Answered step by step

Verified Expert Solution

Question

1 Approved Answer

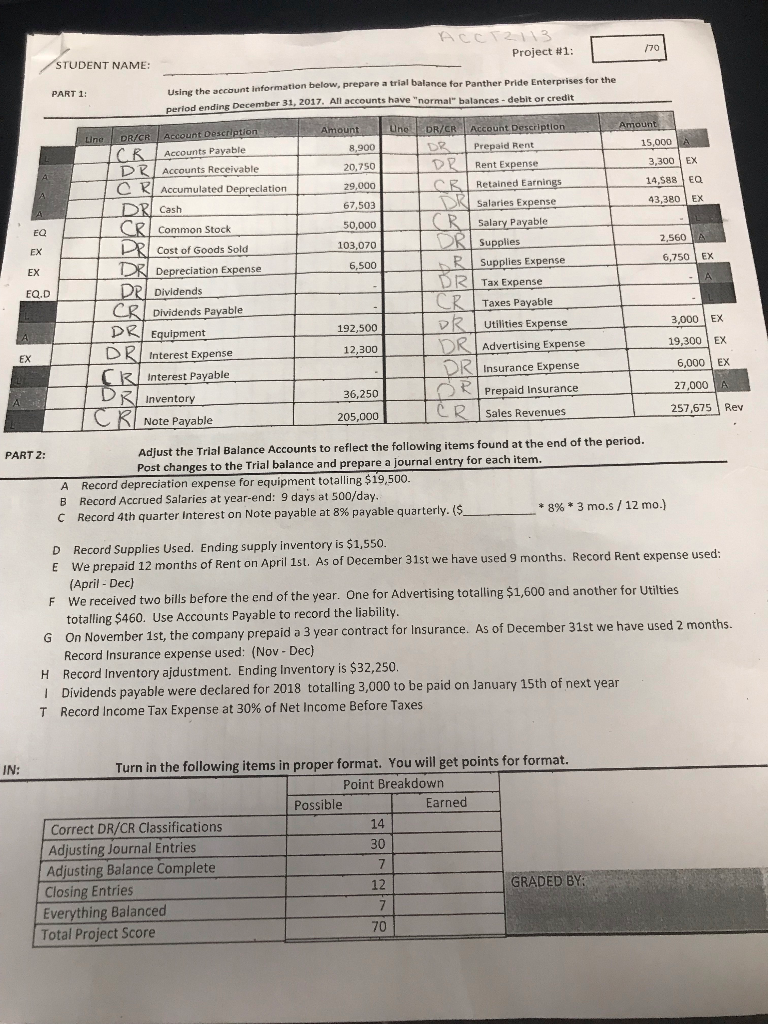

Having trouble with the last 2 pages on Adjusting Journal Entries and Closing Journal Entries STUDENT NAME: Project # 1: PART 1 Using the account

Having trouble with the last 2 pages on Adjusting Journal Entries and Closing Journal Entries

