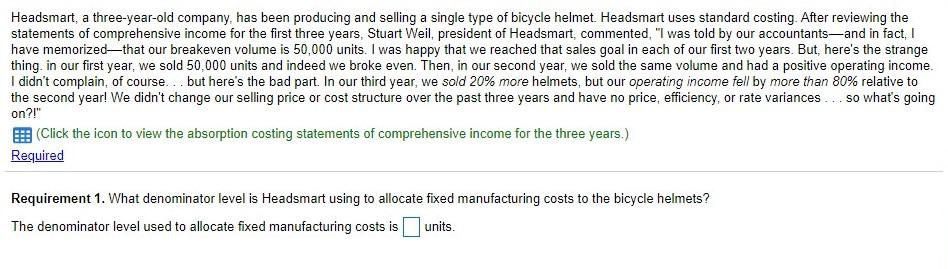

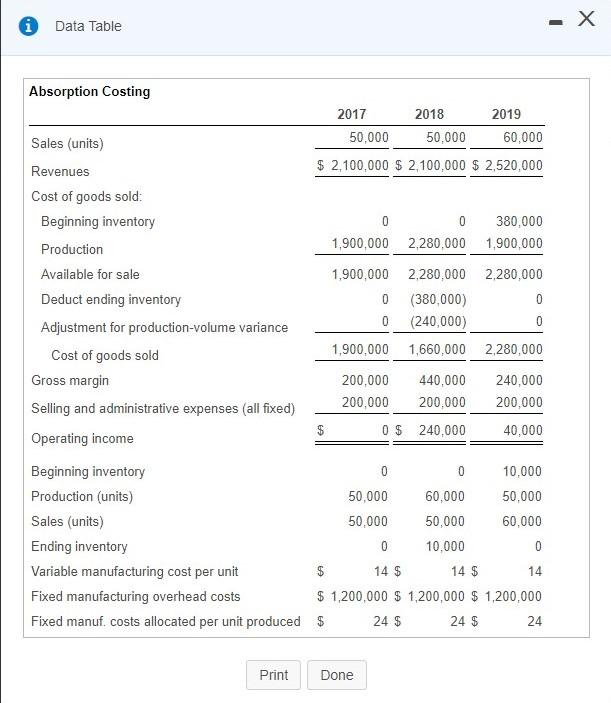

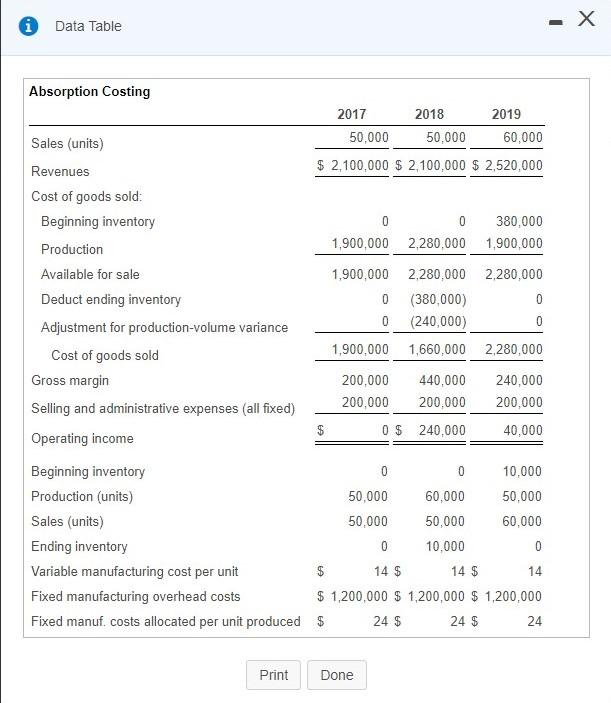

Headsmart, a three-year-old company, has been producing and selling a single type of bicycle helmet. Headsmart uses standard costing. After reviewing the statements of comprehensive income for the first three years, Stuart Weil, president of Headsmart, commented, "I was told by our accountantsand in fact, I have memorizedthat our breakeven volume is 50,000 units. I was happy that we reached that sales goal in each of our first two years. But, here's the strange thing in our first year, we sold 50,000 units and indeed we broke even. Then, in our second year, we sold the same volume and had a positive operating income. I didn't complain, of course... but here's the bad part. In our third year, we sold 20% more helmets, but our operating income fell by more than 80% relative to the second year! We didn't change our selling price or cost structure over the past three years and have no price, efficiency, or rate variances so what's going on?!" (Click the icon to view the absorption costing statements of comprehensive income for the three years.) Required Requirement 1. What denominator level is Headsmart using to allocate fixed manufacturing costs to the bicycle helmets? The denominator level used to allocate fixed manufacturing costs is units. - Data Table Absorption Costing 2017 2018 2019 50,000 Sales (units) 50,000 60,000 Revenues $ 2,100,000 $2,100,000 $ 2,520,000 Cost of goods sold: Beginning inventory 0 0 380,000 Production 1,900,000 2,280,000 1,900,000 Available for sale 1,900,000 2,280,000 2,280,000 Deduct ending inventory 0 0 (380,000) 0 (240,000) 0 Adjustment for production-volume variance 1,900,000 1,660,000 2,280,000 Cost of goods sold Gross margin 200,000 440,000 240,000 Selling and administrative expenses (all fixed) 200,000 200,000 200,000 $ 0 $ 240,000 40,000 Operating income Beginning inventory 0 0 10,000 Production (units) 50,000 60,000 50,000 Sales (units) 50,000 50,000 60,000 Ending inventory 0 10,000 0 Variable manufacturing cost per unit $ 14 $ 14 $ 14 Fixed manufacturing overhead costs $ 1,200,000 $ 1,200,000 $ 1,200,000 Fixed manuf. costs allocated per unit produced $ 24 $ 24 $ 24 Print Done i Required 1. What denominator level is Headsmart using to allocate fixed manufacturing costs to the bicycle helmets? How is Headsmart disposing of any favourable or unfavourable production-volume variance at the end of the year? Explain your answer briefly. 2. How did Headsmart's accountants arrive at the breakeven volume of 50,000 units