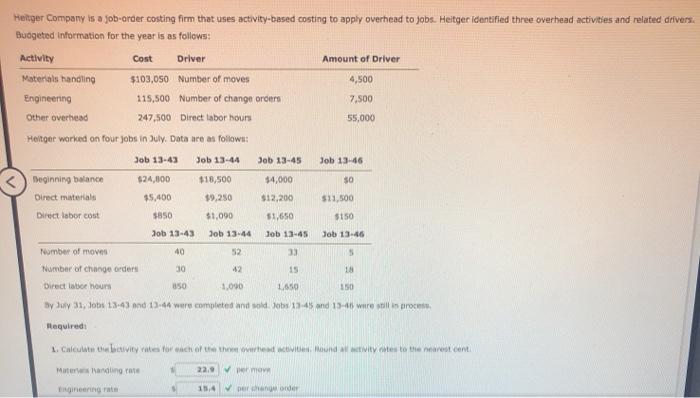

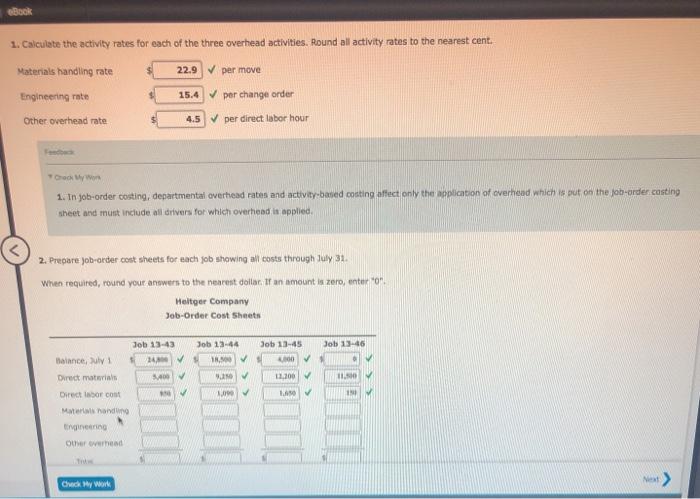

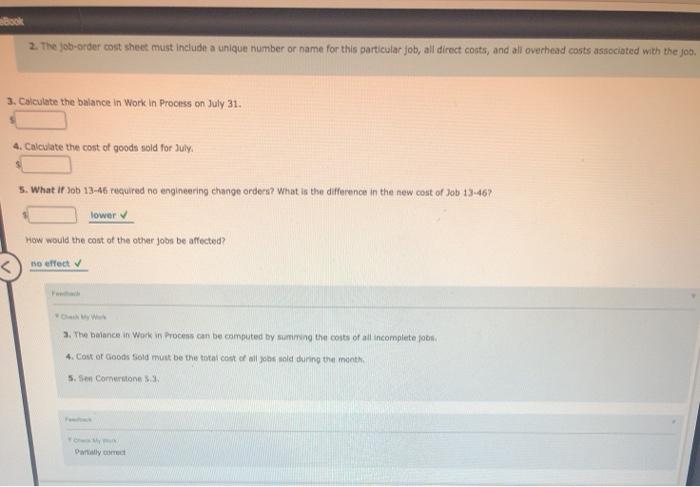

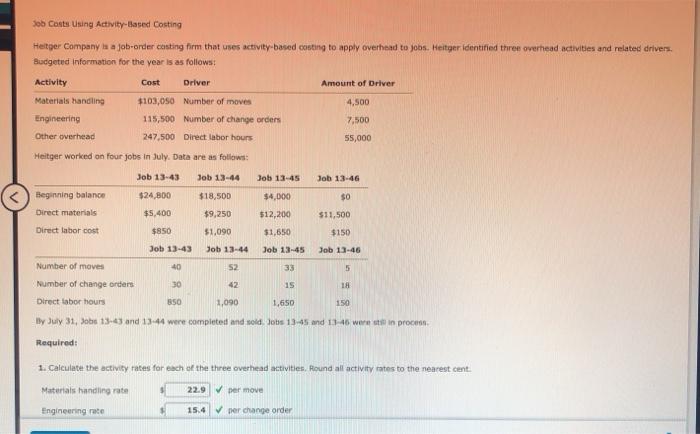

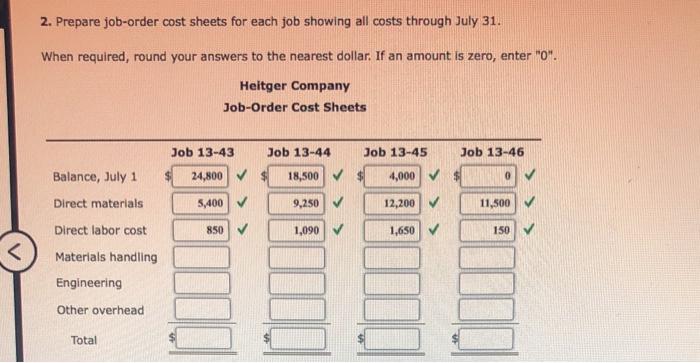

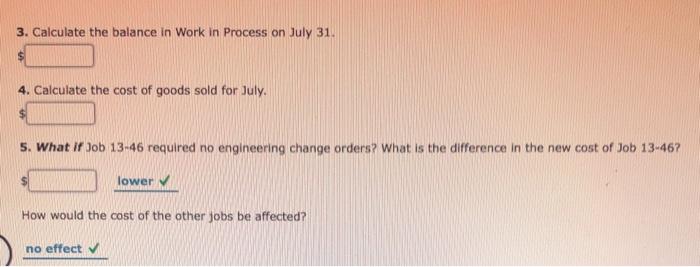

Heitger Company is a job-order costing firm that uses activity-based costing to apply overhead to jobs. Heitger identified three overhead activities and related drivers. Budgeted Information for the year is as follows: Activity Cost Driver Amount of Driver Materials handling $103,050 Number of moves 4,500 Engineering 115,500 Number of change orders 7.500 Other overhead 247,500 Direct labor hours 55,000 Helter worked on four jobs in July. Data e as follows: Job 13-43 Job 13-44 Job 13-45 Job 13-46 $24,000 $18,500 Beginning balance Direct materials $4,000 $12,200 SO $11,500 $9,250 $5,400 $850 Direct labor cost $1,090 $150 Job 13.43 Job 13.44 53,650 Job 13-45 33 Job 13-46 40 52 5 Number of moves Number of change orders Direct to our 30 42 15 18 350 1,090 1.650 150 by July 31. Job 13:43 and 13-14 were completed and sold Jobs 13:45 and 15-16 were still in proceso Required 1. Calotto bavity rates for each of the twoverhed Hound a twity notes to the nearest cent Matervandlingar 229 Mo Ingineering te 15.4 perchen oder Book 1. Calculate the activity rates for each of the three overhead activities. Round all activity rates to the nearest cent. Materials handling rate 22.9 per move Engineering te 15.4 per change order Other overhead rate 4.5 per direct labor hour Oy 1. In job-order costing, departmental overhead rates and activity based costing affect only the application of overhead which put on the job-order costing sheet and must include all drivers for which overhead is applied 2. Prepare job-order cost sheets for each job showing all costs through July 31. When required, round your answers to the nearest dollar. If an amount is zero, enter on Heltger Company Job-Order Cost Sheets Job 13:46 Job 13-43 1417 Job 13.44 1. Job 13-45 WIN 2.100 11. Balance, Direct materials Director Co Materhad Evening 1.00 Over overhead Next Check My Work book 2. The job-order cost sheet must include a unique number or name for this particular job, all direct costs, and all overhead costs associated with the joo. 3. Calculate the balance in Work In Process on July 31. 