Answered step by step

Verified Expert Solution

Question

1 Approved Answer

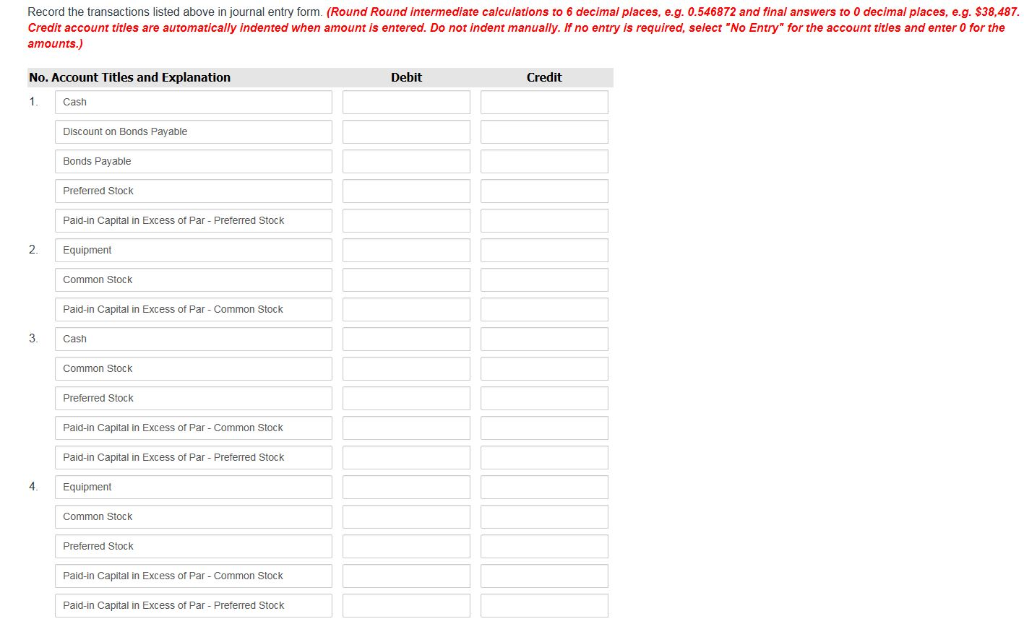

Headland Corporations charter authorized issuance of 102,000 shares of $ 10 par value common stock and 54,100 shares of $ 50 preferred stock. The following

Headland Corporations charter authorized issuance of 102,000 shares of $ 10 par value common stock and 54,100 shares of $ 50 preferred stock. The following transactions involving the issuance of shares of stock were completed. Each transaction is independent of the others.

| 1. | Issued a $ 10,400, 8% bond payable at par and gave as a bonus one share of preferred stock, which at that time was selling for $ 108 a share. | |

| 2. | Issued 470 shares of common stock for equipment. The equipment had been appraised at $ 7,300; the sellers book value was $ 5,500. The most recent market price of the common stock is $ 15 a share. | |

| 3. | Issued 389 shares of common and 103 shares of preferred for a lump sum amounting to $ 10,800. The common had been selling at $ 13 and the preferred at $ 63. | |

| 4. | Issued 190 shares of common and 52 shares of preferred for equipment. The common had a fair value of $ 15 per share; the equipment has a fair value of $ 6,900. |

*Not sure if Account Titles are correct*

Record the transactions listed above in journal entry form. (Round Round intermediate calculations to 6 decimal places, e.g. 0.546872 and final answers to 0 decimal places, e.g. $38,487 Credit account titles are automatically indented when amount is entered. Do not indent manually-lf no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) No. Account Titles and Explanation Debit Credit 1 Cash Discount on Bonds Payable Bonds Payable Preferred Stock Paid-in Capital in Excess of Par- Preferred Stock 2. Equipment Common Stock Paid-in Capital in Excess of Par Common Stock 3. Cash Common Stock Preferred Stock Paid-in Capital in Excess of Par-Common Stock Paid-in Capital in Excess of Par - Preferred Stock 4. Equipment Common Stock Preferred Stock Paid-in Capital in Excess of Par Common Stock Paid-in Capital in Excess of Par- Preferred StockStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started