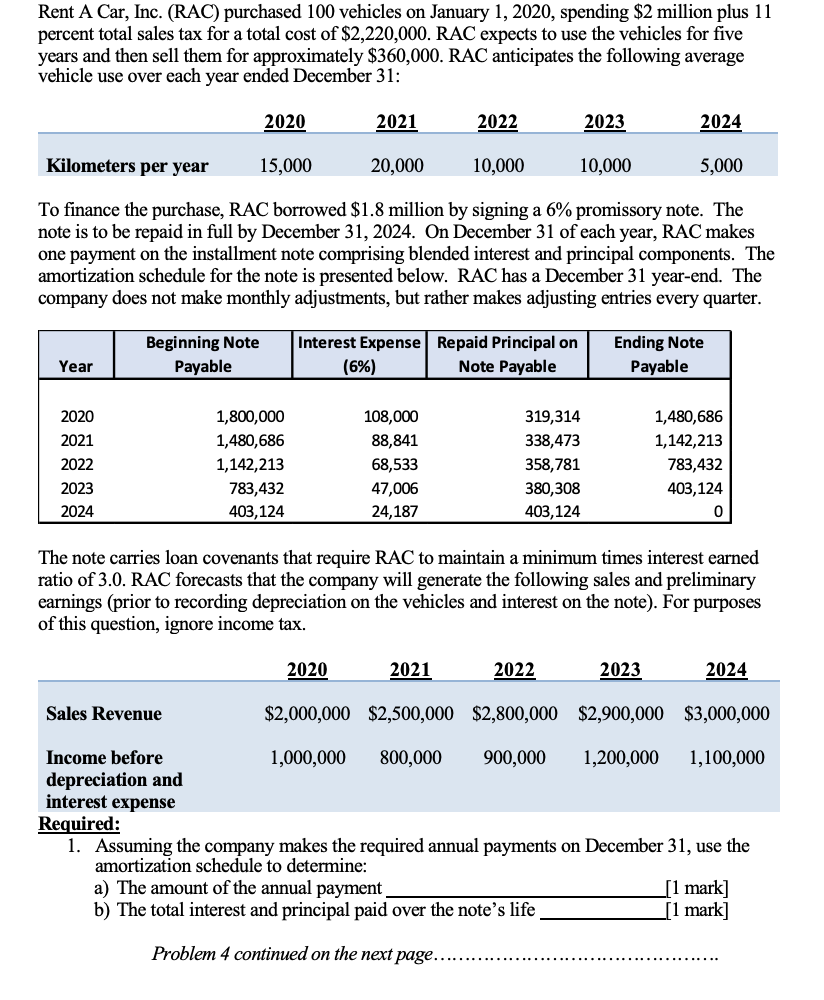

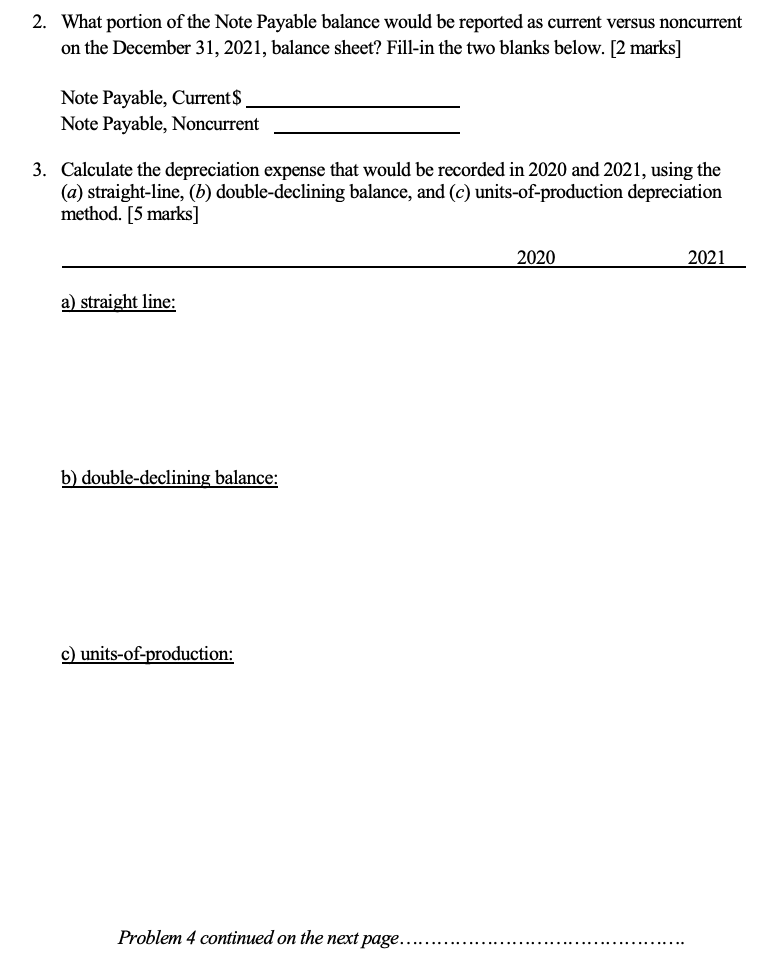

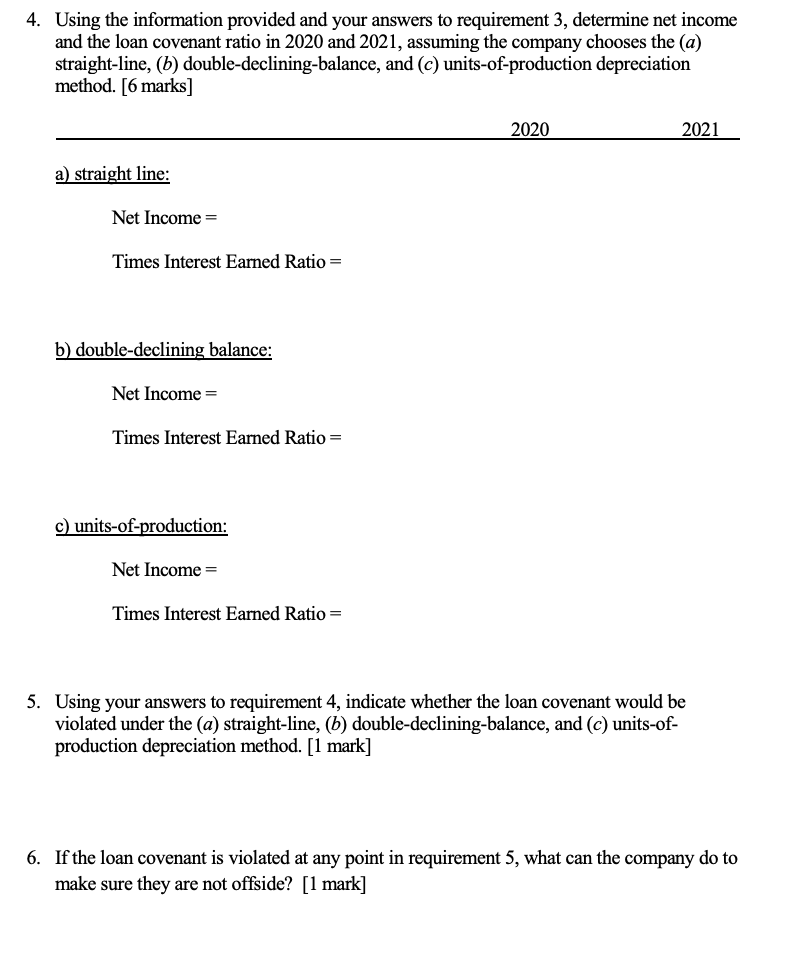

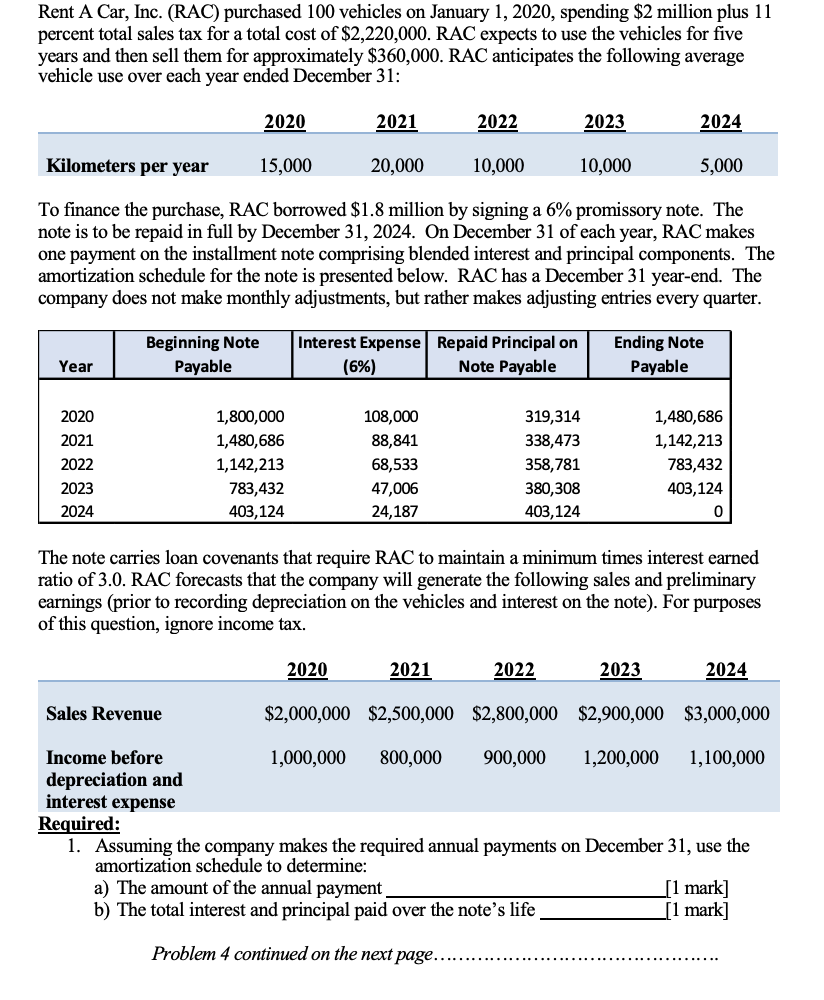

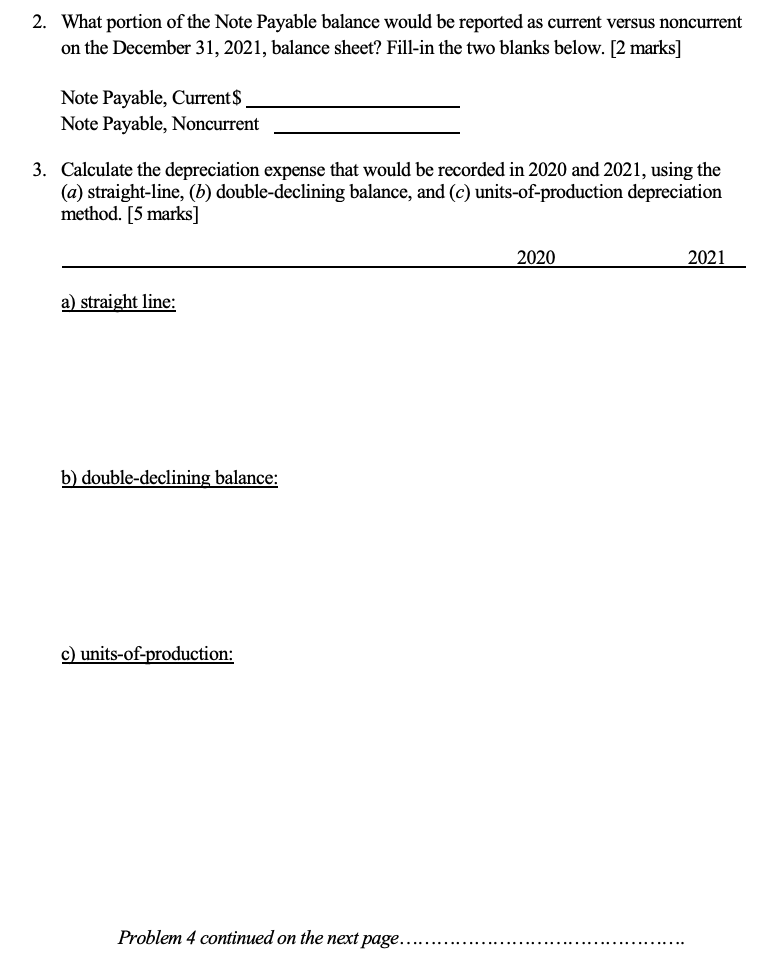

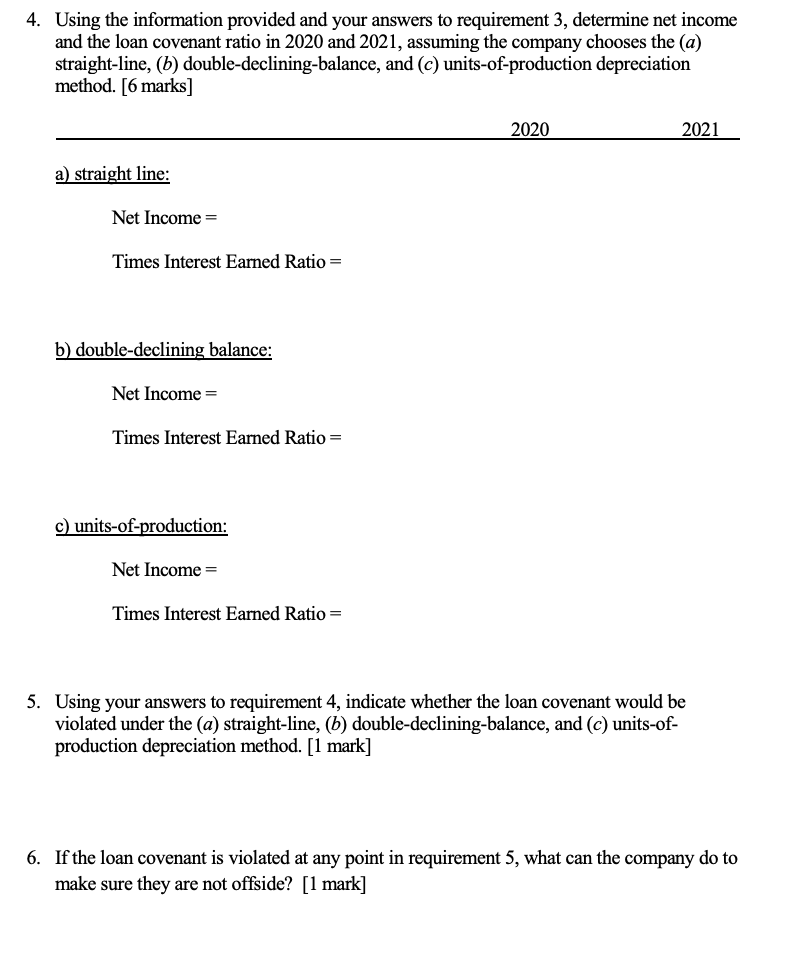

Rent A Car, Inc. (RAC) purchased 100 vehicles on January 1, 2020, spending $2 million plus 11 percent total sales tax for a total cost of $2,220,000. RAC expects to use the vehicles for five years and then sell them for approximately $360,000. RAC anticipates the following average vehicle use over each year ended December 31: 2020 2023 2024 2021 20,000 2022 10,000 Kilometers per year 15,000 10,000 5,000 To finance the purchase, RAC borrowed $1.8 million by signing a 6% promissory note. The note is to be repaid in full by December 31, 2024. On December 31 of each year, RAC makes one payment on the installment note comprising blended interest and principal components. The amortization schedule for the note is presented below. RAC has a December 31 year-end. The company does not make monthly adjustments, but rather makes adjusting entries every quarter. Beginning Note Payable Interest Expense Repaid Principal on (6%) Note Payable Ending Note Payable Year 2020 2021 2022 2023 2024 1,800,000 1,480,686 1,142,213 783,432 403,124 108,000 88,841 68,533 47,006 24,187 319,314 338,473 358,781 380,308 403, 124 1,480,686 1,142,213 