4. Calculate the cost of goods sold for July 5. What if 30 13-46 required no engineering change orders? What is the differences in the new cost of Job 13-467 lower How would the cost of the other jobs be affected? no effect 3. The balance in Work in Process can be computed by sumining the costs of all incomplete jobs 4. Cost of Goods Sold must be the total cost of all sold during the month 5. Sen Comerstone Daily Sob Conts Using Activity-Based Costing Hetger Company is a job-order casting firm that uses activity-based costing to apply overhead to jobs. Heitger identified three overhead activities and related drivers. Budgeted information for the year is as follows: Amount of Driver Activity Cost Driver Materials handling $103,050 Number of moves Engineering 115,500 Number of change orders Other overhead 247.500 Direct labor hours Heitger worked on four jobs in July. Data are as follows: 4,500 7,500 55,000 Job 13-44 Job 13-45 Job 13-46 Job 13-43 $24,800 $4,000 $0 Beginning balance Direct materials $5,400 $18,500 $9,250 51,090 $12,200 $11,500 $150 Direct labor cost $850 $1,650 Job 13:43 Job 13-44 Job 13-45 Job 13-46 Number of moves 40 52 33 5 30 42 15 18 Number of change orders Direct labor hours 850 1,090 1,650 150 By July 31, Job 13.43 and 13:44 were completed and sold lotis 13:45 and 1146 were in process Required: 1. Calculate the activity rates for each of the three overhead activities. Round all activity rates to the nearest cent Material handling rate 22.9 per move Engineeringute 15.4 per change order 2. Prepare job-order cost sheets for each job showing all costs through July 31. When required, round your answers to the nearest dollar. If an amount is zero, enter "O". Heitger Company Job-Order Cost Sheets Job 13-44 Job 13-46 Job 13-43 24,800 Job 13-45 4,000 Balance, July 1 18,500 Direct materials 5,400 9,250 12,200 11,500 850 1,090 1,650 150 Direct labor cost Materials handling Engineering Other overhead Total 3. Calculate the balance in Work in Process on July 31. 4. Calculate the cost of goods sold for July. 5. What if Job 13-46 required no engineering change orders? What is the difference in the new cost of Job 13-46? lower How would the cost of the other jobs be affected? no effect