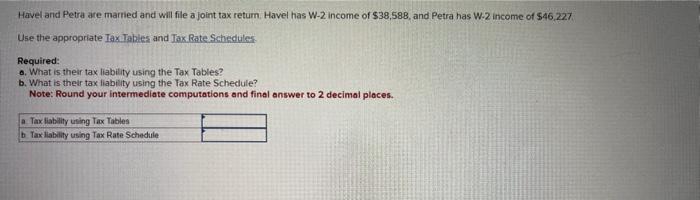

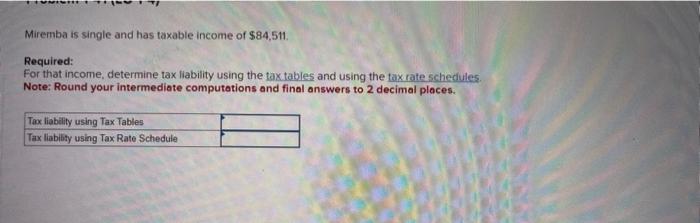

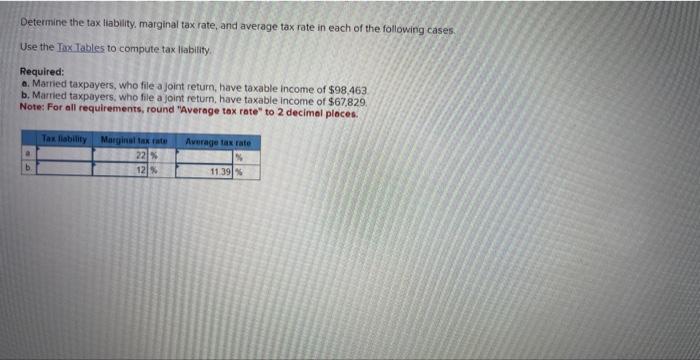

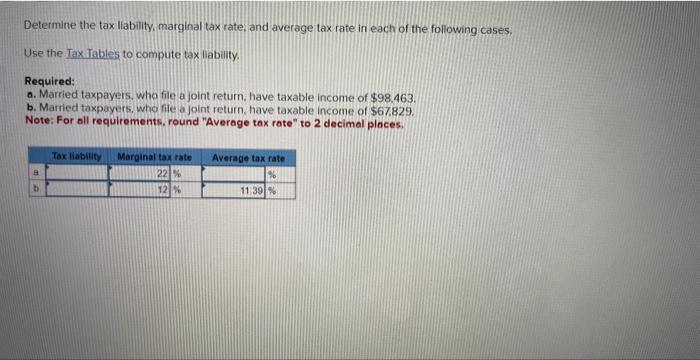

Havel and Petra are marned and wil file a joint tax return. Havel has W-2 income of $38,588, and Petra has W-2 income of $46,227. Use the appropriate Iax Tables and Tax Rate Schedules Required: a. What is their tax liability using the Tax Tables? b. What is their tax liability using the Tax Rate Schedule? Note: Round your intermediate computations and final answer to 2 decimal places. Miremba is single and has taxable income of $84,511. Required: For that income, determine tax liability using the tax tables and using the tax rate schedules. Note: Round your intermediate computations and final answers to 2 decimal places. Deteimine the tax liability. marginal tax rate, and average tax rate in each of the following cases. Use the Tax Tables to compute tax liability. Required: o. Marned taxpayers, who file a joint return, have taxable income of $98.463. b. Married taxpayers, who file a joint return, have taxable income of $67.829. Note: For all requirements, round "Average tax rate" to 2 decimal ploces. Determine the tax liability, marginal tax rate, and average tax rate in each of the following cases. Use the Tax Tables to compute tax liability. Required: a. Married taxpayers, who file a joint return, have taxable income of $98.463. b. Married taxpayers, who file a joint return, have taxable income of $67.829. Note: For all requirements, round "Average tax rate" to 2 decimal places. Havel and Petra are marned and wil file a joint tax return. Havel has W-2 income of $38,588, and Petra has W-2 income of $46,227. Use the appropriate Iax Tables and Tax Rate Schedules Required: a. What is their tax liability using the Tax Tables? b. What is their tax liability using the Tax Rate Schedule? Note: Round your intermediate computations and final answer to 2 decimal places. Miremba is single and has taxable income of $84,511. Required: For that income, determine tax liability using the tax tables and using the tax rate schedules. Note: Round your intermediate computations and final answers to 2 decimal places. Deteimine the tax liability. marginal tax rate, and average tax rate in each of the following cases. Use the Tax Tables to compute tax liability. Required: o. Marned taxpayers, who file a joint return, have taxable income of $98.463. b. Married taxpayers, who file a joint return, have taxable income of $67.829. Note: For all requirements, round "Average tax rate" to 2 decimal ploces. Determine the tax liability, marginal tax rate, and average tax rate in each of the following cases. Use the Tax Tables to compute tax liability. Required: a. Married taxpayers, who file a joint return, have taxable income of $98.463. b. Married taxpayers, who file a joint return, have taxable income of $67.829. Note: For all requirements, round "Average tax rate" to 2 decimal places