Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Having a bit a trouble with these questions. Appreciate any help explaining the process, Thank you! Scrimshander, Inc. is a shipping company, transporting goods using

Having a bit a trouble with these questions. Appreciate any help explaining the process, Thank you!

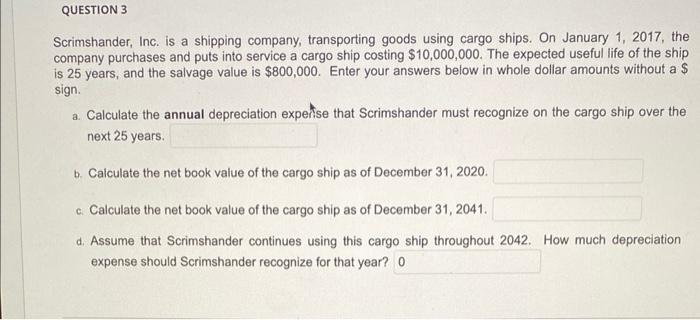

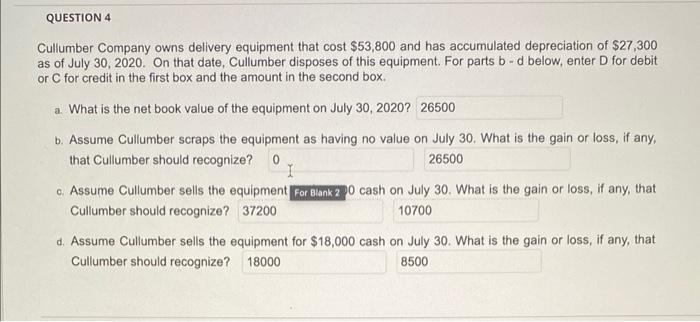

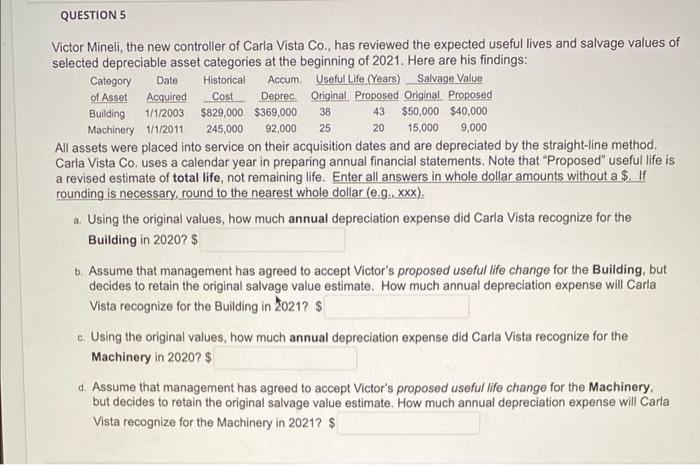

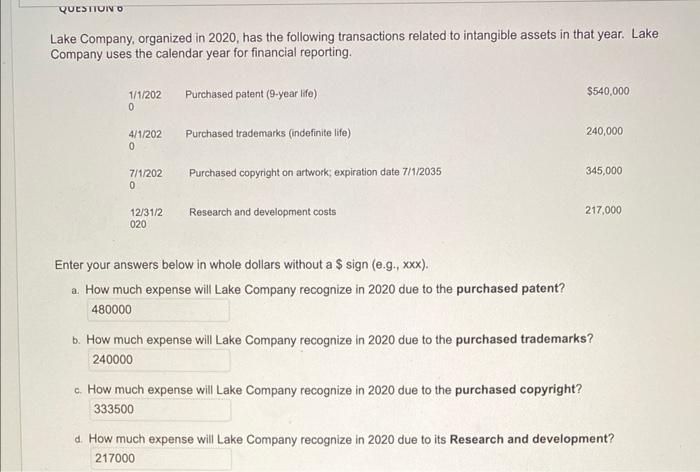

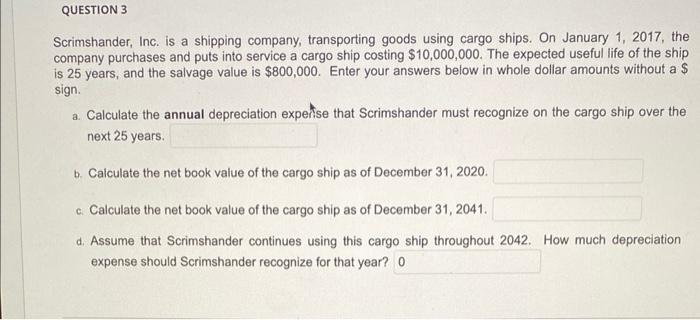

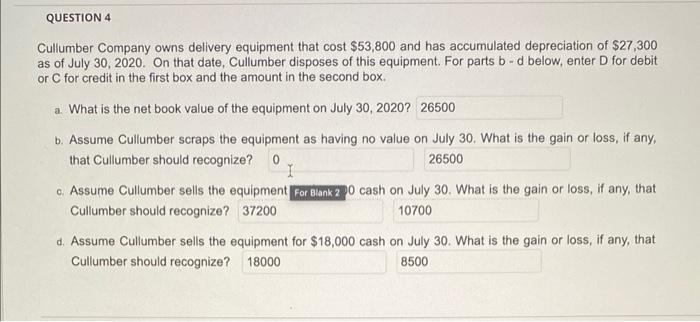

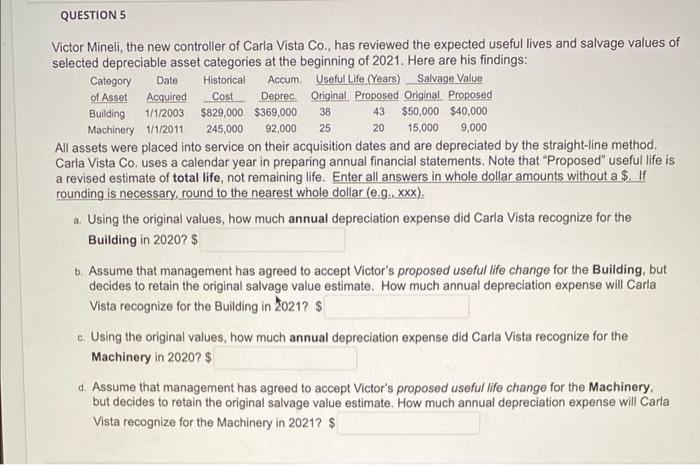

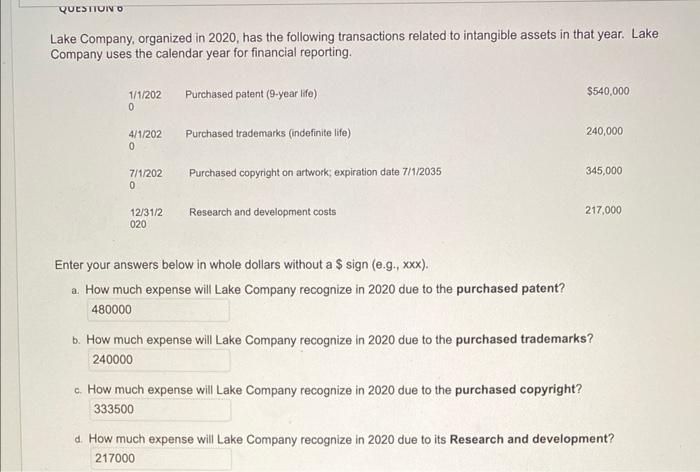

Scrimshander, Inc. is a shipping company, transporting goods using cargo ships. On January 1, 2017, the company purchases and puts into service a cargo ship costing $10,000,000. The expected useful life of the ship is 25 years, and the salvage value is $800,000. Enter your answers below in whole dollar amounts without a $ sign. a. Calculate the annual depreciation expentse that Scrimshander must recognize on the cargo ship over the next 25 years. b. Calculate the net book value of the cargo ship as of December 31,2020. c. Calculate the net book value of the cargo ship as of December 31,2041. d. Assume that Scrimshander continues using this cargo ship throughout 2042. How much depreciation expense should Scrimshander recognize for that year? Cullumber Company owns delivery equipment that cost $53,800 and has accumulated depreciation of $27,300 as of July 30,2020 . On that date, Cullumber disposes of this equipment. For parts b- d below, enter D for debit or C for credit in the first box and the amount in the second box. a. What is the net book value of the equipment on July 30,2020 ? b. Assume Cullumber scraps the equipment as havina no value on July 30 . What is the gain or loss, if any, that Cullumber should recognize? c. Assume Cullumber sells the equipment For Blank 2 20 cash on July 30 . What is the gain or loss, if any, that Cullumber should recognize? d. Assume Cullumber sells the equipment for $18,000 cash on July 