Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Healthcare Finance Homework Scenario: You represent the management team at Marble Valley Medical Center, a 95 bed, non-profit general acute care hospital. Their financial statements

Healthcare Finance Homework Scenario:

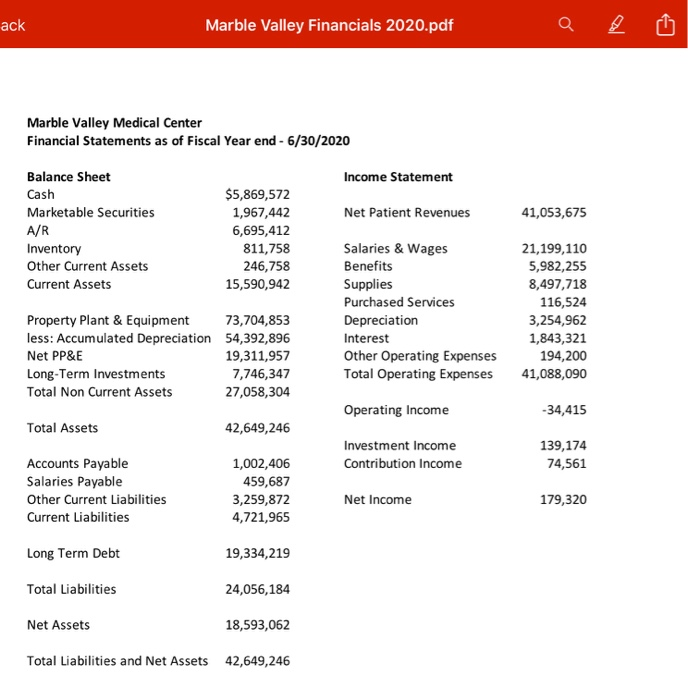

You represent the management team at Marble Valley Medical Center, a 95 bed, non-profit general acute care hospital. Their financial statements as of June 30, 2020 are included (Marble Valley Financials 2020 - see picture).

You are reviewing these financial statements with your governing board finance committee and the question of interest rates comes up. You currently have one large debt item and some smaller equipment loans in your long term debt. The major debt item is a 2008 bond issue totaling $27,500,000, payable annually at 7.25% for 20 years. the debt was issued under an A credit rating by Standard & Poors. You still qualify for similar debt rating today. You also have a short-term credit revolver (which is the amount in your "other current liabilities") that you are currently paying 4% on, but have crossed a debt size threshold ($2 million) where the interest rate will increase to 8% in the next year. Neither of these debt instruments have prepayment penalties.

Formulate an ANALYSIS of the debt situation you have and present a RECOMMENDATION to the board on your debt structure, based on the current interest rate landscape.

Additional info: According to my professor, you should everything in the question and the attachment to answer the question.

ack Marble Valley Financials 2020.pdf Q Marble Valley Medical Center Financial Statements as of Fiscal Year end - 6/30/2020 Income Statement Net Patient Revenues 41,053,675 Balance Sheet Cash Marketable Securities A/R Inventory Other Current Assets Current Assets $5,869,572 1,967,442 6,695,412 811,758 246,758 15,590,942 Salaries & Wages Benefits Supplies Purchased Services Depreciation Interest Other Operating Expenses Total Operating Expenses 21,199,110 5,982,255 8,497,718 116,524 3,254,962 1,843,321 194,200 41,088,090 Property Plant & Equipment 73,704,853 less: Accumulated Depreciation 54,392,896 Net PP&E 19,311,957 Long-Term Investments 7,746,347 Total Non Current Assets 27,058,304 Operating Income -34,415 Total Assets 42,649,246 Investment Income Contribution Income 139,174 74,561 Accounts Payable Salaries Payable Other Current Liabilities Current Liabilities 1,002,406 459,687 3,259,872 4,721,965 Net Income 179,320 Long Term Debt 19,334,219 Total Liabilities 24,056,184 Net Assets 18,593,062 Total Liabilities and Net Assets 42,649,246 ack Marble Valley Financials 2020.pdf Q Marble Valley Medical Center Financial Statements as of Fiscal Year end - 6/30/2020 Income Statement Net Patient Revenues 41,053,675 Balance Sheet Cash Marketable Securities A/R Inventory Other Current Assets Current Assets $5,869,572 1,967,442 6,695,412 811,758 246,758 15,590,942 Salaries & Wages Benefits Supplies Purchased Services Depreciation Interest Other Operating Expenses Total Operating Expenses 21,199,110 5,982,255 8,497,718 116,524 3,254,962 1,843,321 194,200 41,088,090 Property Plant & Equipment 73,704,853 less: Accumulated Depreciation 54,392,896 Net PP&E 19,311,957 Long-Term Investments 7,746,347 Total Non Current Assets 27,058,304 Operating Income -34,415 Total Assets 42,649,246 Investment Income Contribution Income 139,174 74,561 Accounts Payable Salaries Payable Other Current Liabilities Current Liabilities 1,002,406 459,687 3,259,872 4,721,965 Net Income 179,320 Long Term Debt 19,334,219 Total Liabilities 24,056,184 Net Assets 18,593,062 Total Liabilities and Net Assets 42,649,246 The way I'm thinking about it is that the company has a loan at 7.5% in 2008 with a credit rating of A. Since the comapny has a similar credit rating now, it can still raise money at 7.5%. But, the short term financing has become expensive for the company as they increased gtom yhrit limit of $2 million. Therefore, the company needs to deleverage in the short term obligations by increasing their leverage in the long term position. Therefore, the recommendation to the board should be to prepay (3259872-2000000 = $1259872) off their short term debt and refinance it with long term debt. This will reduce the overall capacity for the company.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started