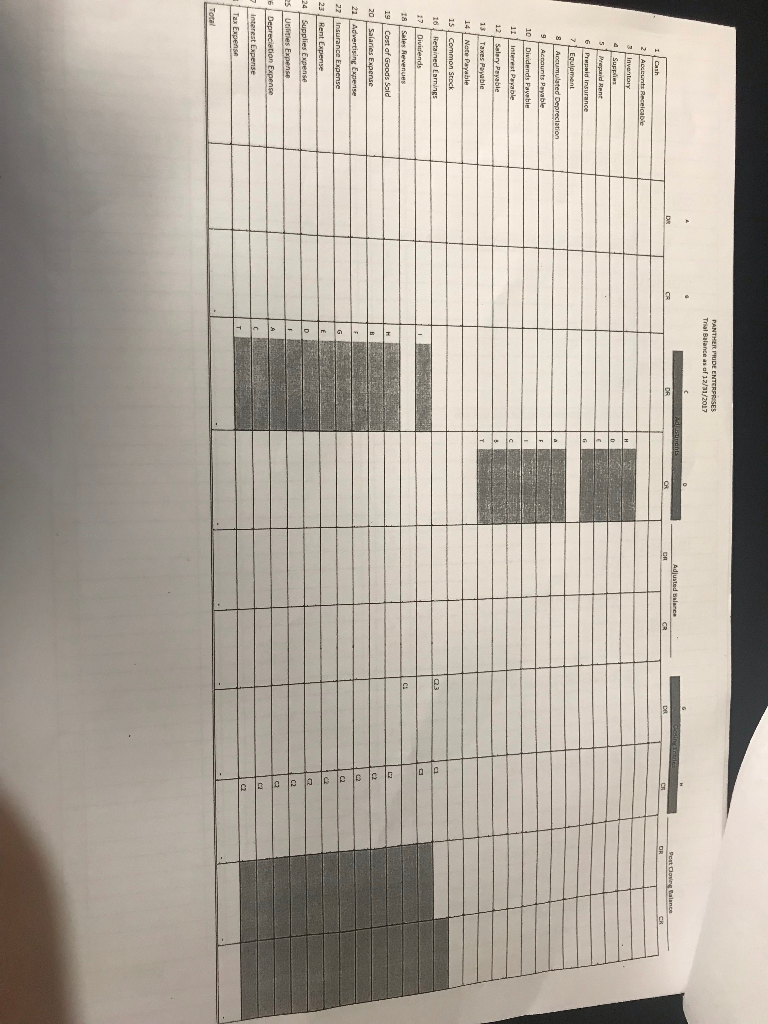

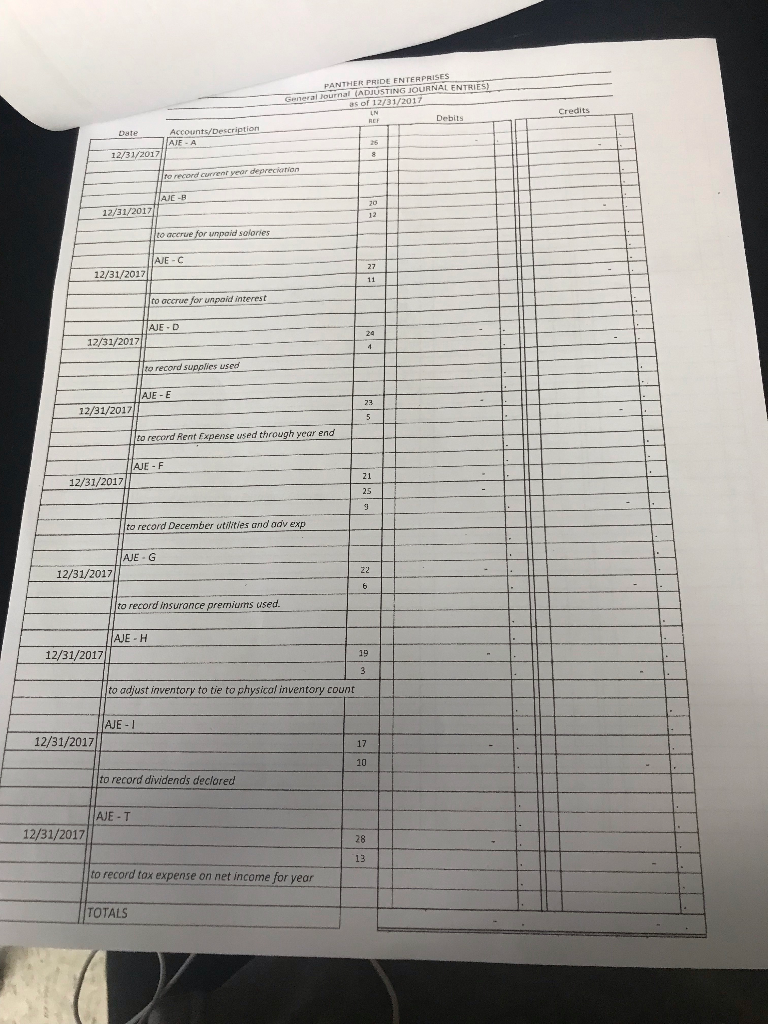

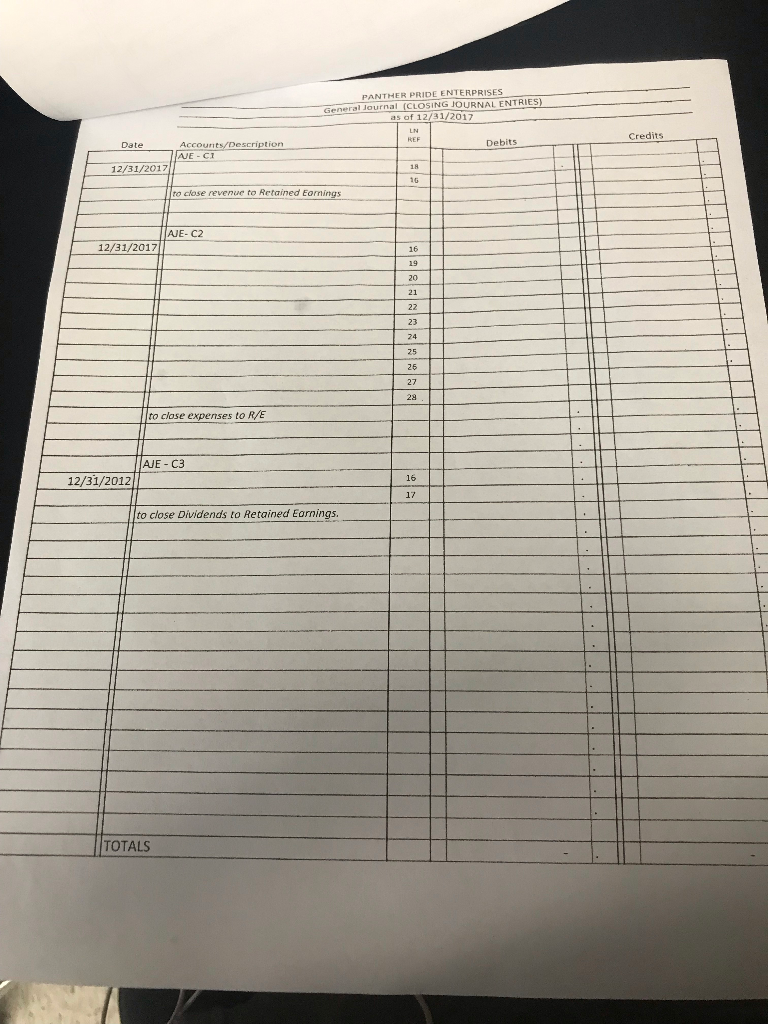

STUDENT NAME: Project # 1: PART 1 Using the account information below, prepare a trial balance for Panther Pride Enterprises for the 31, 2017. All accounts have "normal" balances - debit or credit CR ACcounts Payable D Accounts Receivable c Accumulated Depreciation 8,900 20,750 29,000 67,503 50,000 103,070 6,500 aid Rent 15,000 Rent Expense Retained Earnings Salaries Ex 3,300EX 14,588 EQ 43,380 Ex R Cash RSalary Payable Common Stock Cost of Goods Sold Depreciation Expense Dividends EQ EX Supplies 2,560 Supplies Expense 6,750 1 EX EX Tax Expense Taxes Payable Utilities Expense Advertising Expense Insurance Expense Prepaid Insurance EQ.D Dividends Payable Equipment 3,0001 EX 19,300 EX 192,500 D R I interest Expense EX 12,300 nterest Payable Inventory Note Payable 6,000 EX 27,000 257,675 Rev 36,250 C Sales Revenues 205,000 Adjust the Trial Balance Accounts to refl Post changes to the Trial balance and prepare a journal entry for each item PART 2: lect the following items found at the end of the period. Record depreciation expense for equipment totalling $19,500 B Record Accrued Salaries at year-end: 9 days at 500/day C Record 4th quarter interest on Note payable at 8% payable quarterly. (S A . * 8%* 3 mo.s /12 mo.) Record Supplies Used. Ending supply inventory is $1,550 E D months of Rent on April 1st. As of December 31st we have used 9 months. Record Rent expense used: We prepaid 12 (April - Dec) F We received two bills before the end of the year. One for Advertising totalling $1,600 and another for totalling $460. Use Accounts