Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hat will be the total value of the firm? OS CIC (6 marks) (c) Suppose now that Raby can hedge its euro exposure with a

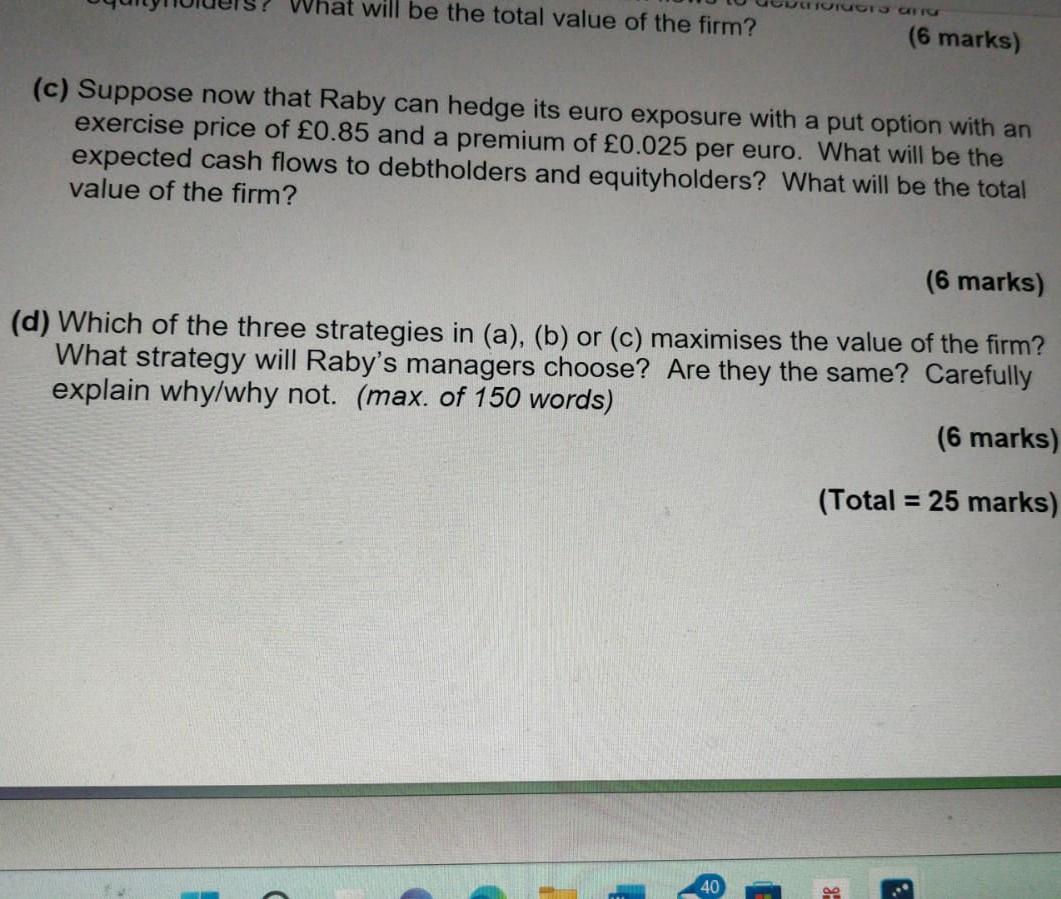

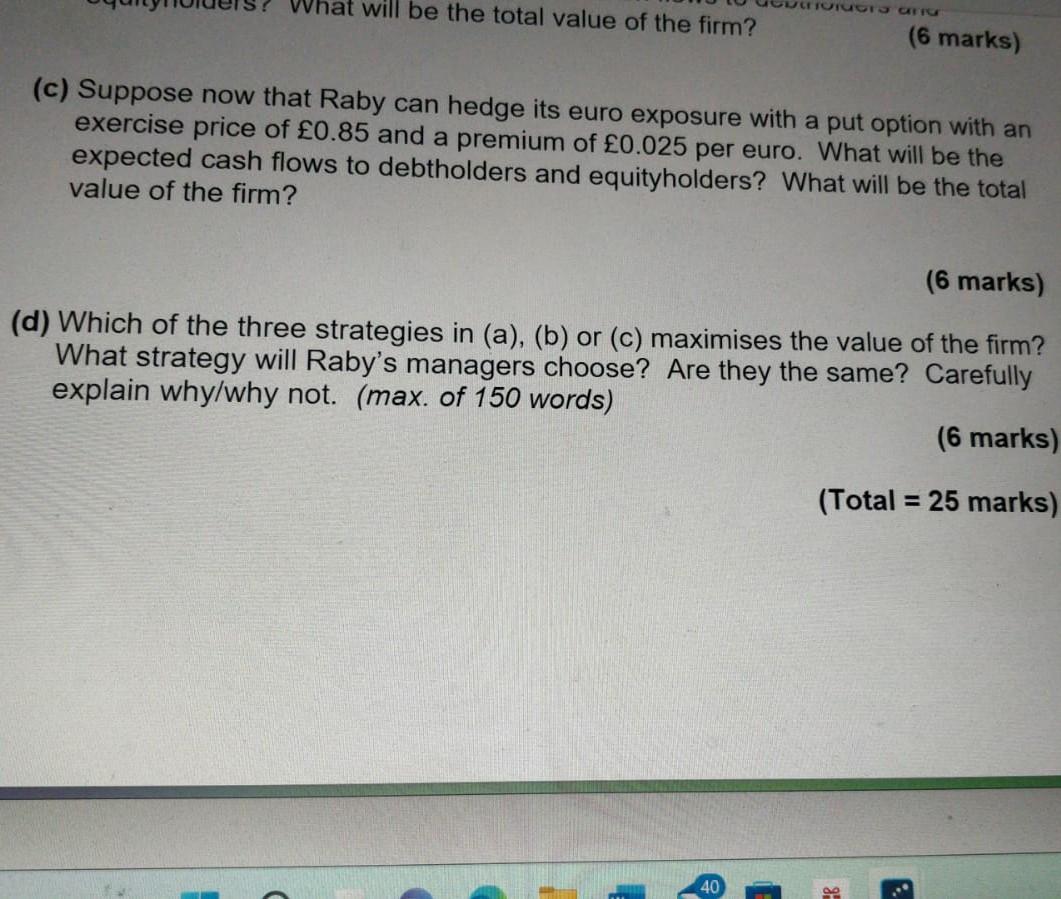

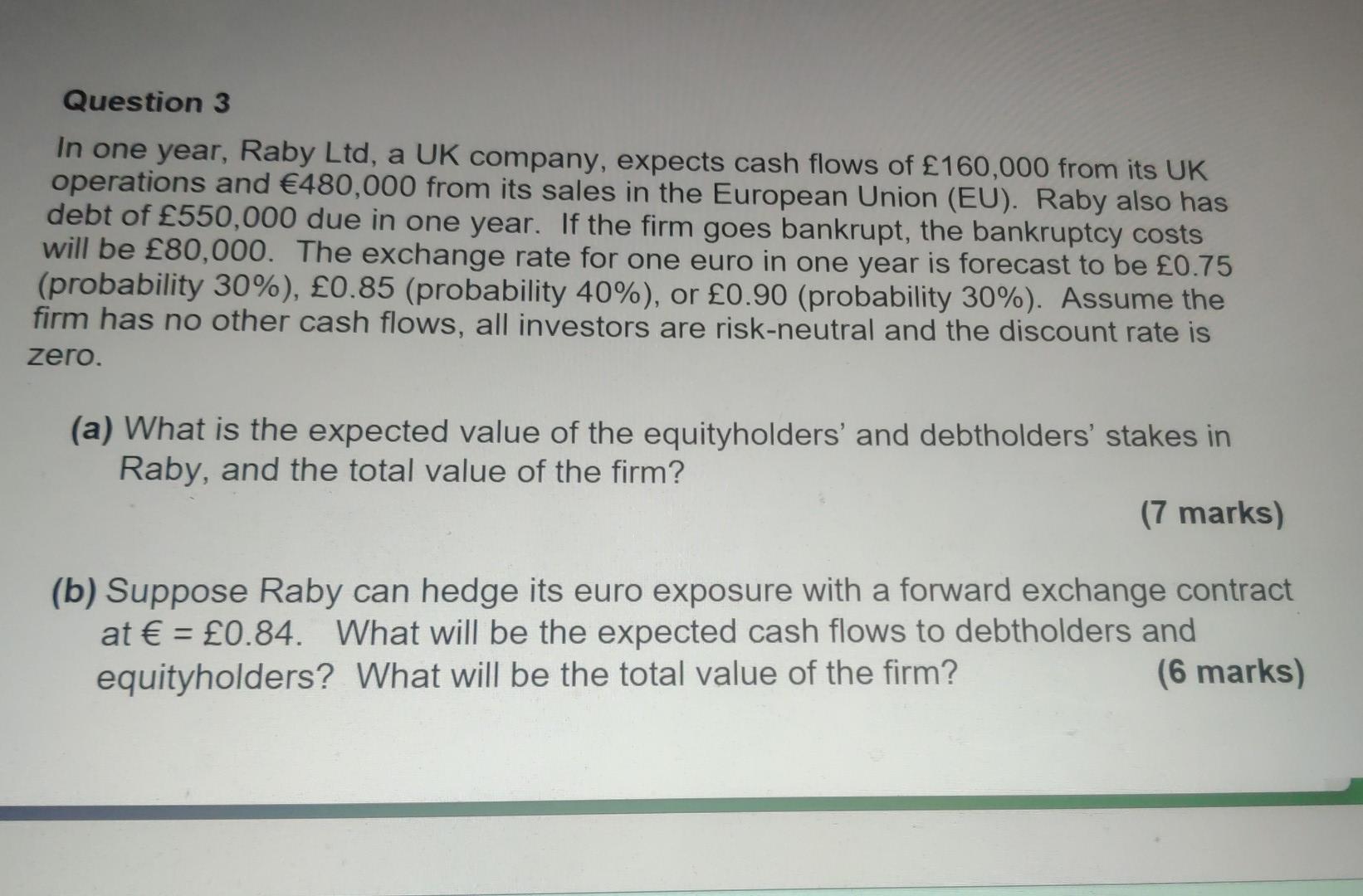

hat will be the total value of the firm? OS CIC (6 marks) (c) Suppose now that Raby can hedge its euro exposure with a put option with an exercise price of 0.85 and a premium of 0.025 per euro. What will be the expected cash flows to debtholders and equityholders? What will be the total value of the firm? (6 marks) (d) Which of the three strategies in (a), (b) or (c) maximises the value of the firm? What strategy will Raby's managers choose? Are they the same? Carefully explain why/why not. (max. of 150 words) (6 marks) (Total = 25 marks) 40 91 hat will be the total value of the firm? OS CIC (6 marks) (c) Suppose now that Raby can hedge its euro exposure with a put option with an exercise price of 0.85 and a premium of 0.025 per euro. What will be the expected cash flows to debtholders and equityholders? What will be the total value of the firm? (6 marks) (d) Which of the three strategies in (a), (b) or (c) maximises the value of the firm? What strategy will Raby's managers choose? Are they the same? Carefully explain why/why not. (max. of 150 words) (6 marks) (Total = 25 marks) 40 91 Question 3 In one