Answered step by step

Verified Expert Solution

Question

1 Approved Answer

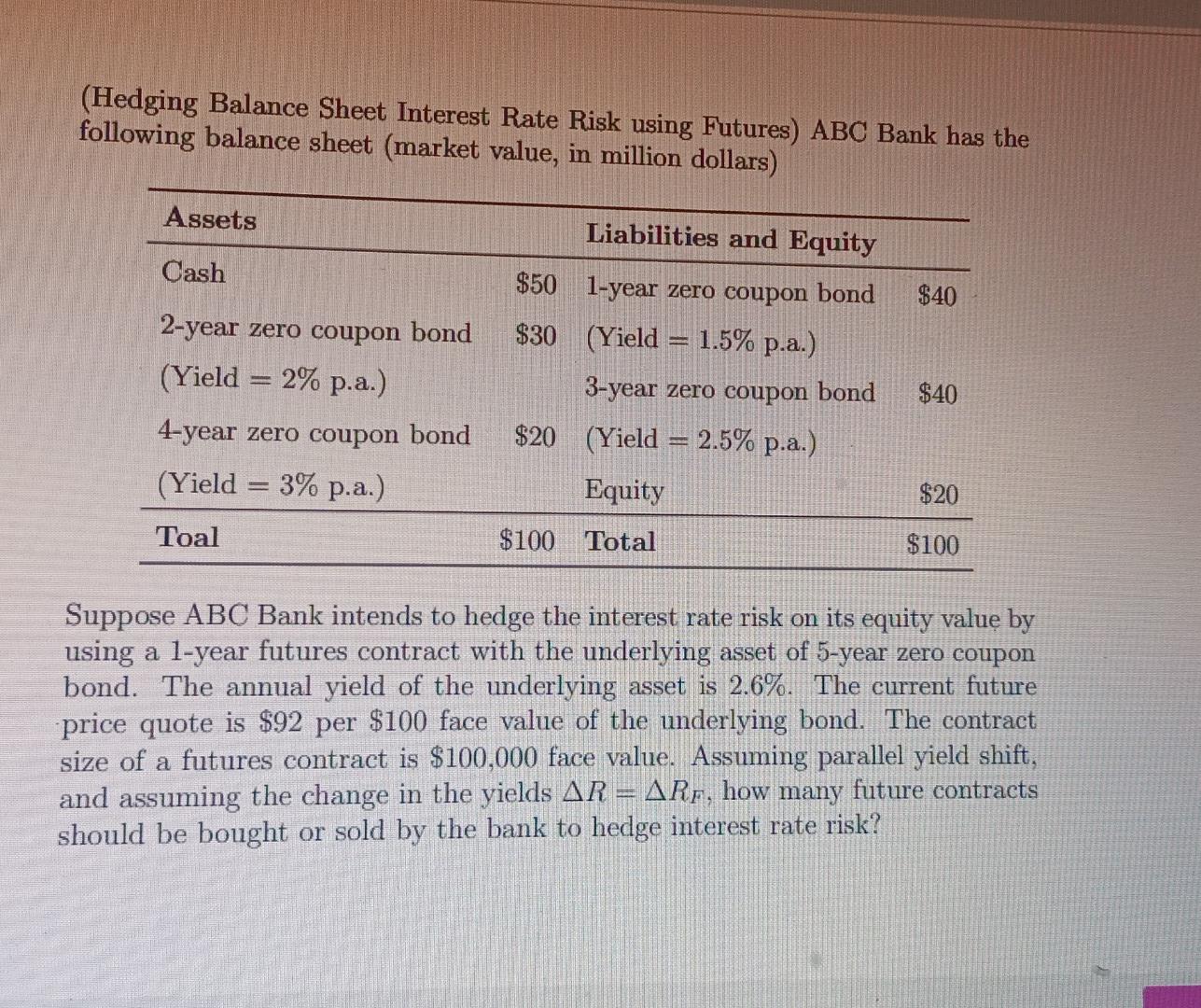

(Hedging Balance Sheet Interest Rate Risk using Futures) ABC Bank has the following balance sheet (market value, in million dollars) Assets Liabilities and Equity Cash

(Hedging Balance Sheet Interest Rate Risk using Futures) ABC Bank has the following balance sheet (market value, in million dollars) Assets Liabilities and Equity Cash $40 $50 1-year zero coupon bond $30 (Yield = 1.5% p.a.) 3-year zero coupon bond $20 (Yield = 2.5% p.a.) Equity 2-year zero coupon bond (Yield = 2% p.a.) 4-year zero coupon bond (Yield = 3% p.a.) $40 $20 Toal $100 Total $100 Suppose ABC Bank intends to hedge the interest rate risk on its equity value by using a l-year futures contract with the underlying asset of 5-year zero coupon bond. The annual yield of the underlying asset is 2.6%. The current future price quote is $92 per $100 face value of the underlying bond. The contract size of a futures contract is $100,000 face value. Assuming parallel yield shift, and assuming the change in the yields AR = ARF, how many future contracts should be bought or sold by the bank to hedge interest rate risk? (Hedging Balance Sheet Interest Rate Risk using Futures) ABC Bank has the following balance sheet (market value, in million dollars) Assets Liabilities and Equity Cash $40 $50 1-year zero coupon bond $30 (Yield = 1.5% p.a.) 3-year zero coupon bond $20 (Yield = 2.5% p.a.) Equity 2-year zero coupon bond (Yield = 2% p.a.) 4-year zero coupon bond (Yield = 3% p.a.) $40 $20 Toal $100 Total $100 Suppose ABC Bank intends to hedge the interest rate risk on its equity value by using a l-year futures contract with the underlying asset of 5-year zero coupon bond. The annual yield of the underlying asset is 2.6%. The current future price quote is $92 per $100 face value of the underlying bond. The contract size of a futures contract is $100,000 face value. Assuming parallel yield shift, and assuming the change in the yields AR = ARF, how many future contracts should be bought or sold by the bank to hedge interest rate risk

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started