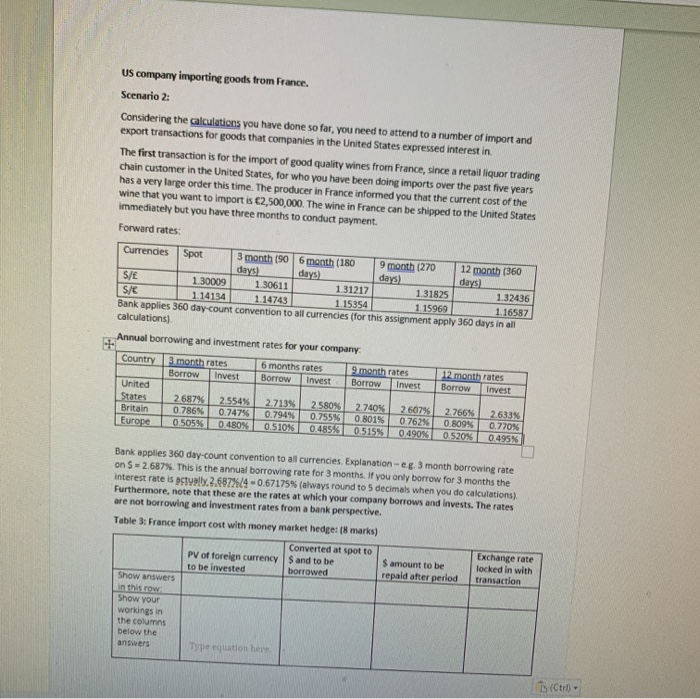

US company importing goods from France. Scenario 2: Considering the calculations you have done so far, you need to attend to a number of import and export transactions for goods that companies in the United States expressed interest in The first transaction is for the import of good quality wines from France, since a retail liquor trading chain customer in the United States, for who you have been doing imports over the past five years has a very large order this time. The producer in France informed you that the current cost of the wine that you want to import is C2,500,000. The wine in France can be shipped to the United States immediately but you have three months to conduct payment. Forward rates: SIE Currencies Spot 3 month 1906 month (1809 month (270 12 month (360 days) days) days) days) 1.30009 1.30611 131217 1 31825 1 .32436 S/C 1 14134114743 115354 115969 116587 Bank applies 360 day-count convention to all currencies (for this assignment apply 360 days in all calculations) Annual borrowing and investment rates for your company Country 3 month rates BorrowInvest 6 months rates Borrow Invest 9 month rates Borrow Invest 12 month rates Borrow Invest United States Britain Europe 2 687% 0.786% 0.505 2.554% 0.747% 0.480% 2.713% 0.794% 0.510% 2580% 0.755% 0.4853 2.740% 0.8015 0.515% 2 607% 0.762% 0.490% 2.766% 0.809% 0.520% 2.633% 0.770% 0.4959 Bank applies 360 day.count convention to all currencies. Explanation - eg. 3 month borrowing rate on $ 2.687%. This is the annual borrowing rate for 3 months. If you only borrow for 3 months the interest rate is St .2.687%C4-0.67175 (always round to 5 decimals when you do calculations) Furthermore, note that these are the rates at which your company borrows and invests. The rates are not borrowing and Investment rates from a bank perspective. Table 3: France import cost with money market hedge: (8 marks) PV of foreign currency to be invested Converted at spot to and to be borrowed Samount to be repaid after period Exchange rate locked in with transaction Show answers in this row Show your working in the columns below the answers Type equation here (ctro