HELLLPPP PLEASEE!!!

HELLLPPP PLEASEE!!!

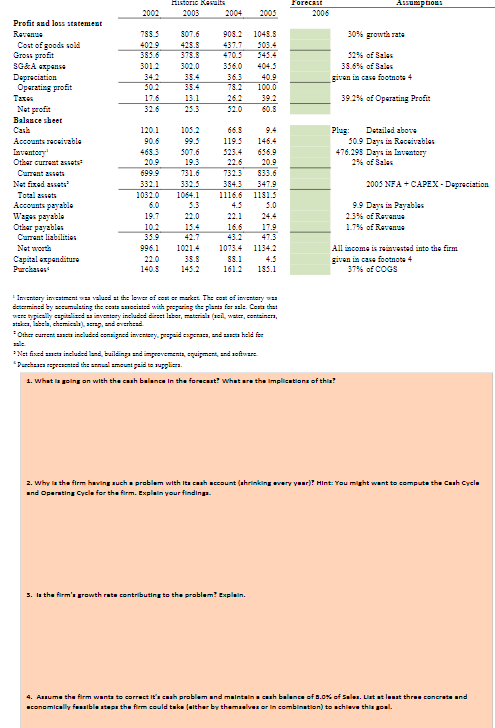

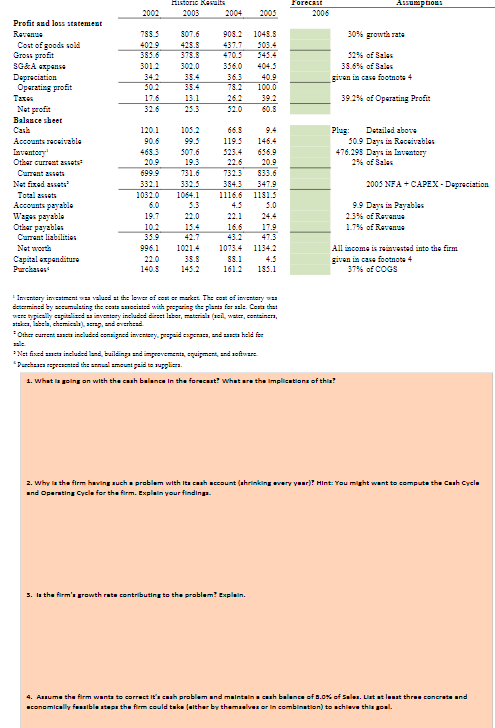

Historic Keralt. 2003 2004 2002 Assumptious Forecast 2006 2005 9052 1045.8 503.4 30% growth rate 7883 4029 3856 3012 301.6 425.8 375.8 302.0 35.4 470.5 3560 36.3 78.2 52% of Sales 38.6% of Sales given in case footnots 4 502 17.6 32.6 13.1 100.0 39.2 60.5 39.2% of Operating Profit 52.0 145.4 Profit and loss statemet Revenge Cost of goods sold Gross profit 3G&A expose Depreciation Operating profit T25 Net profit Balance sheet Cash Accorants receivable Inventory Other current 2010 Camrent assets Ne fixed assets Totalsts Accorants payable Wages payable Other perables Carrent liabilities Net worth Capital expenditure Purchases 66.3 119.3 523.4 22.6 Plus Detailed above 50.9 Days in Receivables 476.295 Days in Inventory 2% of Sales 1032 99.3 507.6 19.3 731.6 332.3 1064.1 3.3 22.0 15.4 7323 120.1 90.6 4653 2009 699.9 3321 10320 6.0 19.7 102 33.9 996.1 22.0 140 $ 3843 1116.6 833.6 3479 1181.3 5.0 2005 NFA + CAPEX - Depreciation 9.9 Days in Payables 23% of Revenues 1.7% of Revents 16.6 17.9 4733 11342 1021.4 38.8 10734 83.1 161.2 All income is reinvested into the firm given in case footnote 4 37% of COGS 185.1 In enery im caiment valued at the loweefseer market. The cost of imetery in: =y ====maluing th: ==ri =Heritis: "wis pr-priya: plaria for al: Central ver bypically capitalized a venisey included et laber, eteris (asil, wait, certainera, stakalala chemicals ang. enderrhead - Othe cur== == issuest INEFIETY. F==paid ape=3E2, === ==ra had far = Mat first aana iraiuest ==e auilding art :=pravanants, =guipment, and natur- Durerepresented the annual meniged to suppliers 1. What is going on with the cuh balance in the forecast? What are the implications of this! 2. Why is the firm having such problem with its cash account (shrinking every year)? Hint: You might want to compute the Cush Cycle and Operating Cycle for the firm. Explain your finding 5. la tha firm's growth rate contributing to the problem? Explain. 4. Arzuma tha firm wants to correct it's cash problem and maintain cush balance of 5.0% of Sule. Let at least three concreta and economically forrible stap the firm could take wither by themselves or in combination) to achieve this poel Historic Keralt. 2003 2004 2002 Assumptious Forecast 2006 2005 9052 1045.8 503.4 30% growth rate 7883 4029 3856 3012 301.6 425.8 375.8 302.0 35.4 470.5 3560 36.3 78.2 52% of Sales 38.6% of Sales given in case footnots 4 502 17.6 32.6 13.1 100.0 39.2 60.5 39.2% of Operating Profit 52.0 145.4 Profit and loss statemet Revenge Cost of goods sold Gross profit 3G&A expose Depreciation Operating profit T25 Net profit Balance sheet Cash Accorants receivable Inventory Other current 2010 Camrent assets Ne fixed assets Totalsts Accorants payable Wages payable Other perables Carrent liabilities Net worth Capital expenditure Purchases 66.3 119.3 523.4 22.6 Plus Detailed above 50.9 Days in Receivables 476.295 Days in Inventory 2% of Sales 1032 99.3 507.6 19.3 731.6 332.3 1064.1 3.3 22.0 15.4 7323 120.1 90.6 4653 2009 699.9 3321 10320 6.0 19.7 102 33.9 996.1 22.0 140 $ 3843 1116.6 833.6 3479 1181.3 5.0 2005 NFA + CAPEX - Depreciation 9.9 Days in Payables 23% of Revenues 1.7% of Revents 16.6 17.9 4733 11342 1021.4 38.8 10734 83.1 161.2 All income is reinvested into the firm given in case footnote 4 37% of COGS 185.1 In enery im caiment valued at the loweefseer market. The cost of imetery in: =y ====maluing th: ==ri =Heritis: "wis pr-priya: plaria for al: Central ver bypically capitalized a venisey included et laber, eteris (asil, wait, certainera, stakalala chemicals ang. enderrhead - Othe cur== == issuest INEFIETY. F==paid ape=3E2, === ==ra had far = Mat first aana iraiuest ==e auilding art :=pravanants, =guipment, and natur- Durerepresented the annual meniged to suppliers 1. What is going on with the cuh balance in the forecast? What are the implications of this! 2. Why is the firm having such problem with its cash account (shrinking every year)? Hint: You might want to compute the Cush Cycle and Operating Cycle for the firm. Explain your finding 5. la tha firm's growth rate contributing to the problem? Explain. 4. Arzuma tha firm wants to correct it's cash problem and maintain cush balance of 5.0% of Sule. Let at least three concreta and economically forrible stap the firm could take wither by themselves or in combination) to achieve this poel

HELLLPPP PLEASEE!!!

HELLLPPP PLEASEE!!!