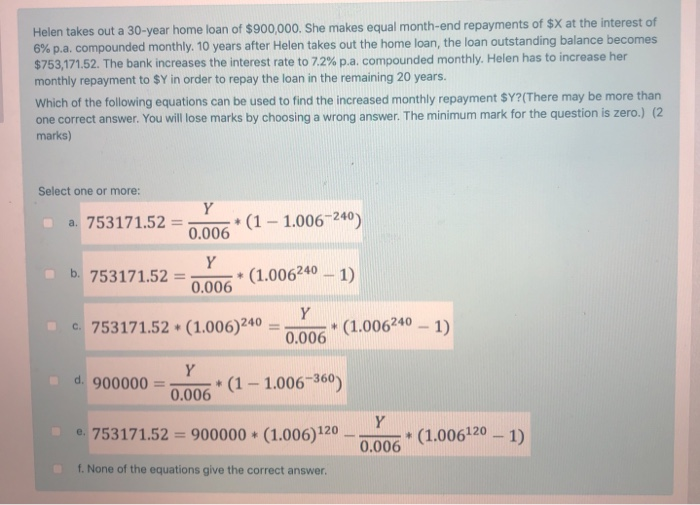

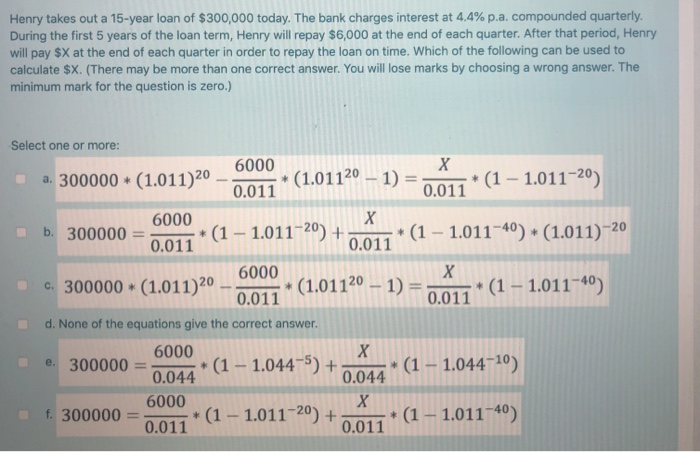

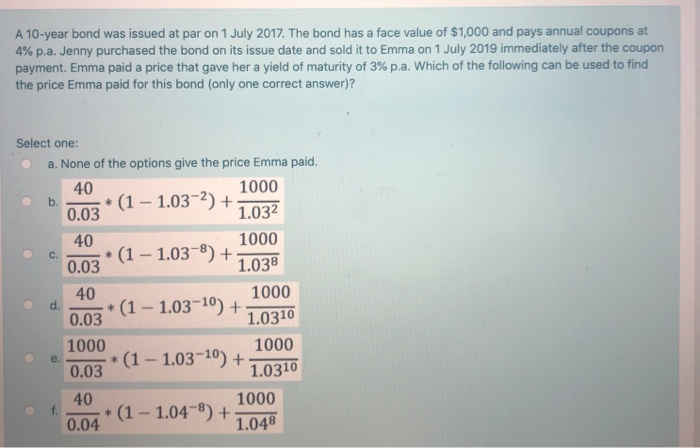

Helen takes out a 30-year home loan of $900,000. She makes equal month-end repayments of $X at the interest of 6% p.a. compounded monthly 10 years after Helen takes out the home loan, the loan outstanding balance becomes $753,171.52. The bank increases the interest rate to 7.2% p.a. compounded monthly. Helen has to increase her monthly repayment to SY in order to repay the loan in the remaining 20 years. Which of the following equations can be used to find the increased monthly repayment SY?(There may be more than one correct answer. You will lose marks by choosing a wrong answer. The minimum mark for the question is zero.) (2 marks) Select one or more: Y a. 753171.52 + (1 - 1.006-240) 0.006 Y b. 753171.52 = + (1.006240 1) 0.006 Y c. 753171.52 - (1.006)240 (1.006240 - 1) 0.006 d. 900000 Y * (1 - 1.006-360) 0.006 e. 753171.52 = 900000 + (1.006)120 Y 0.006 * (1.006120 - 1) f. None of the equations give the correct answer. Henry takes out a 15-year loan of $300,000 today. The bank charges interest at 4.4%p.a. compounded quarterly. During the first 5 years of the loan term, Henry will repay $6,000 at the end of each quarter. After that period, Henry will pay $X at the end of each quarter in order to repay the loan on time. Which of the following can be used to calculate $X. (There may be more than one correct answer. You will lose marks by choosing a wrong answer. The minimum mark for the question is zero.) * Select one or more: 6000 a. 300000 + (1.011)20 (1.01120 1) = * (1 - 1.011-20) 0.011 0.011 6000 b. 300000 + (1 - 1.011-20) + * (1 - 1.011-40) + * (1.011)-20 0.011 0.011 6000 c. 300000 (1.011)20 - * (1.01120 1) = + (1 - 1.011-40) 0.011 0.011 d. None of the equations give the correct answer. 6000 X e. 300000 * (1 - 1.044-5)+ (1 - 1.044-10) 0.044 0.044 6000 f. 300000 + (1 - 1.011-20) + + (1 - 1.011-40) 0.011 0.011 * A 10-year bond was issued at par on 1 July 2017. The bond has a face value of $1,000 and pays annual coupons at 4% p.a. Jenny purchased the bond on its issue date and sold it to Emma on 1 July 2019 immediately after the coupon payment. Emma paid a price that gave her a yield of maturity of 3% p.a. Which of the following can be used to find the price Emma paid for this bond (only one correct answer)? Select one: a. None of the options give the price Emma paid. 40 1000 b. (1 1.03-2) + 0.03 1.032 40 1000 *(1 1.03-8) + 0.03 1.038 40 1000 *(1 - 1.03-10) + 0.03 1.0310 1000 1000 + (1 - 1.03-10) + 0.03 1.0310 40 1000 f. + (1 - 1.04-8) + 0.04 1.048 d. e