30 . What is the gain or loss, if any, that Cullumber should recognize? Victor Mineli, the new controller of Carla Vista Co., has reviewed the expected useful lives and salvage values of selected depreciable asset categories at the beginning of 2021 . Here are his findings: All assets were placed into service on their acquisition dates and are depreciated by the straight-line method. Carla Vista Co. uses a calendar year in preparing annual financial statements. Note that "Proposed" useful life is a revised estimate of total life, not remaining life. Enter all answers in whole dollar amounts without a \$. If rounding is necessary, round to the nearest whole dollar (e.g., .xxx). a. Using the original values, how much annual depreciation expense did Carla Vista recognize for the Building in 2020? \$ b. Assume that management has agreed to accept Victor's proposed useful life change for the Building, but decides to retain the original salvage value estimate. How much annual depreciation expense will Carla Vista recognize for the Building in 2021 ? \$ c. Using the original values, how much annual depreciation expense did Carla Vista recognize for the Machinery in 2020 ? \$ d. Assume that management has agreed to accept Victor's proposed useful life change for the Machinery, but decides to retain the original salvage value estimate. How much annual depreciation expense will Carla Vista recognize for the Machinery in 2021 ? \$ Lake Company, organized in 2020 , has the following transactions related to intangible assets in that year. Lake Company uses the calendar year for financial reporting. Enter your answers below in whole dollars without a $ sign (e.g., xxx). a. How much expense will Lake Company recognize in 2020 due to the purchased patent? b. How much expense will Lake Company recognize in 2020 due to the purchased trademarks? c. How much expense will Lake Company recognize in 2020 due to the purchased copyright? d. How much expense will Lake Company recognize in 2020 due to its Research and development

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started