783,432 403,124 The note carries loan covenants that require RAC to maintain a minimum times interest earned ratio of 3.0. RAC forecasts that the company will generate the following sales and preliminary earnings (prior to recording depreciation on the vehicles and interest on the note). For purposes of this question, ignore income tax. 2020 2021 2022 2023 2024 Sales Revenue $2,000,000 $2,500,000 $2,800,000 $2,900,000 $3,000,000 Income before 1,000,000 800,000 900,000 1,200,000 1,100,000 depreciation and interest expense Required: 1. Assuming the company makes the required annual payments on December 31, use the amortization schedule to determine: a) The amount of the annual payment [1 mark] b) The total interest and principal paid over the note's life _[1 mark] Problem 4 continued on the next page.......... 2. What portion of the Note Payable balance would be reported as current versus noncurrent on the December 31, 2021, balance sheet? Fill-in the two blanks below. [2 marks] Note Payable, Current $. Note Payable, Noncurrent 3. Calculate the depreciation expense that would be recorded in 2020 and 2021, using the (a) straight-line, (b) double-declining balance, and (c) units-of-production depreciation method. (5 marks] 2020 2021 a) straight line: b) double-declining balance: c) units-of-production: Problem 4 continued on the next page....... 4. Using the information provided and your answers to requirement 3, determine net income and the loan covenant ratio in 2020 and 2021, assuming the company chooses the (a) straight-line, (b) double-declining-balance, and (c) units-of-production depreciation method. [6 marks] 2020 2021 a) straight line: Net Income = Times Interest Earned Ratio = b) double-declining balance: Net Income = Times Interest Earned Ratio = c) units-of-production: Net Income = Times Interest Earned Ratio = 5. Using your answers to requirement 4, indicate whether the loan covenant would be violated under the (a) straight-line, (b) double-declining-balance, and (c) units-of- production depreciation method. [1 mark] 6. If the loan covenant is violated at any point in requirement 5, what can the company do to make sure they are not offside? [1 mark] Rent A Car, Inc. (RAC) purchased 100 vehicles on January 1, 2020, spending $2 million plus 11 percent total sales tax for a total cost of $2,220,000. RAC expects to use the vehicles for five years and then sell them for approximately $360,000. RAC anticipates the following average vehicle use over each year ended December 31: 2020 2023 2024 2021 20,000 2022 10,000 Kilometers per year 15,000 10,000 5,000 To finance the purchase, RAC borrowed $1.8 million by signing a 6% promissory note. The note is to be repaid in full by December 31, 2024. On December 31 of