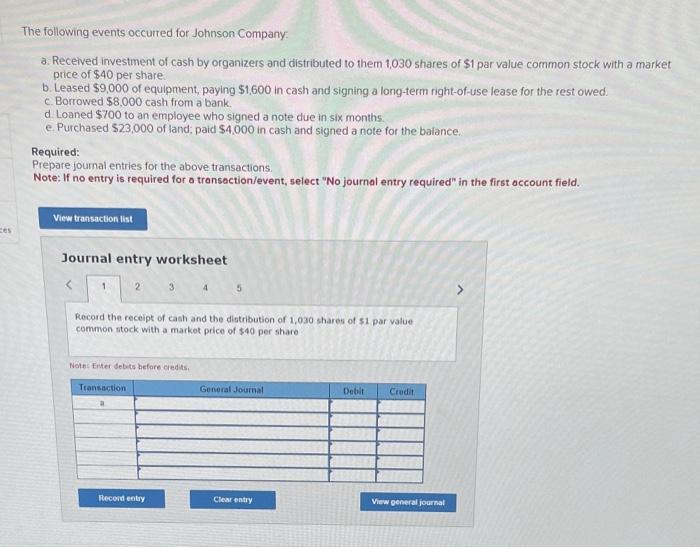

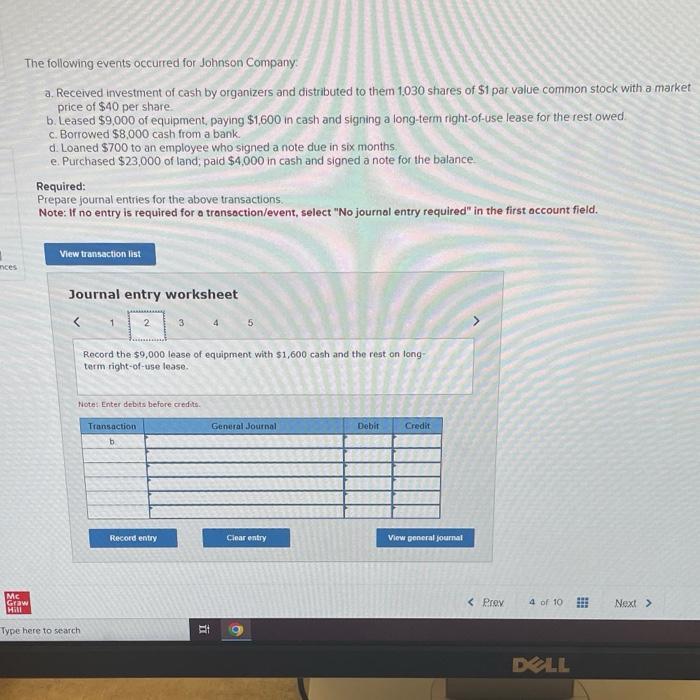

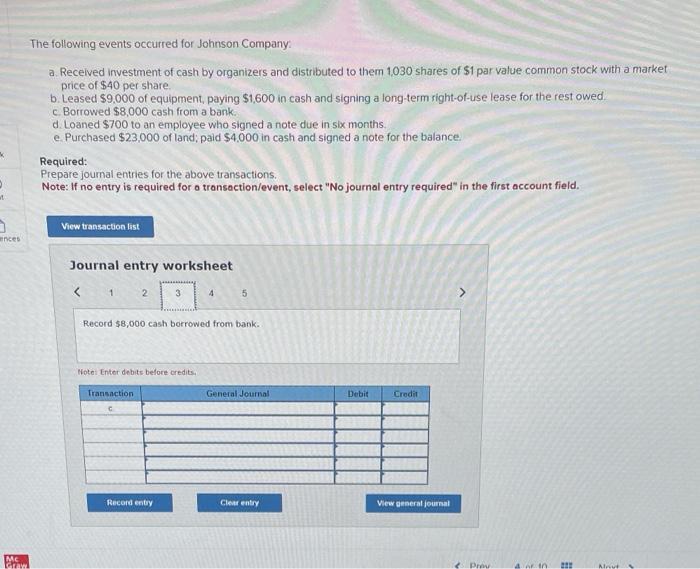

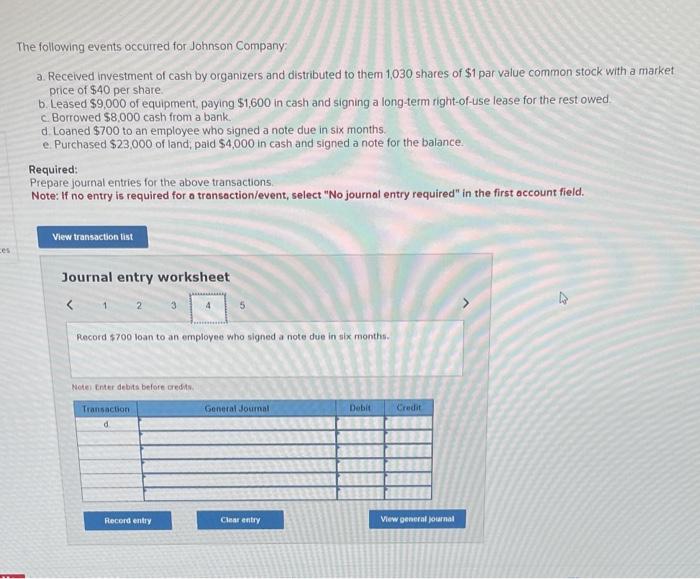

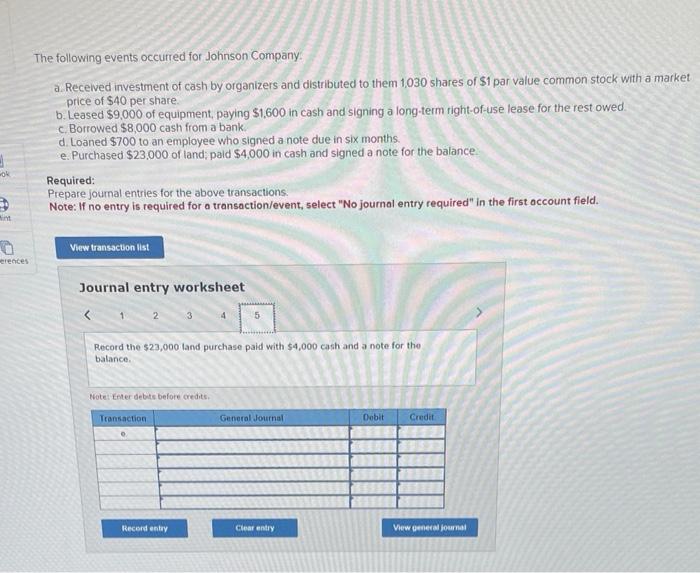

he following events occurred for Johnson Company: a. Recelved investment of cash by organizers and distributed to them 1,030 shares of $1 par value common stock with a market price of $40 per share. b. Leased $9,000 of equipment, paying $1,600 in cash and signing a long-term right-of-use lease for the rest owed. c. Borrowed $8,000 cash from a bank. d. Loaned $700 to an employee who signed a note due in six months. e. Purchased $23,000 of land; paid $4,000 in cash and signed a note for the balance. Required: Prepare journal entries for the above transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the receipt of cash and the distribution of 1,030 shares of 51 par value common stock with a market price of $40 per share Netes Eruer deluts before credts. The following events occurred for Johnson Company. a. Received investment of cash by organizers and distributed to them 1.030 shares of $1 par value common stock with a market price of $40 per share. b. Leased $9.000 of equipment, paying $1,600 in cash and signing a long-term right-of-use lease for the rest owed. c. Borrowed $8.000 cash from a bank. d. Loaned $700 to an employee who signed a note due in six months. e. Purchased $23,000 of land; paid $4,000 in cash and signed a note for the balance. Required: Prepare journal entries for the above transactions. Note: If no entry is required for a transoction/event, select "No journal entry required" in the first account field. Journal entry worksheet 5 Record the $9,000 lease of equipment with $1,600 cash and the rest on long: term right-of-use lease. Notes Enter debis before credfts. The following events occurred for Johnson Company: a. Recelved investment of cash by organizers and distributed to them 1,030 shares of $1 par value common stock with a market price of $40 per share. b. Leased $9,000 of equipment, paying $1,600 in cash and signing a long-term right-of-use lease for the rest owed. c. Borrowed $8,000 cash from a bank: d. Loaned $700 to an employee who signed a note due in six months. e. Purchased $23,000 of land; paid $4.000 in cash and signed a note for the balance. Required: Prepare journal entries for the above transactions. Note: If no entry is required for o transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet