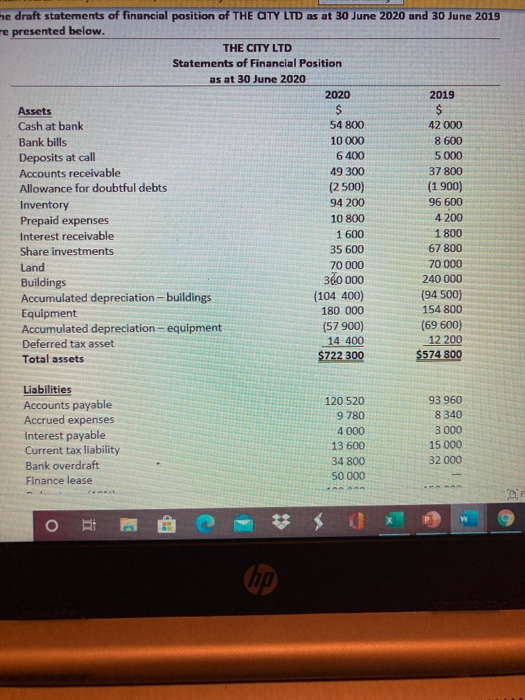

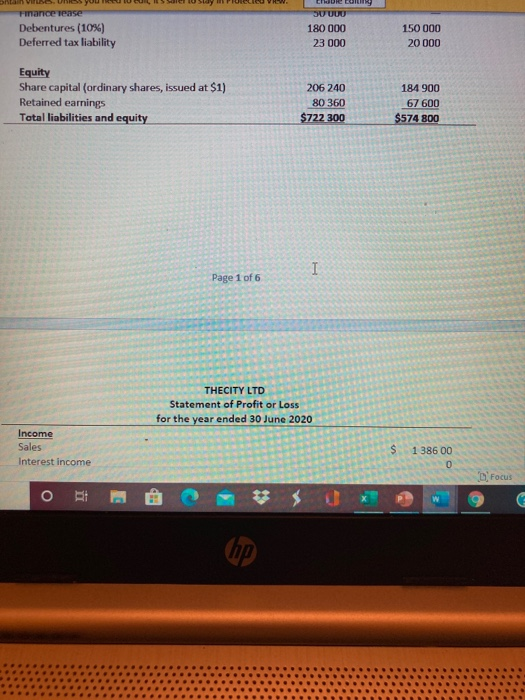

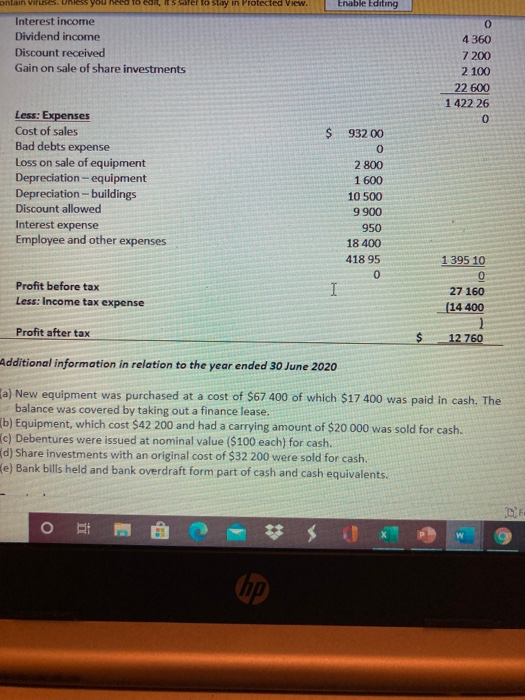

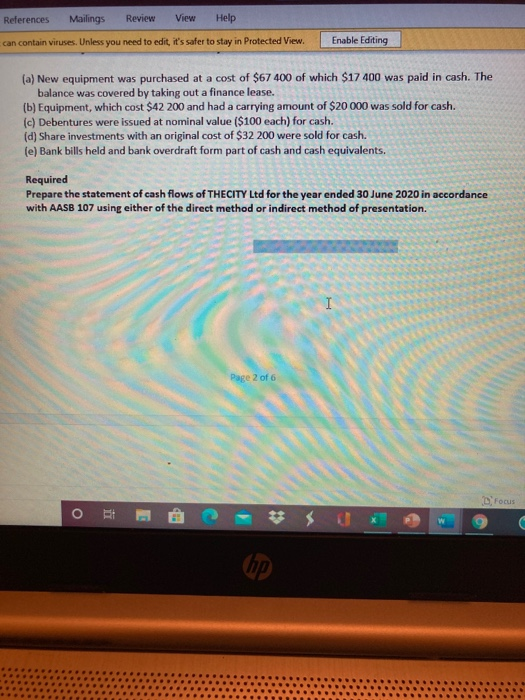

he draft statements of financial position of THE CITY LTD as at 30 June 2020 and 30 June 2019 e presented below. THE CITY LTD Statements of Financial Position as at 30 June 2020 2020 2019 Assets $ Cash at bank 54 800 42 000 Bank bills 10 000 8 600 Deposits at call 6 400 5 000 Accounts receivable 49 300 37 800 Allowance for doubtful debts (2 500) (1 900) Inventory 94 200 96 600 Prepaid expenses 10 800 4 200 Interest receivable 1 600 1 800 Share investments 35 600 67 800 Land 70 000 70 000 Buildings 360 000 240 000 Accumulated depreciation - buildings (104 400) (94 500) Equipment 180 000 154 800 Accumulated depreciation - equipment (57 900) (69 600) Deferred tax asset 14 400 12 200 Total assets $722 300 $574 800 Liabilities Accounts payable Accrued expenses Interest payable Current tax liability Bank overdraft Finance lease 120 520 9780 4 000 13 600 34 800 50 000 93 960 8 340 3 000 15 000 32 000 DE the JUUUU France Tease Debentures (10%) Deferred tax liability 180 000 23 000 150 000 20 000 Equity Share capital (ordinary shares, issued at $1) Retained earnings Total liabilities and equity 206 240 80 360 $722 300 184 900 67 600 $574 800 I Page 1 of 6 THECITY LTD Statement of Profit or Loss for the year ended 30 June 2020 Income Sales Interest income $ 1 386 00 0 Focus ORA hp ontain vies Enable Editing To edit, Sarer to stay in Protected view. Interest income Dividend income Discount received Gain on sale of share investments 0 4 360 7 200 2 100 22 600 1422 26 0 $ Less: Expenses Cost of sales Bad debts expense Loss on sale of equipment Depreciation - equipment Depreciation - buildings Discount allowed Interest expense Employee and other expenses 932 00 0 2 800 1 600 10 500 9900 950 18 400 418 95 0 Profit before tax Less: Income tax expense I 1 395 10 0 27 160 (14 400 Profit after tax $ 12 760 Additional information in relation to the year ended 30 June 2020 a) New equipment was purchased at a cost of $67 400 of which $17 400 was paid in cash. The balance was covered by taking out a finance lease. (b) Equipment, which cost $42 200 and had a carrying amount of $20 000 was sold for cash. c) Debentures were issued at nominal value ($100 each) for cash. d) Share investments with an original cost of $32 200 were sold for cash. e) Bank bills held and bank overdraft form part of cash and cash equivalents. ORA E References Mailings Review View Help can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing (a) New equipment was purchased at a cost of $67 400 of which $17 400 was paid in cash. The balance was covered by taking out a finance lease. (b) Equipment, which cost $42 200 and had a carrying amount of $20 000 was sold for cash. (c) Debentures were issued at nominal value ($100 each) for cash. (d) Share investments with an original cost of $32 200 were sold for cash. (e) Bank bills held and bank overdraft form part of cash and cash equivalents. Required Prepare the statement of cash flows of THECITY Ltd for the year ended 30 June 2020 in accordance with AASB 107 using either