each year, RAC makes one payment on the installment note comprising blended interest and principal components. The amortization schedule for the note is presented below. RAC has a December 31 year-end. The company does not make monthly adjustments, but rather makes adjusting entries every quarter. Beginning Note Payable Interest Expense Repaid Principal on (6%) Note Payable Ending Note Payable Year 2020 2021 2022 2023 2024 1,800,000 1,480,686 1,142,213 783,432 403,124 108,000 88,841 68,533 47,006 24,187 319,314 338,473 358,781 380,308 403, 124 1,480,686 1,142,213 783,432 403,124 The note carries loan covenants that require RAC to maintain a minimum times interest earned ratio of 3.0. RAC forecasts that the company will generate the following sales and preliminary earnings (prior to recording depreciation on the vehicles and interest on the note). For purposes of this question, ignore income tax. 2020 2021 2022 2023 2024 Sales Revenue $2,000,000 $2,500,000 $2,800,000 $2,900,000 $3,000,000 Income before 1,000,000 800,000 900,000 1,200,000 1,100,000 depreciation and interest expense Required: 1. Assuming the company makes the required annual payments on December 31, use the amortization schedule to determine: a) The amount of the annual payment [1 mark] b) The total interest and principal paid over the note's life _[1 mark] Problem 4 continued on the next page.......... 2. What portion of the Note Payable balance would be reported as current versus noncurrent on the December 31, 2021, balance sheet? Fill-in the two blanks below. [2 marks] Note Payable, Current $. Note Payable, Noncurrent 3. Calculate the depreciation expense that would be recorded in 2020 and 2021, using the (a) straight-line, (b) double-declining balance, and (c) units-of-production depreciation method. (5 marks] 2020 2021 a) straight line: b) double-declining balance: c) units-of-production: Problem 4 continued on the next page....... 4. Using the information provided and your answers to requirement 3, determine net income and the loan covenant ratio in 2020 and 2021, assuming the company chooses the (a) straight-line, (b) double-declining-balance, and (c) units-of-production depreciation method. [6 marks] 2020 2021 a) straight line: Net Income = Times Interest Earned Ratio = b) double-declining balance: Net Income = Times Interest Earned Ratio = c) units-of-production: Net Income = Times Interest Earned Ratio = 5. Using your answers to requirement 4, indicate whether the loan covenant would be violated under the (a) straight-line, (b) double-declining-balance, and (c) units-of- production depreciation method. [1 mark] 6. If the loan covenant is violated at any point in requirement 5, what can the company do to make sure they are not offside? [1 mark]