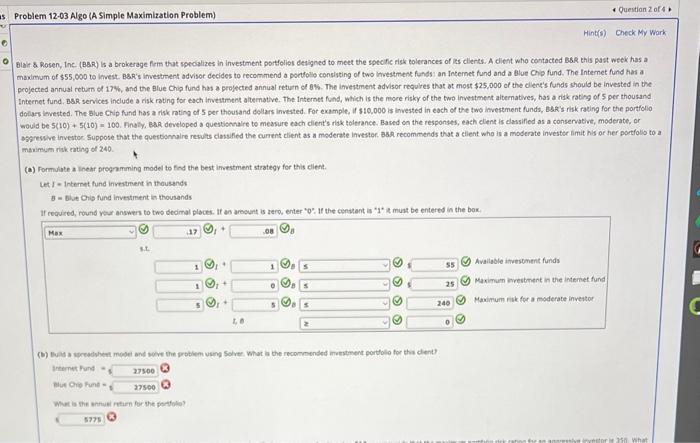

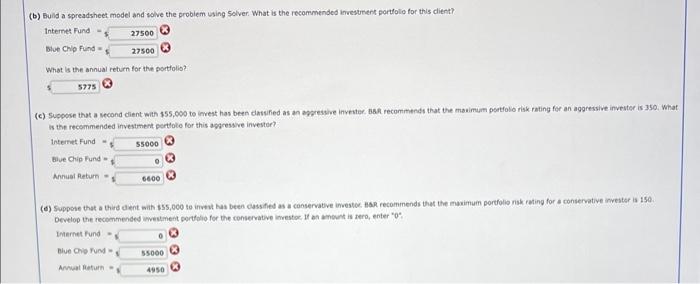

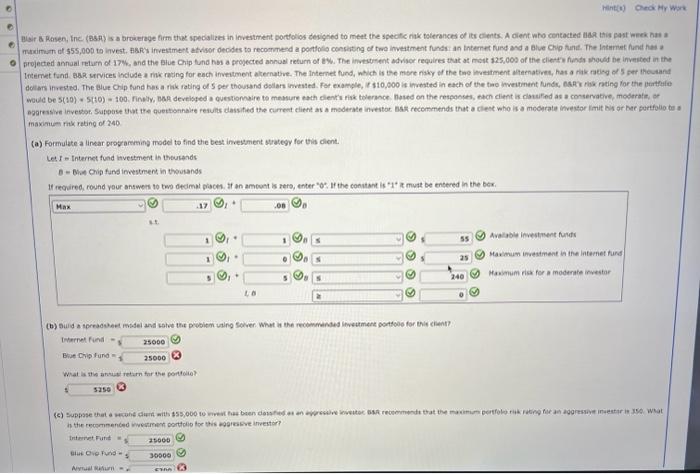

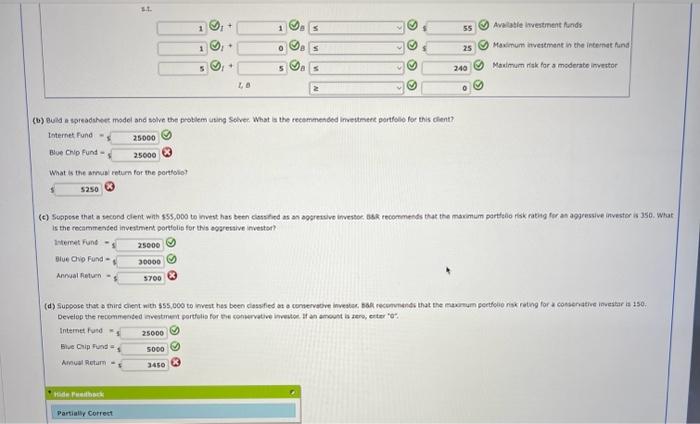

haximum of $55,000 to livest. Bak's ifvestment advisor decides to recommend a portollo consisting of two lavestment funds] an Internet fund and a Blue Chip fund. The Internet fund has a cojected annual reburn of 17%, and the Blue Chip fund has a projected annual retum of 8%. The invetment advisor requlres that at most $25,000 of the dlent's funds should be invested in the internet fund. BaR services include a risk rating for each investment attemative. The interat fund, which is the more risky of the two inveitment aiternatives, has a riak rating of 5 per thousand dollars levested. The blue Chip fund has a risk rating of 5 per thousand dolars invested. For example, if $10,000 is lnvested in each of the two livestment funds, Bak's risk rading for the portfolio would be 5(10)+5(10)=100. Fnaly, BaR developed a questionalre to measure each client's riak tolerance. Based on the responses, each clent is dansified as a conservative, moderate, or osgrewive investor Suppose that the querbomnire results cissifed the ourrent client as a moderate investor. Bsh recommends that a cilent who is a moderate investor limit his or her portollo to a manimum risk enting of 240. (a) Formulate a inehr pregnmming model to find the best imestment strategy for this clent. Let I= internet fund investment in thousands g= bive Ois fund investment in thousands If required, round yeur answers to two dedinal places. If an areount is zero, enter ' 0 ". If the constant is "1' it muat be entered in the box. Whar io the snesuid retien for the fortotis? (b) Eulld a spreadsheet model and solve the problem using Solver. What is the recommended invesunent portfolo for this client? Internet Fund = blue chip Find = What is the annual return for the portfolis? is the recommended investment pertoto for this agareswe investor? (d) Suppote that a third dent wah iss, 0co to invou has been cassifed as a conservative investoc bag recommends that the maximum portfolio nsk rating for a conserative inveitse is ise. Develop the recommended wesetment portfolio for the conservative investoc, if as whount is sero, enter " 0 " internet fund = Bive Gil furd = Armat keturn = 8 taximien ritk reting of 240 (a) Formulate a linear prograrming model to find the best invesument dwategy for this olent. Le f = thternet fund investment in thoutands B = Bhat Ohip fund ievestment in thoutands If required, round vour answens to two dedmal pioces. It an amouet is rers, enter "o: It the conutant is 1+4 t muat be entered in the bes. iternet finil = Brechip fund =1 What is the antise retam tor the portolio? intareetfunt =1 (b) 8ukd a toreadshee model and solve the problem uting Solver. What a the recemmended limeitmere gortfolo for this olient? thternet fund = Bive crip Fund = What is the arnup return for the portfolo? is the rocammended investment portfelis for this ogareitive investor? deterest fund = Biue cie fund = Arnial feturi = Deveiop the recommected aveitinem portfelia for the cohiervatiow inwhore