A:

B:

C:

C:

D:

D:

E:

E:

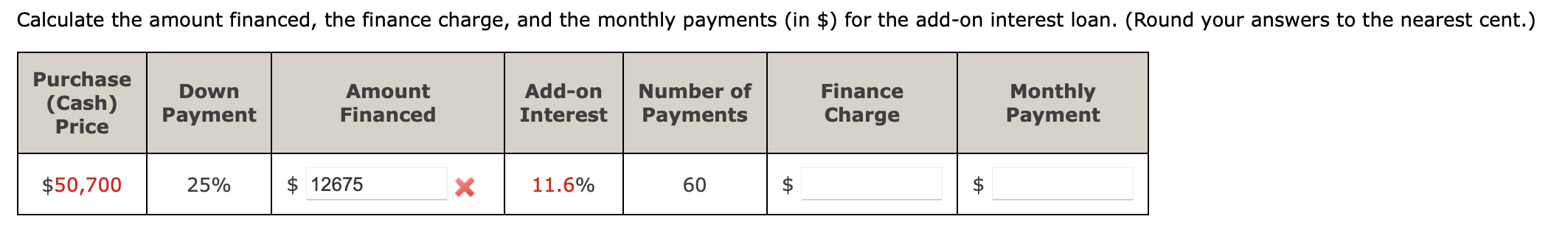

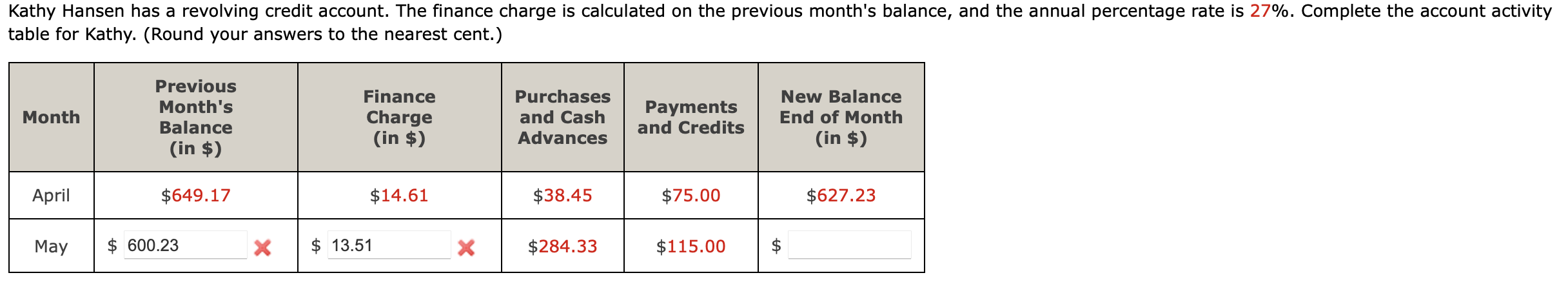

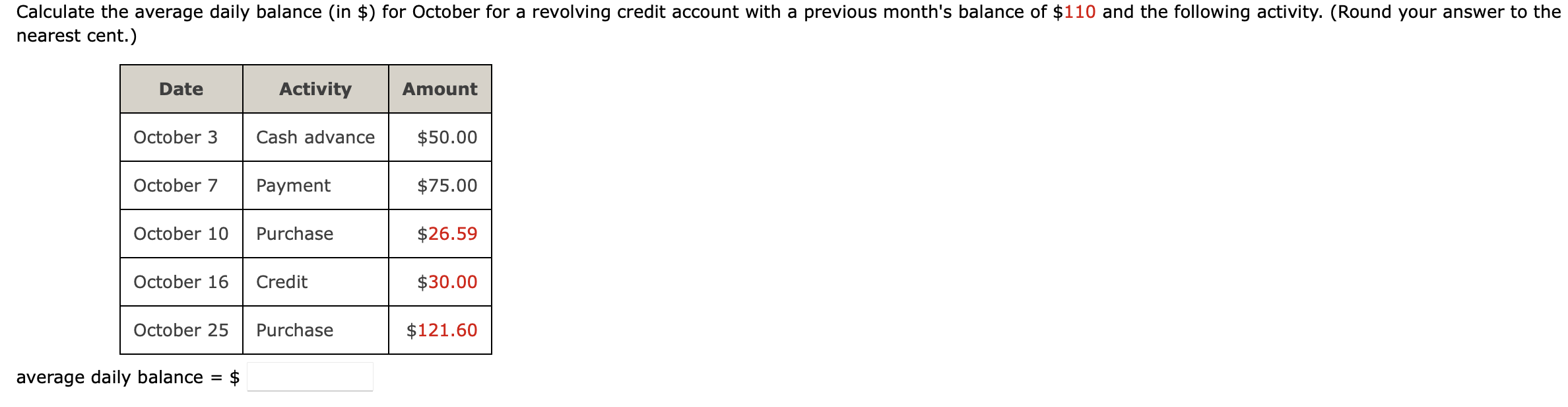

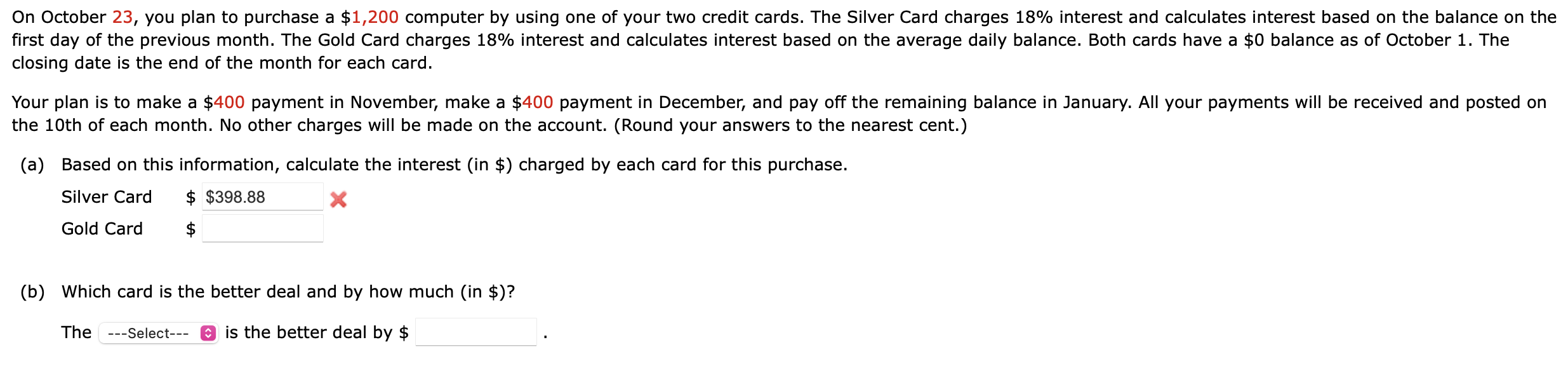

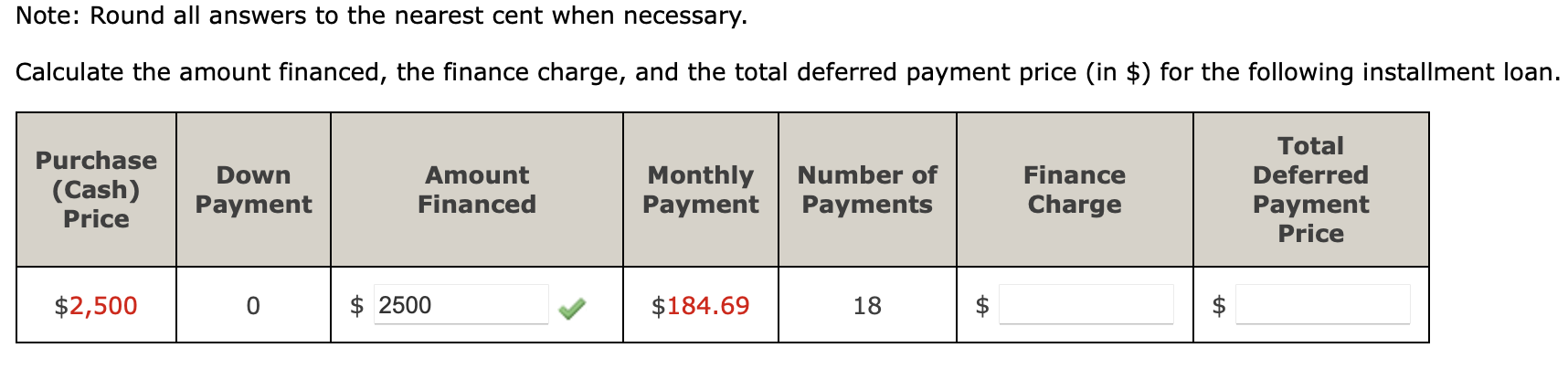

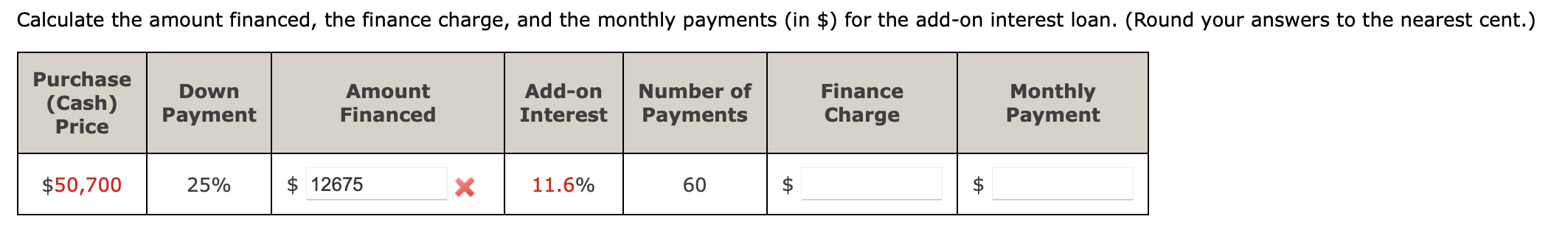

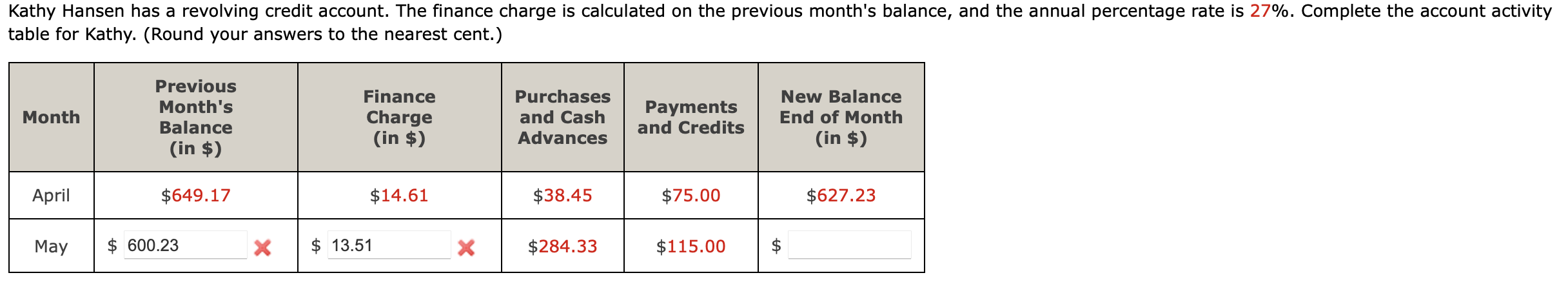

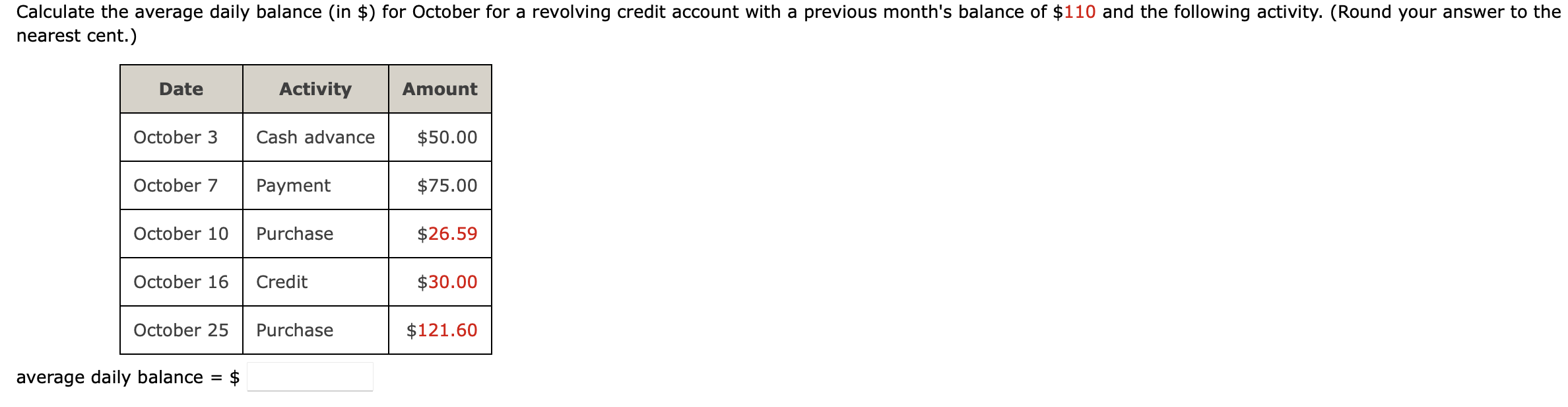

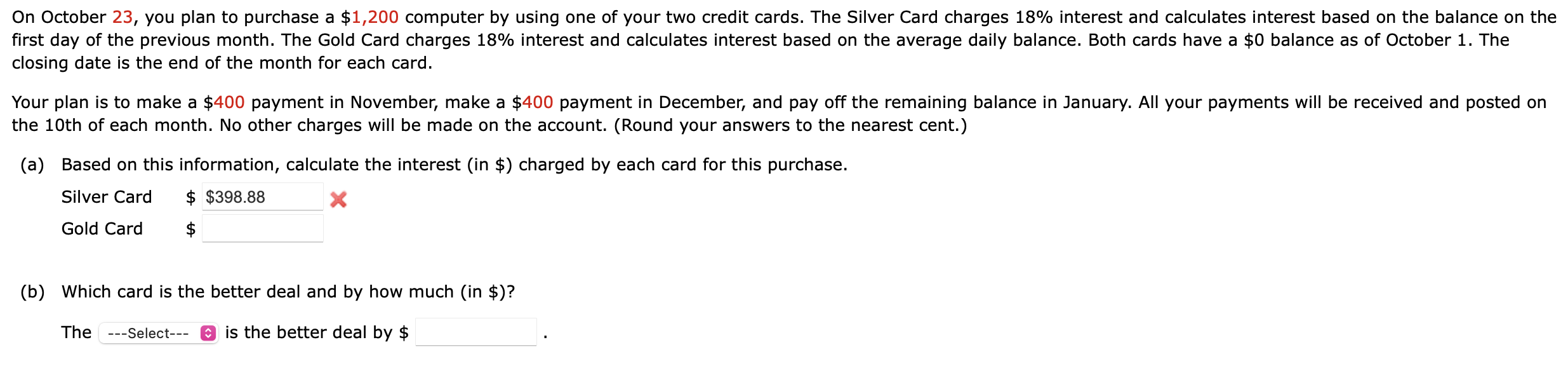

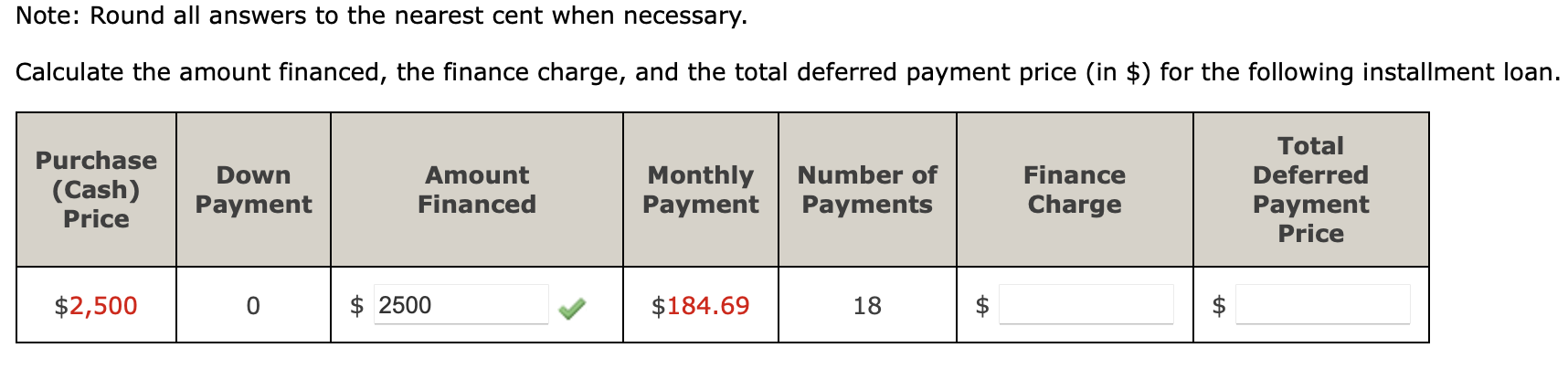

Kathy Hansen has a revolving credit account. The finance charge is calculated on the previous month's balance, and the annual percentage rate is 27%. Complete the account activity table for Kathy. (Round your answers to the nearest cent.) Month Previous Month's Balance (in $) Finance Charge (in $) Purchases and Cash Advances Payments and Credits New Balance End of Month (in $) April $649.17 $14.61 $38.45 $75.00 $627.23 May $ 600.23 x $ 13.51 x $284.33 $115.00 $ Calculate the average daily balance (in $) for October for a revolving credit account with a previous month's balance of $110 and the following