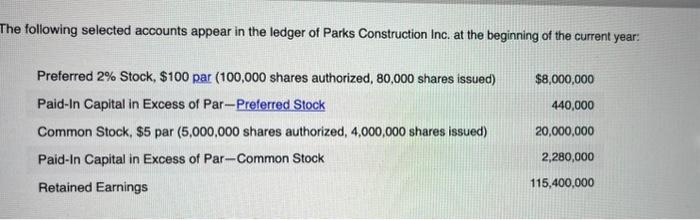

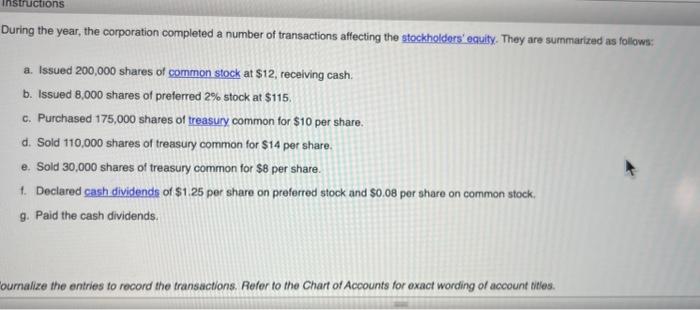

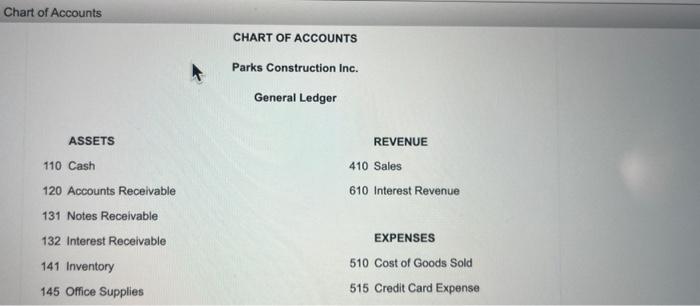

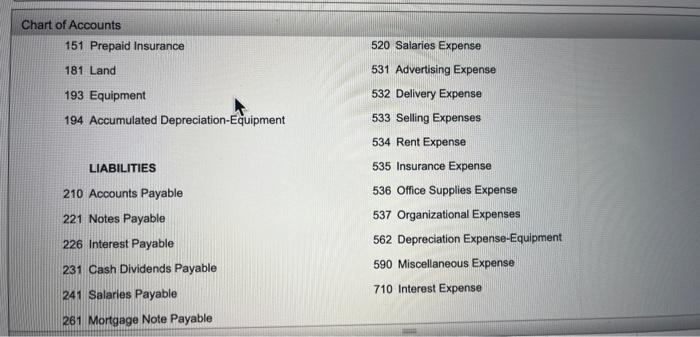

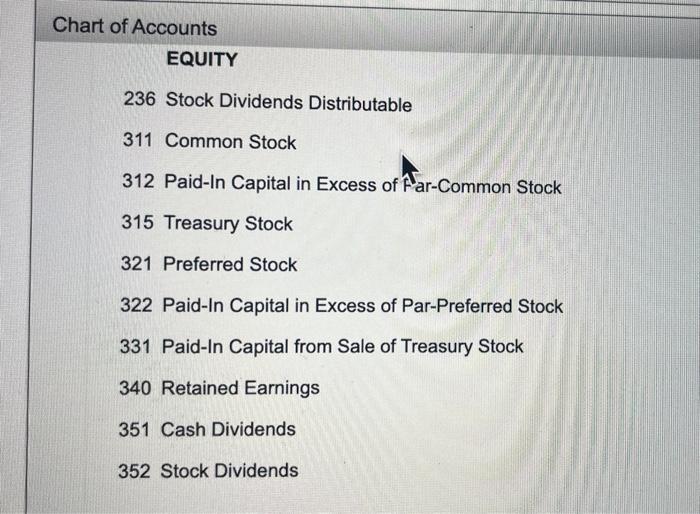

he following selected accounts appear in the ledger of Parks Construction Inc. at the beginning of the current year: During the year, the corporation completed a number of transactions affecting the stockholders' equity. They are summarizad as follows: a. Issued 200,000 shares of common stock at $12, recelving cash. b. Issued 8,000 shares of preferred 2% stock at $115. c. Purchased 175,000 shares of treasury common for $10 per share. d. Sold 110,000 shares of treasury common for $14 per share. e. Sold 30,000 shares of treasury common for $8 per share. 1. Declared cash dividends of $1.25 per share on preferred stock and $0.08 per share on common stock. g. Paid the cash dividends. ournalize the entries to rocord the transactions. Refer to the Chart of Accounts for exact wording of account titles. Joumat DATE Chart of Accounts CHART OF ACCOUNTS Parks Construction Inc. General Ledger ASSETS110Cash120AccountsReceivable131NotesReceivable132InterestReceivable141Inventory145OfficeSuppliesREVENUE410Sales610InterestRevenueEXPENSES510CostofGoodsSold515CreditCardExpense Chart of Accounts \begin{tabular}{ll} 151 Prepaid Insurance & 520 Salaries Expense \\ 181 Land & 531 Advertising Expense \\ 193 Equipment & 532 Delivery Expense \\ 194 Accumulated Depreciation-Equipment & 533 Selling Expenses \\ & 534 Rent Expense \\ LIABILITIES & 535 Insurance Expense \\ 210 Accounts Payable & 536 Office Supplies Expense \\ 221 Notes Payable & 537 Organizational Expenses \\ 226 Interest Payable & 562 Depreciation Expense-Equipr \\ 231 Cash Dividends Payable & 590 Miscellaneous Expense \\ 241 Salaries Payable & 710 Interest Expense \\ \hline 261 Mortgage Note Payable \end{tabular} 236 Stock Dividends Distributable 311 Common Stock 312 Paid-In Capital in Excess of Far-Common Stock 315 Treasury Stock 321 Preferred Stock 322 Paid-In Capital in Excess of Par-Preferred Stock 331 