if an arnoust is dere; ertar "g". Intermet futd = Bive Cip furat = Ahigot Retarm = haximum of $55,000 to livest. Bak's ifvestment advisor decides to recommend a portollo consisting of two lavestment funds] an Internet fund and a Blue Chip fund. The Internet fund has a cojected annual reburn of 17%, and the Blue Chip fund has a projected annual retum of 8%. The invetment advisor requlres that at most $25,000 of the dlent's funds should be invested in the internet fund. BaR services include a risk rating for each investment attemative. The interat fund, which is the more risky of the two inveitment aiternatives, has a riak rating of 5 per thousand dollars levested. The blue Chip fund has a risk rating of 5 per thousand dolars invested. For example, if $10,000 is lnvested in each of the two livestment funds, Bak's risk rading for the portfolio would be 5(10)+5(10)=100. Fnaly, BaR developed a questionalre to measure each client's riak tolerance. Based on the responses, each clent is dansified as a conservative, moderate, or osgrewive investor Suppose that the querbomnire results cissifed the ourrent client as a moderate investor. Bsh recommends that a cilent who is a moderate investor limit his or her portollo to a manimum risk enting of 240. (a) Formulate a inehr pregnmming model to find the best imestment strategy for this clent. Let I= internet fund investment in thousands g= bive Ois fund investment in thousands If required, round yeur answers to two dedinal places. If an areount is zero, enter ' 0 ". If the constant is "1' it muat be entered in the box. Whar io the snesuid retien for the fortotis? (b) Eulld a spreadsheet model and solve the problem using Solver. What is the recommended invesunent portfolo for this client? Internet Fund = blue chip Find = What is the annual return for the portfolis? is the recommended investment pertoto for this agareswe investor? (d) Suppote that a third dent wah iss, 0co to invou has been cassifed as a conservative investoc bag recommends that the maximum portfolio nsk rating for a conserative inveitse is ise. Develop the recommended wesetment portfolio for the conservative investoc, if as whount is sero, enter " 0 " internet fund = Bive Gil furd = Armat keturn = 8 taximien ritk reting of 240 (a) Formulate a linear prograrming model to find the best invesument dwategy for this olent. Le f = thternet fund investment in thoutands B = Bhat Ohip fund ievestment in thoutands If required, round vour answens to two dedmal pioces. It an amouet is rers, enter "o: It the conutant is 1+4 t muat be entered in the bes. iternet finil = Brechip fund =1 What is the antise retam tor the portolio? intareetfunt =1 (b) 8ukd a toreadshee model and solve the problem uting Solver. What a the recemmended limeitmere gortfolo for this olient? thternet fund = Bive crip Fund = What is the arnup return for the portfolo? is the rocammended investment portfelis for this ogareitive investor? deterest fund = Biue cie fund = Arnial feturi = Deveiop the recommected aveitinem portfelia for the cohiervatiow inwhore if an arnoust is dere; ertar "g". Intermet futd = Bive Cip furat = Ahigot Retarm =