activity. (Round your answer to the nearest cent.) Date Activity Amount October 3 Cash advance $50.00 October 7 Payment $75.00 October 10 Purchase $26.59 October 16 Credit $30.00 October 25 Purchase $121.60 average daily balance = $ On October 23, you plan to purchase a $1,200 computer by using one of your two credit cards. The Silver Card charges 18% interest and calculates interest based on the balance on the first day of the previous month. The Gold Card charges 18% interest and calculates interest based on the average daily balance. Both cards have a $0 balance as of October 1. The closing date is the end of the month for each card. Your plan is to make a $400 payment in November, make a $400 payment in December, and pay off the remaining balance in January. All your payments will be received and posted on the 10th of each month. No other charges will be made on the account. (Round your answers to the nearest cent.) (a) Based on this information, calculate the interest (in $) charged by each card for this purchase. Silver Card $ $398.88 x Gold Card (b) Which card is the better deal and by how much (in $)? The ---Select--- is the better deal by $ Note: Round all answers to the nearest cent when necessary. Calculate the amount financed, the finance charge, and the total deferred payment price (in $) for the following installment loan. Purchase (Cash) Price Down Payment Amount Financed Monthly Payment Number of Payments Finance Charge Total Deferred Payment Price $2,500 0 $ 2500 $184.69 18 $ $ Calculate the amount financed, the finance charge, and the monthly payments (in $) for the add-on interest loan. (Round your answers to the nearest cent.) Purchase (Cash) Price Down Payment Amount Financed Add-on Interest Number of Payments Finance Charge Monthly Payment $50,700 25% $ 12675 x 11.6% 60 $ Kathy Hansen has a revolving credit account. The finance charge is calculated on the previous month's balance, and the annual percentage rate is 27%. Complete the account activity table for Kathy. (Round your answers to the nearest cent.) Month Previous Month's Balance (in $) Finance Charge (in $) Purchases and Cash