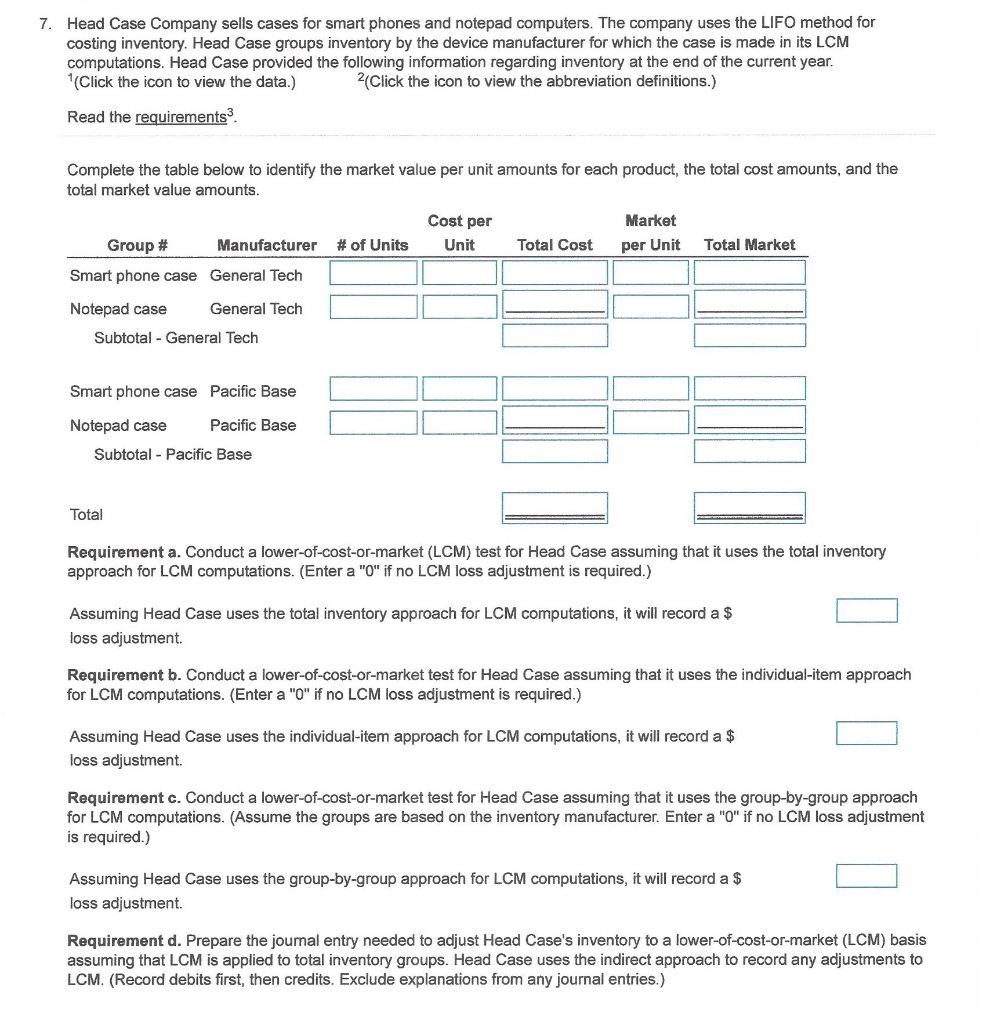

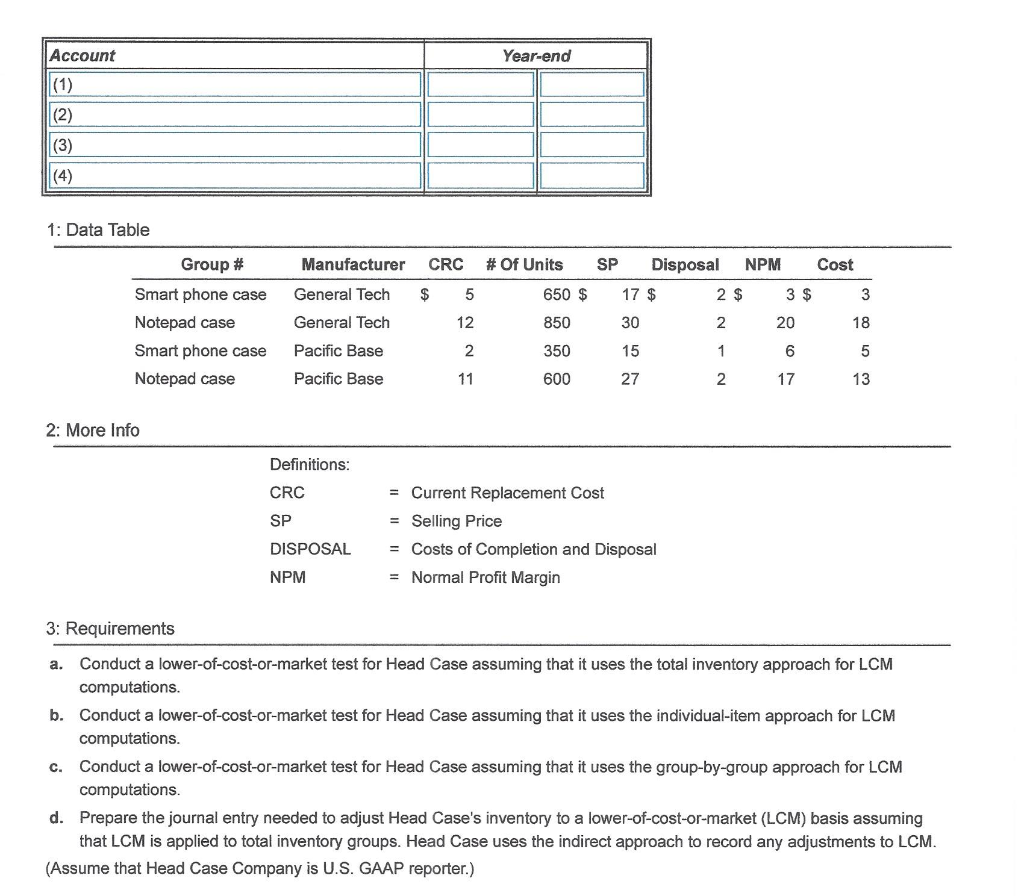

Head Case Company sells cases for smart phones and notepad computers. The company uses the LIFO method for costing inventory. Head Case groups inventory by the device manufacturer for which the case is made in its LCM computations. Head Case provided the following information regarding inventory at the end of the current year. (Click the icon to view the data.) 7 2(Click the icon to view the abbreviation definitions.) Read the requirements3 Complete the table below to identify the market value per unit amounts for each product, the total cost amounts, and the total market value amounts. Cost per Market #of Units Total Cost Total Market Group # Manufacturer Unit per Unit Smart phone case General Tech Notepad case General Tech Subtotal General Tech Smart phone case Pacific Base Notepad case Pacific Base Subtotal Pacific Base Total Requirement a. Conduct a lower-of-cost-or-market (LCM) test for Head Case assuming that it uses the total inventory approach for LCM computations. (Enter a "0" if no LCM loss adjustment is required.) Assuming Head Case uses the total inventory approach for LCM computations, it will record a $ loss adjustment. Requirement b. Conduct a lower-of-cost-or-market test for Head Case assuming that for LCM computations. (Enter a "0" if no LCM loss adjustment is required.) uses the individual-item approach Assuming Head Case uses the individual-item approach for LCM computations, it will record a $ loss adjustment Requirement c. Conduct a lower-of-cost-or-market test for Head Case assuming that it uses the group-by-group approach for LCM computations. (Assume the groups are based on the inventory manufacturer. Enter a "0" if no LCM loss adjustment is required.) Assuming Head Case uses the group-by-group approach for LCM computations, it will record a $ loss adjustment. Requirement d. Prepare the journal entry needed to adjust Head Case's inventory to a lower-of-cost-or-market (LCM) basis assuming that LCM is applied to total inventory groups. Head Case uses the indirect approach to record any adjustments to LCM. (Record debits first, then credits. Exclude explanations from any journal entries.) Account Year-end (1) (2) (3) (4) 1: Data Table Manufacturer Group # CRC #Of Units SP Disposal NPM Cost Smart phone case 650 $ 17 $ 2 $ 3 $ General Tech 5 Notepad case General Tech 12 850 30 20 18 2 Smart phone case Pacific Base 2 350 15 6 1 5 Notepad case Pacific Base 11 600 27 2 17 13 2: More Info Definitions: CRC Current Replacement Cost = Selling Price SP DISPOSAL Costs of Completion and Disposal Normal Profit Margin NPM 3: Requirements Conduct a lower-of-cost-or-market test for Head Case assuming that it uses the total inventory approach for LCM a. computations b. Conduct a lower-of-cost-or-market test for Head Case assuming that it uses the individual-item approach for LCM computations. Conduct a lower-of-cost-or-market test for Head Case assuming that it uses the group-by-group approach for LCM computations. C. d. Prepare the journal entry needed to adjust Head Case's inventory to a lower-of-cost-or-market (LCM) basis assuming that LCM is applied to total inventory groups. Head Case uses the indirect approach to record any adjustments to LCM. (Assume that Head Case Company is U.S. GAAP reporter.) Head Case Company sells cases for smart phones and notepad computers. The company uses the LIFO method for costing inventory. Head Case groups inventory by the device manufacturer for which the case is made in its LCM computations. Head Case provided the following information regarding inventory at the end of the current year. (Click the icon to view the data.) 7 2(Click the icon to view the abbreviation definitions.) Read the requirements3 Complete the table below to identify the market value per unit amounts for each product, the total cost amounts, and the total market value amounts. Cost per Market #of Units Total Cost Total Market Group # Manufacturer Unit per Unit Smart phone case General Tech Notepad case General Tech Subtotal General Tech Smart phone case Pacific Base Notepad case Pacific Base Subtotal Pacific Base Total Requirement a. Conduct a lower-of-cost-or-market (LCM) test for Head Case assuming that it uses the total inventory approach for LCM computations. (Enter a "0" if no LCM loss adjustment is required.) Assuming Head Case