Answered step by step

Verified Expert Solution

Question

1 Approved Answer

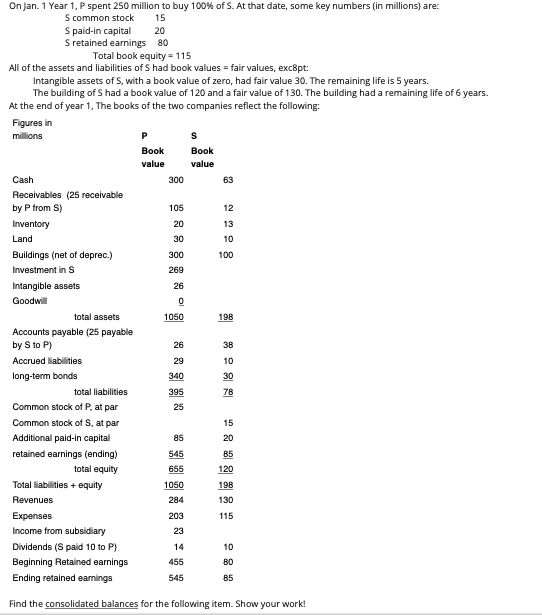

Can you find the receivables as well. 3 questions in total. Thank you. 300 On Jan. 1 Year 1, P spent 250 million to buy

Can you find the receivables as well. 3 questions in total. Thank you.

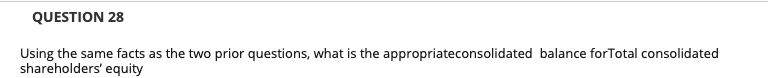

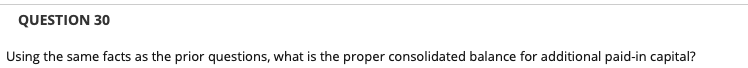

300 On Jan. 1 Year 1, P spent 250 million to buy 100% of S. At that date, some key numbers (in millions) are: S common stock 15 S paid-in capital 20 Sretained earnings 80 Total book equity = 115 All of the assets and liabilities of Shad book values = fair values, except: Intangible assets of S, with a book value of zero, had fair value 30. The remaining life is 5 years. The building of Shad a book value of 120 and a fair value of 130. The building had a remaining life of 6 years. At the end of year 1. The books of the two companies reflect the following: Figures in millions PS Book Book value value Cash Receivables (25 receivable by P from S) Inventory Land Buildings (net of deprec.) Investment in s Intangible assets Goodwill total assets Accounts payable (25 payable by S to P) Accrued liabilities long-term bonds total liabilities Common stock of P. at par Common stock of S, at par Additional paid-in capital retained earnings (ending) total equity Total liabilities + equity Revenues Expenses Income from subsidiary Dividends (Spaid 10 to P) Beginning Retained earnings Ending retained earnings 545 Find the consolidated balances for the following item. Show your work! QUESTION 28 Using the same facts as the two prior questions, what is the appropriateconsolidated balance for Total consolidated shareholders' equity QUESTION 30 Using the same facts as the prior questions, what is the proper consolidated balance for additional paid-in capital? 300 On Jan. 1 Year 1, P spent 250 million to buy 100% of S. At that date, some key numbers (in millions) are: S common stock 15 S paid-in capital 20 Sretained earnings 80 Total book equity = 115 All of the assets and liabilities of Shad book values = fair values, except: Intangible assets of S, with a book value of zero, had fair value 30. The remaining life is 5 years. The building of Shad a book value of 120 and a fair value of 130. The building had a remaining life of 6 years. At the end of year 1. The books of the two companies reflect the following: Figures in millions PS Book Book value value Cash Receivables (25 receivable by P from S) Inventory Land Buildings (net of deprec.) Investment in s Intangible assets Goodwill total assets Accounts payable (25 payable by S to P) Accrued liabilities long-term bonds total liabilities Common stock of P. at par Common stock of S, at par Additional paid-in capital retained earnings (ending) total equity Total liabilities + equity Revenues Expenses Income from subsidiary Dividends (Spaid 10 to P) Beginning Retained earnings Ending retained earnings 545 Find the consolidated balances for the following item. Show your work! QUESTION 28 Using the same facts as the two prior questions, what is the appropriateconsolidated balance for Total consolidated shareholders' equity QUESTION 30 Using the same facts as the prior questions, what is the proper consolidated balance for additional paid-in capitalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started