Advances Payments and Credits New Balance End of Month (in $) April $649.17 $14.61 $38.45 $75.00 $627.23 May $ 600.23 x $ 13.51 x $284.33 $115.00 $ Calculate the average daily balance (in $) for October for a revolving credit account with a previous month's balance of $110 and the following activity. (Round your answer to the nearest cent.) Date Activity Amount October 3 Cash advance $50.00 October 7 Payment $75.00 October 10 Purchase $26.59 October 16 Credit $30.00 October 25 Purchase $121.60 average daily balance = $ On October 23, you plan to purchase a $1,200 computer by using one of your two credit cards. The Silver Card charges 18% interest and calculates interest based on the balance on the first day of the previous month. The Gold Card charges 18% interest and calculates interest based on the average daily balance. Both cards have a $0 balance as of October 1. The closing date is the end of the month for each card. Your plan is to make a $400 payment in November, make a $400 payment in December, and pay off the remaining balance in January. All your payments will be received and posted on the 10th of each month. No other charges will be made on the account. (Round your answers to the nearest cent.) (a) Based on this information, calculate the interest (in $) charged by each card for this purchase. Silver Card $ $398.88 x Gold Card (b) Which card is the better deal and by how much (in $)? The ---Select--- is the better deal by $ Note: Round all answers to the nearest cent when necessary. Calculate the amount financed, the finance charge, and the total deferred payment price (in $) for the following installment loan. Purchase (Cash) Price Down Payment Amount Financed Monthly Payment Number of Payments Finance Charge Total Deferred Payment Price $2,500 0 $ 2500 $184.69 18 $ $ Calculate the amount financed, the finance charge, and the monthly payments (in $) for the add-on interest loan. (Round your answers to the nearest cent.) Purchase (Cash) Price Down Payment Amount Financed Add-on Interest Number of Payments Finance Charge Monthly Payment $50,700 25% $ 12675 x 11.6% 60 $

C:

C: D:

D: E:

E: