Answered step by step

Verified Expert Solution

Question

1 Approved Answer

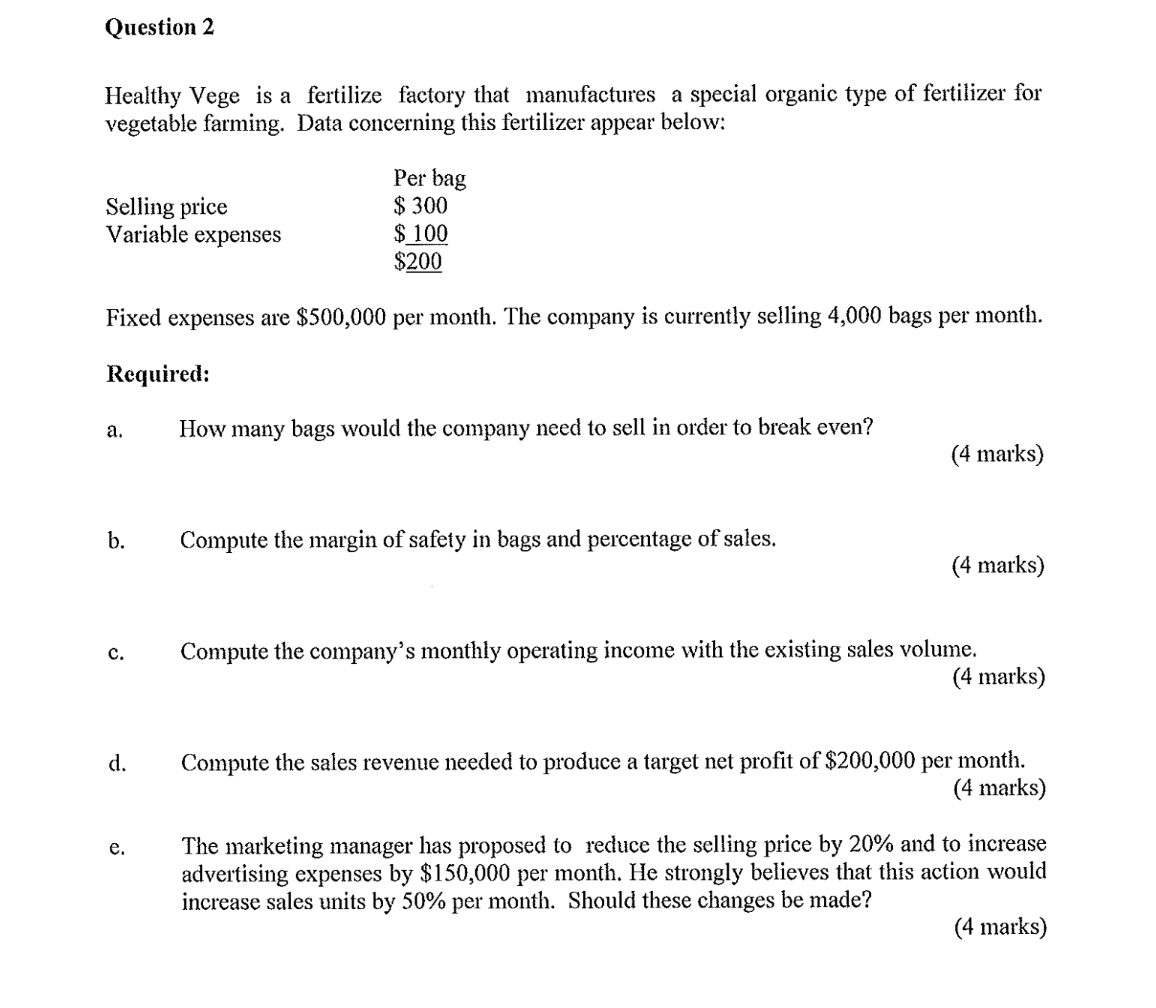

Healthy Vege is a fertilize factory that manufactures a special organic type of fertilizer for vegetable farming. Data concerning this fertilizer appear below: Fixed expenses

