Please do as many journal entries as you can!!

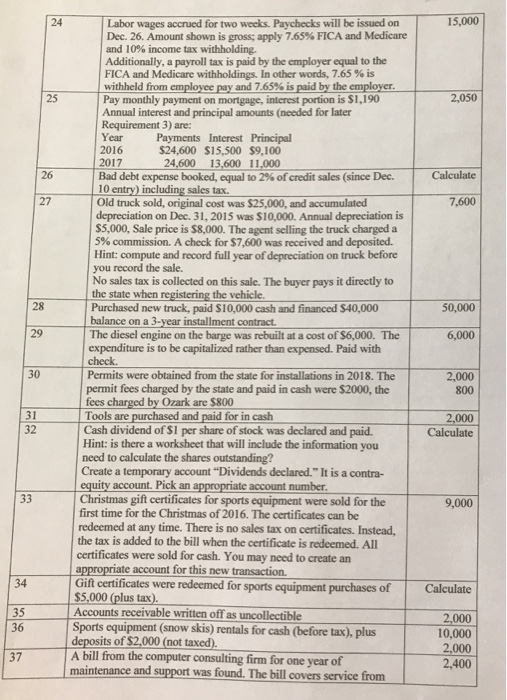

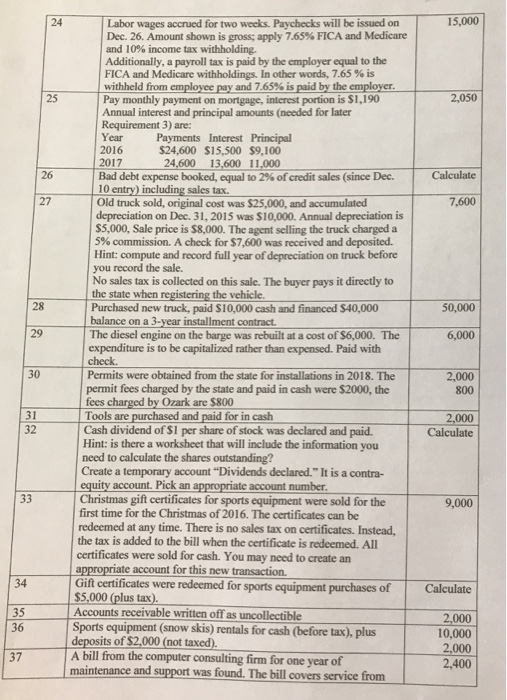

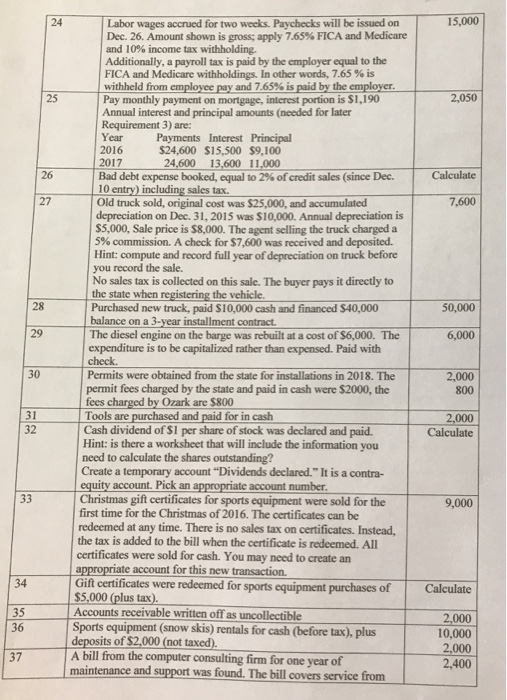

24 Labor wages accrued for two weeks. Paychecks will be issued on Dec. 26, Amount shown is gross, apply 7.65% FICA and Medicare and 10% income tax withholding. Additionally, a payroll tax is paid by the employer equal to the FICA and Medicare withholdings. In other words, 7.65 % is withheldfromemployeepayand 7.65%ispaid by the employer. 25 Pay monthly payment on mortgage, interest portion is $1,190 Annual interest and principal amounts (needed for later Requirement 3) are: Year Payments Interest Principal $24,600 $15,500 $9,100 24,600 13,600 11,000 2016 2017 26 Bad debt expense booked, equal to 2% ofcredit sales (since Dec. Calculate 10 entry) including sales tax. 27 Old truck sold, original cost was $25,000, and accumulated 7,600 depreciation on Dec. 31, 2015 was $10,000. Annual depreciation is $5,000, Sale price is $8,000. The agent selling the truck charged a 5% commission. A check fr $7,600 was received and deposited. Hint: compute and record full year of depreciation on truck before you record the sale. No sales tax is collected on this sale. The buyer pays it directly to the state when registering the vehicle. 28 Purchased new truck, paid $10,000 cash and financed $40,000 balance on a 3-year installment contract The diesel engine on the barge was rebuilt at a cost of $6,000. The 6,000 expenditure is to be capitalized rather than expensed. Paid with 30 Permits were obtained from the state for installations in 2018. The permit fees charged by the state and paid in cash were $2000, the 800 fees charged by Ozark are $800 31 Tools are purchased and paid for in cash Cash dividend of $1 per share of stock was declared and paid. Hint: is there a worksheet that will include the information you need to calculate the shares outstanding? Create a temporary account "Dividends declared." It is a contra- equity account. Pick an appropriate account number Christmas gift certificates for sports equipment were sold for the first time for the Christmas of 2016. The certificates can be redeemed at any time. There is no sales tax on certificates. Instead the tax is added to the bill when the certificate is redeemed. All certificates were sold for cash. You may need to create an 9,000 appropriate account for this new transaction. 34 tificates were redeem Calculate $5,000 (plus tax) Accounts receivable written off as uncollectible 35 2,000 10,000 2,000 2,400 Sports equipment (snow skis) rentals for cash (before tax), plus deposits of S2,000 (not taxed) A bill from the computer consulting firm for one year of maintenance and support was found. The bill covers service from 37