year, Raby Ltd, a UK company, expects cash flows of 160,000 from its UK operations and 480,000 from its sales in the European Union (EU). Raby also has debt of 550,000 due in one year. If the firm goes bankrupt, the bankruptcy costs will be 80,000. The exchange rate for one euro in one year is forecast to be 0.75 (probability 30%), 0.85 (probability 40%), or 0.90 (probability 30%). Assume the firm has no other cash flows, all investors are risk-neutral and the discount rate is zero. (a) What is the expected value of the equityholders' and debtholders' stakes in Raby, and the total value of the firm? (7 marks) (b) Suppose Raby can hedge its euro exposure with a forward exchange contract at = 0.84. What will be the expected cash flows to debtholders and equityholders? What will be the total value of the firm? (6 marks) = hat will be the total value of the firm? OS CIC (6 marks) (c) Suppose now that Raby can hedge its euro exposure with a put option with an exercise price of 0.85 and a premium of 0.025 per euro. What will be the expected cash flows to debtholders and equityholders? What will be the total value of the firm? (6 marks) (d) Which of the three strategies in (a), (b) or (c) maximises the value of the firm? What strategy will Raby's managers choose? Are they the same? Carefully explain why/why not. (max. of 150 words) (6 marks) (Total = 25 marks) 40 91 hat will be the total value of the