Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Heather Mendel works for a company in Alberta. Her regular earnings for the year were $70,000.00. Her vacation pay for the year was $2,800.52.

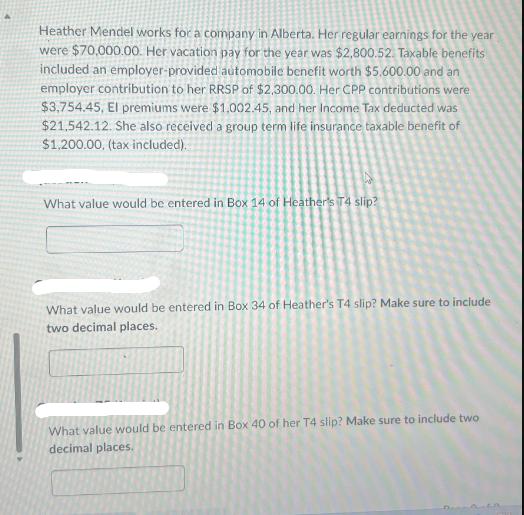

Heather Mendel works for a company in Alberta. Her regular earnings for the year were $70,000.00. Her vacation pay for the year was $2,800.52. Taxable benefits included an employer-provided automobile benefit worth $5.600.00 and an employer contribution to her RRSP of $2,300.00. Her CPP contributions were $3,754.45, El premiums were $1.002.45, and her Income Tax deducted was $21,542.12. She also received a group term life insurance taxable benefit of $1,200.00. (tax included). A What value would be entered in Box 14 of Heather's T4 slip? What value would be entered in Box 34 of Heather's T4 slip? Make sure to include two decimal places. What value would be entered in Box 40 of her T4 slip? Make sure to include two decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the values that would be entered in Heathers T4 slip we nee...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started