Question

Tannenbaum Corporation purchased a truck on March 25, 2023 for $90,000. The truck is estimated to have a salvage value of $3,600 and a

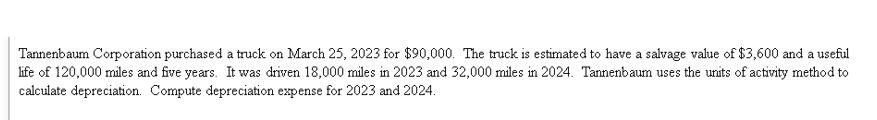

Tannenbaum Corporation purchased a truck on March 25, 2023 for $90,000. The truck is estimated to have a salvage value of $3,600 and a useful life of 120,000 miles and five years. It was driven 18,000 miles in 2023 and 32,000 miles in 2024. Tannenbaum uses the units of activity method to calculate depreciation. Compute depreciation expense for 2023 and 2024.

Step by Step Solution

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Lets calculate it for the truck 1 Depreciable base Cost of truck 90000 Salvage value 3600 De...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Modern Control Systems

Authors: Richard C. Dorf, Robert H. Bishop

12th edition

136024580, 978-0136024583

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App