Payable to record the liability On November 1st, the company prepaid a 3 year contract for Insurance Record Insurance expense used: (Nov - Dec) G . As of December 31st we have used 2 months. H Record Inventory ajdustment. Ending Inventory is $32,250 Dividends payable were declared for 2018 totalling 3,000 to be paid on January 15th of next year T Record Income Tax Expense at 30% of Net Income Before Taxes IN: Turn in the following items in proper format. You will get points for format. Point Breakdown Possible Earned Correct DR/CR Classifications Adjusting Journal Entries Adjusting Balance Complete Closing Entries Everything Balanced Total Project Score 30 12 GRADED BY: General Journal ADJUSTING JOURNAL ENTRIES s of 12/31/201 PANTHER PRIDE ENTERPRISES Credits Debits Dste AJE A AJE -B 20 12/31/2017 to accrue for unpaid salories AJE-C 27 12/31/202 to accrue for unpaid interest AJE D 12/31/2017 to record supplies used AJE E 12/31/2017 to record Rent Expense used through year end AJE - F 21 12/31/2017 25 to record December utiaties and adv exp AJE G 12/31/2017 to record insurance premiusns used AJE H 12/31/2017 19 to adjust inventory to tie to physical inventory count AJE - 12/31/2017 17 10 to record dividends declored AJE T 12/31/2017 28 13 to record tox expense on net income for year TOTALS PANTHER PRIDE ENTERPRISES General Journal(CLOSINGOURNALENT RIES as of 12/31/2017 Credits Date Debits AJE -C 12/31/2017 1G ro close revenue to Retained Eornings AJE- C2 12/31/2017 16 19 20 21 23 74 25 26 27 29 to close expenses to R/E AJE C3 12/31/2012 17 to close Dividends to Retained Eornings TOTALSStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started