Healthy Vege is a fertilize factory that manufactures a special organic type of fertilizer for vegetable farming. Data concerning this fertilizer appear below: Fixed expenses are $500,000 per month. The company is currently selling 4,000 bags per month. Required: a. How many bags would the company need to sell in order to break even? (4 marks) b. Compute the margin of safety in bags and percentage of sales. (4 marks) c. Compute the company's monthly operating income with the existing sales volume. (4 marks) d. Compute the sales revenue needed to produce a target net profit of $200,000 per month. (4 marks) e. The marketing manager has proposed to reduce the selling price by 20% and to increase advertising expenses by $150,000 per month. He strongly believes that this action would increase sales units by 50% per month. Should these changes be made? (4 marks) Management is considering using a new component that would increase the unit variable cost to $120 but since the new component would improve the product quality, the marketing manager predicts that monthly sales would increase by 500 bags. What would be the overall effect of this change on the company's monthly net operating income if fixed expenses are unaffected? Show your workings clearly. (6 marks) Explain how would the following actions by the company will affect the company's break-even point. 1. An increase in the selling price per bag. 2. A decrease in the number of bags sold. (4 marks) Healthy Vege is a fertilize factory that manufactures a special organic type of fertilizer for vegetable farming. Data concerning this fertilizer appear below: Fixed expenses are $500,000 per month. The company is currently selling 4,000 bags per month. Required: a. How many bags would the company need to sell in order to break even? (4 marks) b. Compute the margin of safety in bags and percentage of sales. (4 marks) c. Compute the company's monthly operating income with the existing sales volume. (4 marks) d. Compute the sales revenue needed to produce a target net profit of $200,000 per month. (4 marks) e. The marketing manager has proposed to reduce the selling price by 20% and to increase advertising expenses by $150,000 per month. He strongly believes that this action would increase sales units by 50% per month. Should these changes be made? (4 marks) Management is considering using a new component that would increase the unit variable cost to $120 but since the new component would improve the product quality, the marketing manager predicts that monthly sales would increase by 500 bags. What would be the overall effect of this change on the company's monthly net operating income if fixed expenses are unaffected? Show your workings clearly. (6 marks) Explain how would the following actions by the company will affect the company's break-even point. 1. An increase in the selling price per bag. 2. A decrease in the number of bags sold. (4 marks)

Healthy Vege is a fertilize factory that manufactures a special organic type of fertilizer for vegetable farming. Data concerning this fertilizer appear below: Fixed expenses are $500,000 per month. The company is currently selling 4,000 bags per month. Required: a. How many bags would the company need to sell in order to break even? (4 marks) b. Compute the margin of safety in bags and percentage of sales. (4 marks) c. Compute the company's monthly operating income with the existing sales volume. (4 marks) d. Compute the sales revenue needed to produce a target net profit of $200,000 per month. (4 marks) e. The marketing manager has proposed to reduce the selling price by 20% and to increase advertising expenses by $150,000 per month. He strongly believes that this action would increase sales units by 50% per month. Should these changes be made? (4 marks) Management is considering using a new component that would increase the unit variable cost to $120 but since the new component would improve the product quality, the marketing manager predicts that monthly sales would increase by 500 bags. What would be the overall effect of this change on the company's monthly net operating income if fixed expenses are unaffected? Show your workings clearly. (6 marks) Explain how would the following actions by the company will affect the company's break-even point. 1. An increase in the selling price per bag. 2. A decrease in the number of bags sold. (4 marks) Healthy Vege is a fertilize factory that manufactures a special organic type of fertilizer for vegetable farming. Data concerning this fertilizer appear below: Fixed expenses are $500,000 per month. The company is currently selling 4,000 bags per month. Required: a. How many bags would the company need to sell in order to break even? (4 marks) b. Compute the margin of safety in bags and percentage of sales. (4 marks) c. Compute the company's monthly operating income with the existing sales volume. (4 marks) d. Compute the sales revenue needed to produce a target net profit of $200,000 per month. (4 marks) e. The marketing manager has proposed to reduce the selling price by 20% and to increase advertising expenses by $150,000 per month. He strongly believes that this action would increase sales units by 50% per month. Should these changes be made? (4 marks) Management is considering using a new component that would increase the unit variable cost to $120 but since the new component would improve the product quality, the marketing manager predicts that monthly sales would increase by 500 bags. What would be the overall effect of this change on the company's monthly net operating income if fixed expenses are unaffected? Show your workings clearly. (6 marks) Explain how would the following actions by the company will affect the company's break-even point. 1. An increase in the selling price per bag. 2. A decrease in the number of bags sold. (4 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started