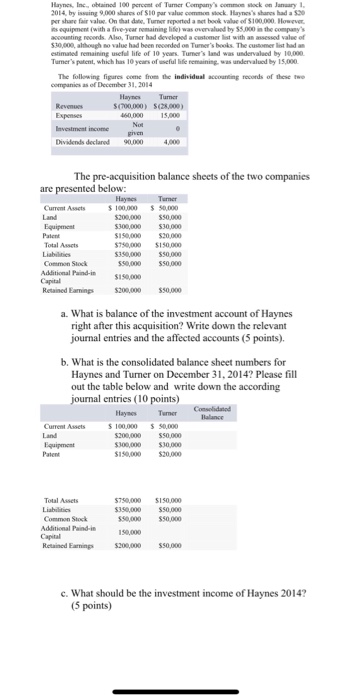

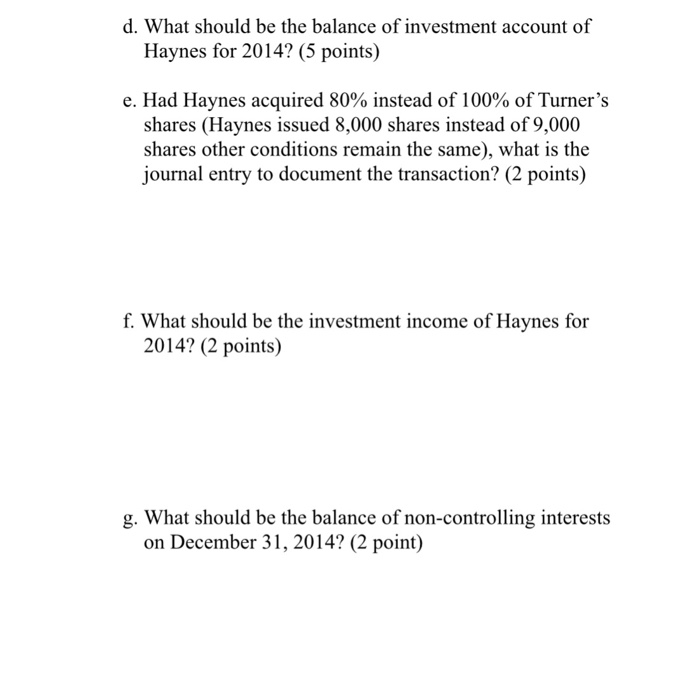

Haynes, Inc obtained 100 percent of Turner Company's common sock on Janary 1, 2014, by isssing 9,000 shares of $10 par value common slock Haynes's shares had a $50 per share fair valu On that date Turner reported a net book value of $100,000 oweer ?? equ"pment twith a five-year romaanne ld', was overvalued by S5,000 the company's accounting reoerds. Also, Tumer had developed a customer list with an assessed valee of 530,000, although so value had been recorded on Tumer's books The cusomer list had an esnimated remaining useful life of 10 years Tumer's land was undervalaed by 10,000 Turner's patent, which has 10 years of useful lhfe remainingwas undervalued by 15,000 following figures come from individ?? accounting records of se two companies as of December 31, 2014 Haynes Turner $(700,000) (28,000) Expenses lavestment incomse given Dividends declared 90000 The pre-acquisition balance sheets of the two companies are presented below Equipment Total Asscts Common Slock Hayses Turner 100,000 50,000 $200,000 50,000 300,000 $30,000 150,000 $20,000 $750,000 $150,000 5350,000 550,000 550,000 $50,000 Additional Paind-in 150,000 Retained Eamings$200,000 50,000 a. What is balance of the investment account of Haynes right after this acquisition? Write down the relevant journal entries and the affected accounts (5 points). b. What is the consolidated balance sheet numbers for Haynes and Turner on December 31, 2014? Please fill out the table below and write down the according journal entries (10 points) Hayses Consolidatod 100,000 50,000 $200,000 $50,000 $300,000 $30,000 $150,000 $20000 Patent $750,000 S0,000 350,000 $50,000 50,000 50,000 Additional Paind-in Capital Retained Eaings$20,000 $50,000 c. What should be the investment income of Haynes 2014? (5 points) Haynes, Inc obtained 100 percent of Turner Company's common sock on Janary 1, 2014, by isssing 9,000 shares of $10 par value common slock Haynes's shares had a $50 per share fair valu On that date Turner reported a net book value of $100,000 oweer ?? equ"pment twith a five-year romaanne ld', was overvalued by S5,000 the company's accounting reoerds. Also, Tumer had developed a customer list with an assessed valee of 530,000, although so value had been recorded on Tumer's books The cusomer list had an esnimated remaining useful life of 10 years Tumer's land was undervalaed by 10,000 Turner's patent, which has 10 years of useful lhfe remainingwas undervalued by 15,000 following figures come from individ?? accounting records of se two companies as of December 31, 2014 Haynes Turner $(700,000) (28,000) Expenses lavestment incomse given Dividends declared 90000 The pre-acquisition balance sheets of the two companies are presented below Equipment Total Asscts Common Slock Hayses Turner 100,000 50,000 $200,000 50,000 300,000 $30,000 150,000 $20,000 $750,000 $150,000 5350,000 550,000 550,000 $50,000 Additional Paind-in 150,000 Retained Eamings$200,000 50,000 a. What is balance of the investment account of Haynes right after this acquisition? Write down the relevant journal entries and the affected accounts (5 points). b. What is the consolidated balance sheet numbers for Haynes and Turner on December 31, 2014? Please fill out the table below and write down the according journal entries (10 points) Hayses Consolidatod 100,000 50,000 $200,000 $50,000 $300,000 $30,000 $150,000 $20000 Patent $750,000 S0,000 350,000 $50,000 50,000 50,000 Additional Paind-in Capital Retained Eaings$20,000 $50,000 c. What should be the investment income of Haynes 2014? (5 points)