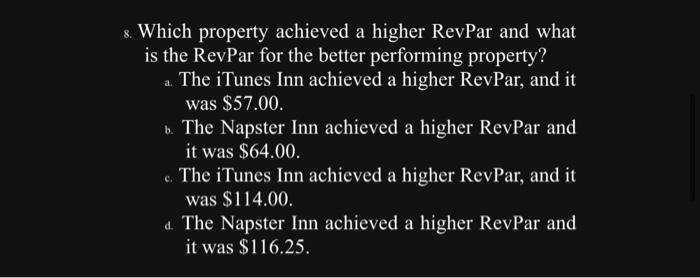

has a debt equity ratio of 31 . b. Both properties have more debt than equity. The creditors generally will not be happy, but they will prefer The iTunes Inn, which has a debt equity ratio of .27 to 1 . c. The creditors will prefer the property that has less debt than equity, which is The Napster Inn. The debt equity ratio is .31 to 1 . 4. The creditors will prefer the iTunes Inn, which has a debt equity ratio of . 27 to 1 . Which property has the higher profit margin and what is that profit margin? * The iTunes Inn has a slightly higher Profit Margin, and it is 17.0% b. The Napster Inn has a higher Profit Margin and it is 17.5%. c. The iTunes Inn has the higher Profit Margin and 6.20% 4. The Napster Inn has the higher Profit Margin and it is 20.75%. 7. Which management team did a better job and what is the Gross Operating Profit Margin Ratio for the better performing property? 2 The management team at the iTunes Inn did a better job and the Gross Operating Profit Margin Ratio was 32.70%. b. The management team at the Napster Inn did a better job and the Gross Operating Profit Margin Ratio was 34.00%. - The management team at the iTunes Inn did a slightly better job and the Operating Efficiency 8. Which property achieved a higher RevPar and what is the RevPar for the better performing property? a. The iTunes Inn achieved a higher RevPar, and it was $57.00. b. The Napster Inn achieved a higher RevPar and it was $64.00. c. The iTunes Inn achieved a higher RevPar, and it was $114.00. d. The Napster Inn achieved a higher RevPar and it was $116.25

has a debt equity ratio of 31 . b. Both properties have more debt than equity. The creditors generally will not be happy, but they will prefer The iTunes Inn, which has a debt equity ratio of .27 to 1 . c. The creditors will prefer the property that has less debt than equity, which is The Napster Inn. The debt equity ratio is .31 to 1 . 4. The creditors will prefer the iTunes Inn, which has a debt equity ratio of . 27 to 1 . Which property has the higher profit margin and what is that profit margin? * The iTunes Inn has a slightly higher Profit Margin, and it is 17.0% b. The Napster Inn has a higher Profit Margin and it is 17.5%. c. The iTunes Inn has the higher Profit Margin and 6.20% 4. The Napster Inn has the higher Profit Margin and it is 20.75%. 7. Which management team did a better job and what is the Gross Operating Profit Margin Ratio for the better performing property? 2 The management team at the iTunes Inn did a better job and the Gross Operating Profit Margin Ratio was 32.70%. b. The management team at the Napster Inn did a better job and the Gross Operating Profit Margin Ratio was 34.00%. - The management team at the iTunes Inn did a slightly better job and the Operating Efficiency 8. Which property achieved a higher RevPar and what is the RevPar for the better performing property? a. The iTunes Inn achieved a higher RevPar, and it was $57.00. b. The Napster Inn achieved a higher RevPar and it was $64.00. c. The iTunes Inn achieved a higher RevPar, and it was $114.00. d. The Napster Inn achieved a higher RevPar and it was $116.25

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started