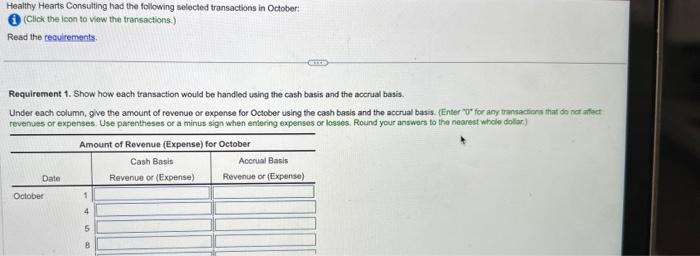

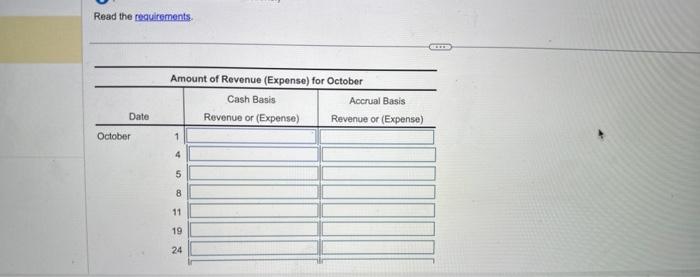

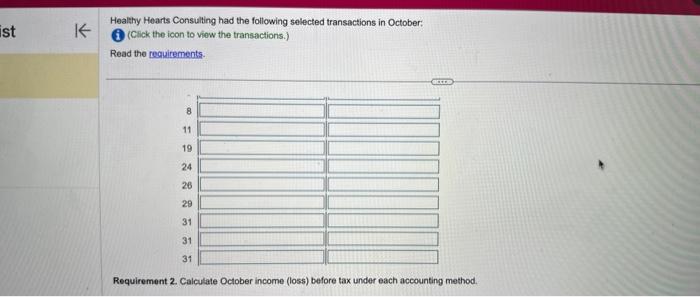

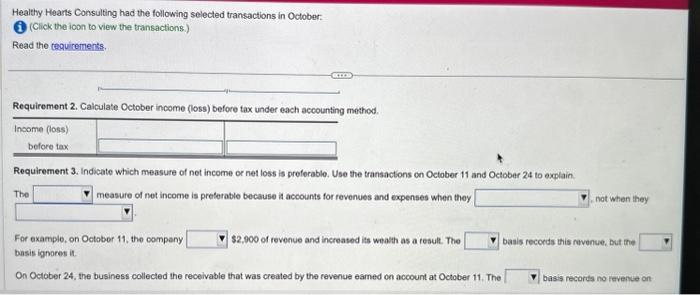

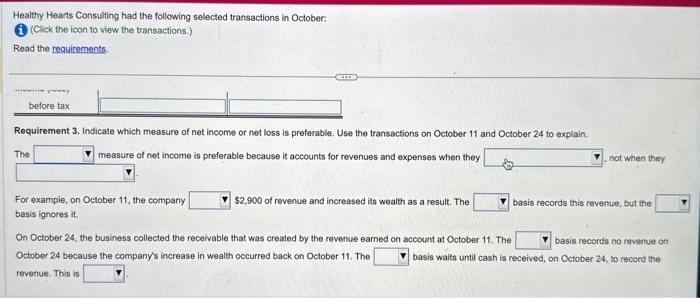

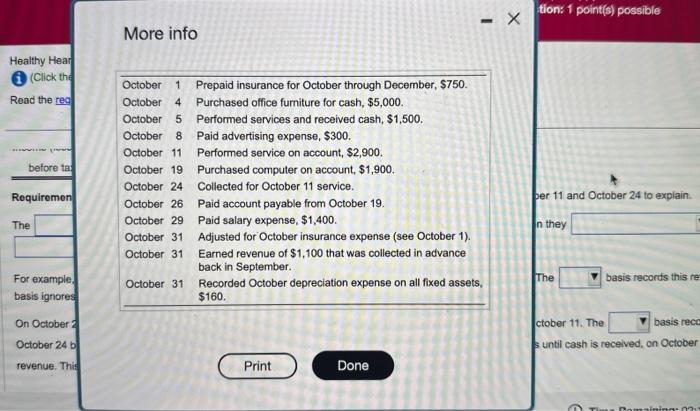

Healthy Hearts Consulting had the following selected transactions in Dctober: (1. (Click the ionn to viow the transactions.) Read the ceculrements. Requirement 1. Show how each transaction would be handled using the cash basis and the accrual basis. Under each column, give the amount of revenue or expense for October using the cash basis and the accrual basis. (Einter "or for any transactions that do nat antect revenues or expenses. Use parentheses or a minus sign when enlering expenses or lesses. Round your answars to the nearest wholo dollar.) Read the requirements. Healhy Hearts Consulting had the following selected transactions in October: (i) (Cick the icon to view the transactions.) Read the requirements. Requirement 2. Calculate October income (loss) before tax under each accounting method. Healthy Hearts Consulting had the following selected transactions in October: (1) (Click the ioon to view the transactions.) Read the tequirements. Requirement 2. Calculate October income (loss) before tax under each accounting method. Requirement 3. Indicate which measure of net income or net loss is preforable. Use the transactions on October 11 and October 24 to explain. The measure of net income is preferable because it accounts for revenues and expenses when they not when they For example, on October 11, the oompeny $2,900 of revenue and increased its weath as a reault. The baais records this revenue, but the basis ignores if. On October 24, the business collected the recelvable that was created by the revenue eamed on account at October 11. The basis recorts no revence on Healthy Hearts Consulting had the following selected transactions in October: i. (Click the icon to view the transactions.) Read the reguirements. Requirement 3. Indicate which measure of net income or net loss is preferable. Use the transactions on October 11 and October 24 to explain. The measure of net income is preferable because it accounts for revenues and expenses when they not when they For example, on October 11, the company $2,900 of revenue and increased its weath as a result. The basis records this revenue, but the basis ignores it. On October 24, the business collected the receivable that was created by the revenue earned on account at October 11. The basis records no revenue on October 24 because the company's increase in wealth occurred back on October 11. The basis waits until cash is received, on October 24, to record the revenue. This is Requirements 1. Show how each transaction would be handed (in terms of recognizing revenues and expenses) using the cash basis and the accrual basis. 2. Calculate October income (loss) before tax under each accounting method. 3. Indicate which measure of net income or net loss is preferable. Use the transactions on October 11 and October 24 to explain. For exam basis ign On Octot 11 and October 24 to expli October 24 because the company's increase in wealth occurred back on October 11. The basis waits untll cash is received, on Octo revenue. This is More info per 11 and October 24 to explain. n they ctober 11. The 3 until cash is received, on October