Question

Heidaka Trust Corporation has two service departments: actuary and economic analysis. Heidaka also has three operating departments: annuity, fund management, and employee benefit services. The

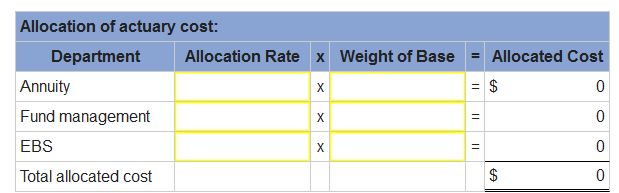

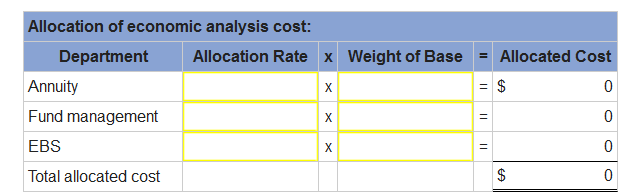

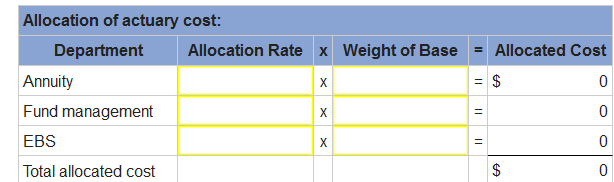

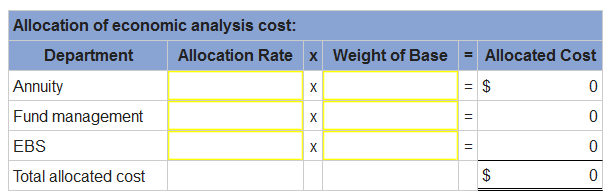

Heidaka Trust Corporation has two service departments: actuary and economic analysis. Heidaka also has three operating departments: annuity, fund management, and employee benefit services. The annual costs of operating the service departments are $495,000 for actuary and $675,000 for economic analysis. Heidaka uses the direct method to allocate service center costs to operating departments. Other relevant data follow:

| Operating Departments | Operating Costs | Revenue |

| Annuity | $482,000.00 | $840,000.00 |

| Fund management | $879,500.00 | $1,260,000.00 |

| Employee benefit services | $888,500.00 | $1,500,000.00 |

Required:

| a | Use operating costs as the cost driver for allocating service center costs to operating departments. (Round "Allocation rate" to 2 decimal places and other answers to nearest whole dollar amount.) |

b. Use revenue as the cost driver for allocating service center costs to operating departments. (Round "Allocation rate" to 4 decimal places and other answers to nearest whole dollar amount.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started