Question

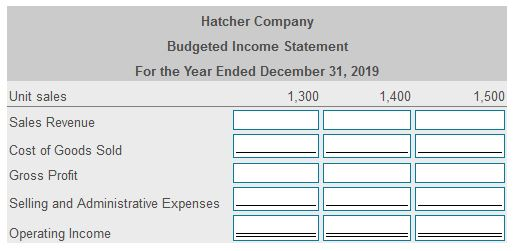

Hatcher Company prepared the following budgeted income statement for 2019: Requirement 1. Prepare a budgeted income statement with columns for 1, 300 units, 1,400 units,

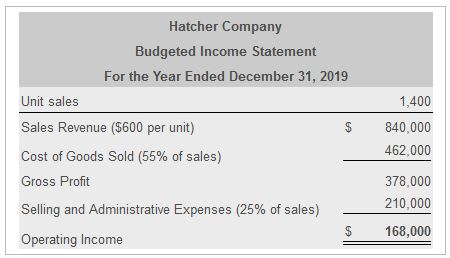

Hatcher Company prepared the following budgeted income statement for 2019:

Requirement 1. Prepare a budgeted income statement with columns for 1, 300 units, 1,400 units, and 1,500 units sold.

Requirement 2. How might managers use this type of budgeted income statement?

The budgeted income statement prepared in Requirement 1 is a (flexible or static) budget. It allows Hatcher's managers to plan for (only a single or various) sales level(s).

Requirement 3. How might spreadsheet software such as Excel assist in this type of analysis?

Technology, such as Excel spreadhseet software, makes it more (cost effective or time consuming) to conduct (financial statement analysis sensitivity or "what-if" analysis)

and prepare a company's (annual report. or master budget.)

If managers have a better understanding of how changes in sales volume and costs are likely to affect (net income or the annual report) they can ( maintain the same course of action or react quickly and make changes) if key assumptions turn out to be wrong.

Hatcher Company Budgeted Income Statement For the Year Ended December 31, 2019 Unit sales Sales Revenue ($600 per unit) Cost of Goods Sold (55% of sales) Gross Profit Selling and Administrative Expenses (25% of sales) Operating Income 1,400 840,000 462,000 378,000 210,000 $ 168,000 Hatcher Company Budgeted Income Statement For the Year Ended December 31, 2019 1,300 1,400 Unit sales Sales Revenue Cost of Goods Sold Gross Profit 1,500 Selling and Administrative Expenses Operating Income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started