Paid-In Capital from Sale of Treasury Stock 340 Retained Earnings 351 Cash Dividends 352 Stock Dividends he following selected accounts appear in the ledger of Parks Construction Inc. at the beginning of the current year: During the year, the corporation completed a number of transactions affecting the stockholders' equity. They are summarizad as follows: a. Issued 200,000 shares of common stock at $12, recelving cash. b. Issued 8,000 shares of preferred 2% stock at $115. c. Purchased 175,000 shares of treasury common for $10 per share. d. Sold 110,000 shares of treasury common for $14 per share. e. Sold 30,000 shares of treasury common for $8 per share. 1. Declared cash dividends of $1.25 per share on preferred stock and $0.08 per share on common stock. g. Paid the cash dividends. ournalize the entries to rocord the transactions. Refer to the Chart of Accounts for exact wording of account titles. Joumat DATE Chart of Accounts CHART OF ACCOUNTS Parks Construction Inc. General Ledger ASSETS110Cash120AccountsReceivable131NotesReceivable132InterestReceivable141Inventory145OfficeSuppliesREVENUE410Sales610InterestRevenueEXPENSES510CostofGoodsSold515CreditCardExpense Chart of Accounts \begin{tabular}{ll} 151 Prepaid Insurance & 520 Salaries Expense \\ 181 Land & 531 Advertising Expense \\ 193 Equipment & 532 Delivery Expense \\ 194 Accumulated Depreciation-Equipment & 533 Selling Expenses \\ & 534 Rent Expense \\ LIABILITIES & 535 Insurance Expense \\ 210 Accounts Payable & 536 Office Supplies Expense \\ 221 Notes Payable & 537 Organizational Expenses \\ 226 Interest Payable & 562 Depreciation Expense-Equipr \\ 231 Cash Dividends Payable & 590 Miscellaneous Expense \\ 241 Salaries Payable & 710 Interest Expense \\ \hline 261 Mortgage Note Payable \end{tabular} 236 Stock Dividends Distributable 311 Common Stock 312 Paid-In Capital in Excess of Far-Common Stock 315 Treasury Stock 321 Preferred Stock 322 Paid-In Capital in Excess of Par-Preferred Stock 331 Paid-In Capital from Sale of Treasury Stock 340 Retained Earnings 351 Cash Dividends 352 Stock Dividends