Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare a worksheet showing the trial balance, adjustments, adjusted trial balance, multi-step income statement (assume utilities, rent, depreciation, and half of the salaries expense as

Prepare a worksheet showing the trial balance, adjustments, adjusted trial balance, multi-step income statement (assume utilities, rent, depreciation, and half of the salaries expense as selling expenses, assume insurance, supplies, and half of the salaries expense as general and administrative expenses), statement of owners' equity, classified balance sheet, prepare the closing entries, and post-closing trial balance

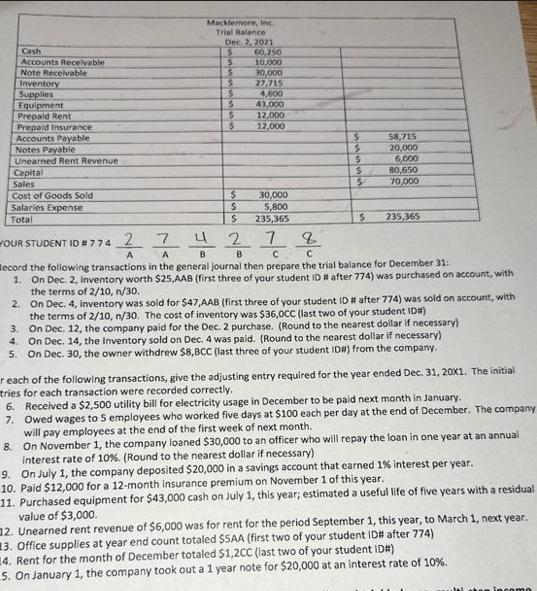

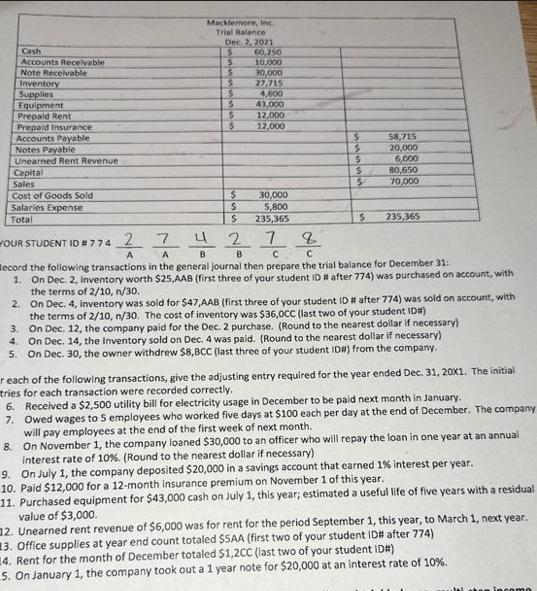

Cash Accounts Receivable Note Receivable Inventory Supplies Equipment Prepaid Rent Prepaid Insurance Accounts Payable Notes Payable Unearned Rent Revenue Capital Sales Cost of Goods Sold Salaries Expense Total Macklemore, Inc. Trial Balance Dec. 2, 2021 3 $ $ $ $ kulutu $ $ $ $ $ 60,250 10,000 30,000 27,715 4,600 43,000 12,000 12,000 30,000 5,800 235,365 OUR STUDENT ID # 774 274 2 7 2 A 55555 $ 58,715 20,000 6,000 80,650 70,000 235,365 A B Record the following transactions in the general journal then prepare the trial balance for December 31: 1. On Dec. 2, inventory worth $25,AAB (first three of your student ID # after 774) was purchased on account, with the terms of 2/10, n/30. 2. On Dec. 4, inventory was sold for $47,AAB (first three of your student ID # after 774) was sold on account, with the terms of 2/10, n/30. The cost of inventory was $36,0CC (last two of your student ID#) 3. On Dec. 12, the company paid for the Dec. 2 purchase. (Round to the nearest dollar if necessary) 4. On Dec. 14, the Inventory sold on Dec. 4 was paid. (Round to the nearest dollar if necessary) 5. On Dec. 30, the owner withdrew $8,BCC (last three of your student ID#) from the company. reach of the following transactions, give the adjusting entry required for the year ended Dec. 31, 20X1. The initial tries for each transaction were recorded correctly. 6. Received a $2,500 utility bill for electricity usage in December to be paid next month in January. 7. Owed wages to 5 employees who worked five days at $100 each per day at the end of December. The company will pay employees at the end of the first week of next month. 8. On November 1, the company loaned $30,000 to an officer who will repay the interest rate of 10%. (Round to the nearest dollar if necessary) in one year at an annual 9. On July 1, the company deposited $20,000 in a savings account that earned 1% interest per year. 10. Paid $12,000 for a 12-month insurance premium on November 1 of this year. 11. Purchased equipment for $43,000 cash on July 1, this year; estimated a useful life of five years with a residual value of $3,000. 12. Unearned rent revenue of $6,000 was for rent for the period September 1, this year, to March 1, next year. 3. Office supplies at year end count totaled $SAA (first two of your student ID# after 774) 4. Rent for the month of December totaled $1,2CC (last two of your student ID#) 5. On January 1, the company took out a 1 year note for $20,000 at an interest rate of 10%.

Step by Step Solution

★★★★★

3.31 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Worksheet Account Trial Balance Adjustments Adjusted Trial Balance Income Statement Statement of Own...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started