of the direct method or indirect method of presentation. I Page 2 of 6 Focus O i hp he draft statements of financial position of THE CITY LTD as at 30 June 2020 and 30 June 2019 e presented below. THE CITY LTD Statements of Financial Position as at 30 June 2020 2020 2019 Assets $ Cash at bank 54 800 42 000 Bank bills 10 000 8 600 Deposits at call 6 400 5 000 Accounts receivable 49 300 37 800 Allowance for doubtful debts (2 500) (1 900) Inventory 94 200 96 600 Prepaid expenses 10 800 4 200 Interest receivable 1 600 1 800 Share investments 35 600 67 800 Land 70 000 70 000 Buildings 360 000 240 000 Accumulated depreciation - buildings (104 400) (94 500) Equipment 180 000 154 800 Accumulated depreciation - equipment (57 900) (69 600) Deferred tax asset 14 400 12 200 Total assets $722 300 $574 800 Liabilities Accounts payable Accrued expenses Interest payable Current tax liability Bank overdraft Finance lease 120 520 9780 4 000 13 600 34 800 50 000 93 960 8 340 3 000 15 000 32 000 DE the JUUUU France Tease Debentures (10%) Deferred tax liability 180 000 23 000 150 000 20 000 Equity Share capital (ordinary shares, issued at $1) Retained earnings Total liabilities and equity 206 240 80 360 $722 300 184 900 67 600 $574 800 I Page 1 of 6 THECITY LTD Statement of Profit or Loss for the year ended 30 June 2020 Income Sales Interest income $ 1 386 00 0 Focus ORA hp ontain vies Enable Editing To edit, Sarer to stay in Protected view. Interest income Dividend income Discount received Gain on sale of share investments 0 4 360 7 200 2 100 22 600 1422 26 0 $ Less: Expenses Cost of sales Bad debts expense Loss on sale of equipment Depreciation - equipment Depreciation - buildings Discount allowed Interest expense Employee and other expenses 932 00 0 2 800 1 600 10 500 9900 950 18 400 418 95 0 Profit before tax Less: Income tax expense I 1 395 10 0 27 160 (14 400 Profit after tax $ 12 760 Additional information in relation to the year ended 30 June 2020 a) New equipment was purchased at a cost of $67 400 of which $17 400 was paid in cash. The balance was covered by taking out a finance lease. (b) Equipment, which cost $42 200 and had a carrying amount of $20 000 was sold for cash. c) Debentures were issued at nominal value ($100 each) for cash. d) Share investments with an original cost of $32 200 were sold for cash. e) Bank bills held and bank overdraft form part of cash and cash equivalents. ORA E References Mailings Review View Help can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing (a) New equipment was purchased at a cost of $67 400 of which $17 400 was paid in cash. The balance was covered by taking out a finance lease. (b) Equipment, which cost $42 200 and had a carrying amount of $20 000 was sold for cash. (c) Debentures were issued at nominal value ($100 each) for cash. (d) Share investments with an original cost of $32 200 were sold for cash. (e) Bank bills held and bank overdraft form part of cash and cash equivalents. Required Prepare the statement of cash flows of THECITY Ltd for the year ended 30 June 2020 in accordance with AASB 107 using either of the direct method or indirect method of presentation. I Page 2 of 6 Focus O i hp