uses the total inventory approach for LCM computations, it will record a $ loss adjustment. Requirement b. Conduct a lower-of-cost-or-market test for Head Case assuming that for LCM computations. (Enter a "0" if no LCM loss adjustment is required.) uses the individual-item approach Assuming Head Case uses the individual-item approach for LCM computations, it will record a $ loss adjustment Requirement c. Conduct a lower-of-cost-or-market test for Head Case assuming that it uses the group-by-group approach for LCM computations. (Assume the groups are based on the inventory manufacturer. Enter a "0" if no LCM loss adjustment is required.) Assuming Head Case uses the group-by-group approach for LCM computations, it will record a $ loss adjustment. Requirement d. Prepare the journal entry needed to adjust Head Case's inventory to a lower-of-cost-or-market (LCM) basis assuming that LCM is applied to total inventory groups. Head Case uses the indirect approach to record any adjustments to LCM. (Record debits first, then credits. Exclude explanations from any journal entries.) Account Year-end (1) (2) (3) (4) 1: Data Table Manufacturer Group # CRC #Of Units SP Disposal NPM Cost Smart phone case 650 $ 17 $ 2 $ 3 $ General Tech 5 Notepad case General Tech 12 850 30 20 18 2 Smart phone case Pacific Base 2 350 15 6 1 5 Notepad case Pacific Base 11 600 27 2 17 13 2: More Info Definitions: CRC Current Replacement Cost = Selling Price SP DISPOSAL Costs of Completion and Disposal Normal Profit Margin NPM 3: Requirements Conduct a lower-of-cost-or-market test for Head Case assuming that it uses the total inventory approach for LCM a. computations b. Conduct a lower-of-cost-or-market test for Head Case assuming that it uses the individual-item approach for LCM computations. Conduct a lower-of-cost-or-market test for Head Case assuming that it uses the group-by-group approach for LCM computations. C. d. Prepare the journal entry needed to adjust Head Case's inventory to a lower-of-cost-or-market (LCM) basis assuming that LCM is applied to total inventory groups. Head Case uses the indirect approach to record any adjustments to LCM. (Assume that Head Case Company is U.S. GAAP reporter.)