firm? OS CIC (6 marks) (c) Suppose now that Raby can hedge its euro exposure with a put option with an exercise price of 0.85 and a premium of 0.025 per euro. What will be the expected cash flows to debtholders and equityholders? What will be the total value of the firm? (6 marks) (d) Which of the three strategies in (a), (b) or (c) maximises the value of the firm? What strategy will Raby's managers choose? Are they the same? Carefully explain why/why not. (max. of 150 words) (6 marks) (Total = 25 marks) 40 91 Question 3 In one year, Raby Ltd, a UK company, expects cash flows of 160,000 from its UK operations and 480,000 from its sales in the European Union (EU). Raby also has debt of 550,000 due in one year. If the firm goes bankrupt, the bankruptcy costs will be 80,000. The exchange rate for one euro in one year is forecast to be 0.75 (probability 30%), 0.85 (probability 40%), or 0.90 (probability 30%). Assume the firm has no other cash flows, all investors are risk-neutral and the discount rate is zero. (a) What is the expected value of the equityholders' and debtholders' stakes in Raby, and the total value of the firm? (7 marks) (b) Suppose Raby can hedge its euro exposure with a forward exchange contract at = 0.84. What will be the expected cash flows to debtholders and equityholders? What will be the total value of the firm? (6 marks) =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started