Answered step by step

Verified Expert Solution

Question

1 Approved Answer

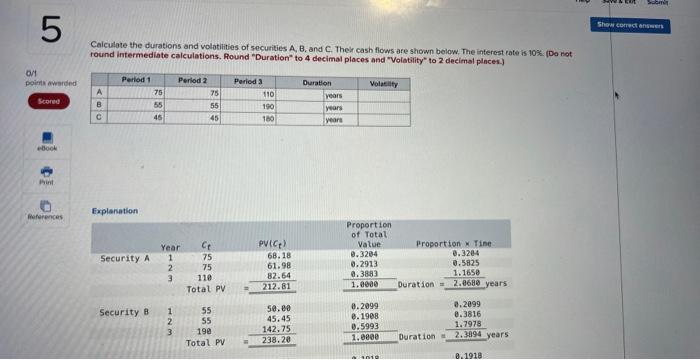

Hello can someone explain me how to do this question in the financial calculator ? Calculate the durations and volatiities of secuities A, B, and

Hello can someone explain me how to do this question in the financial calculator ?

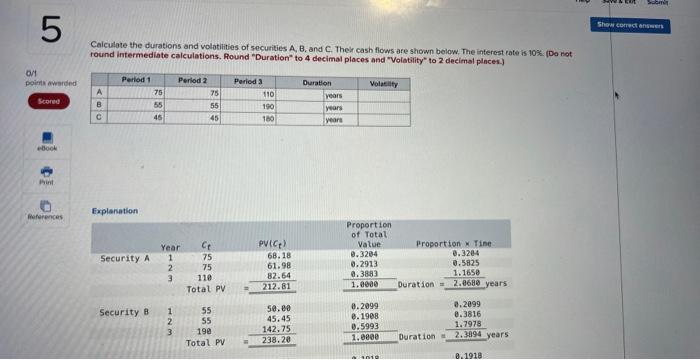

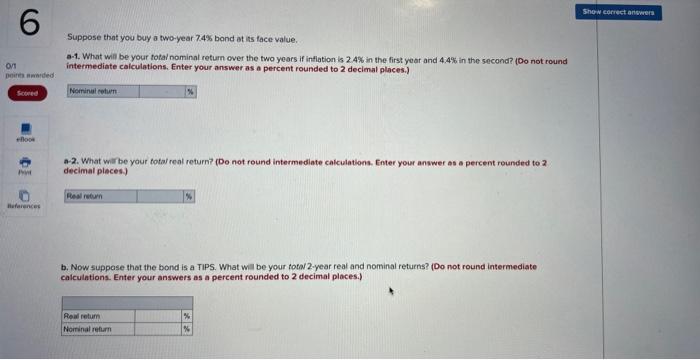

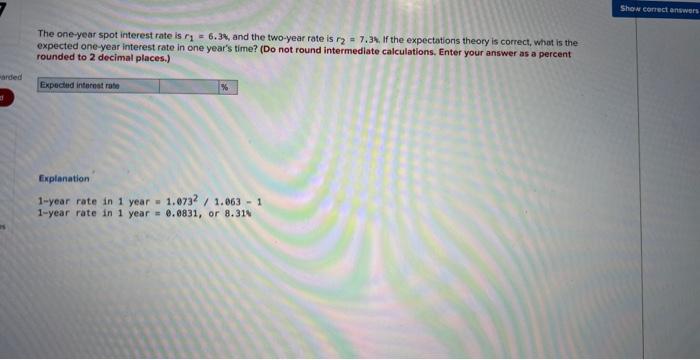

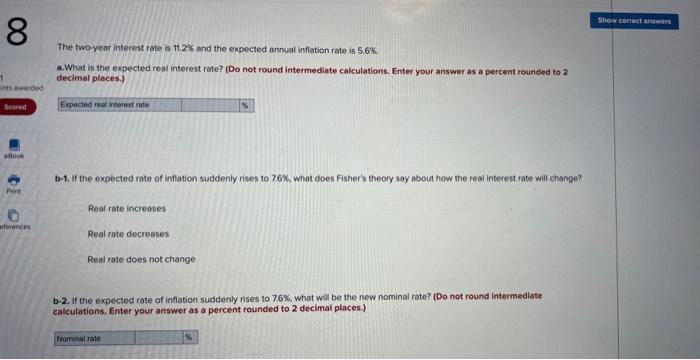

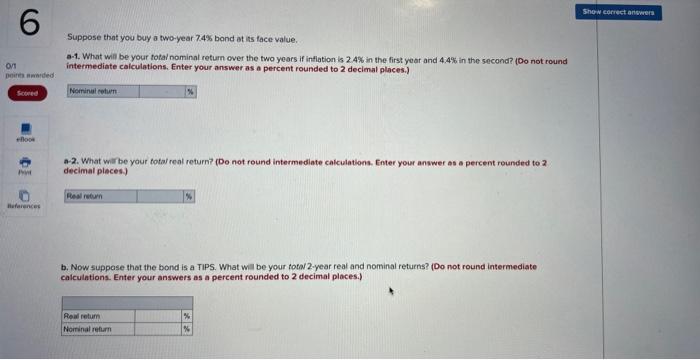

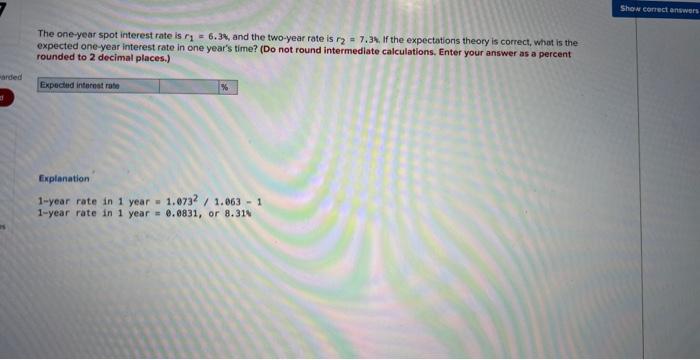

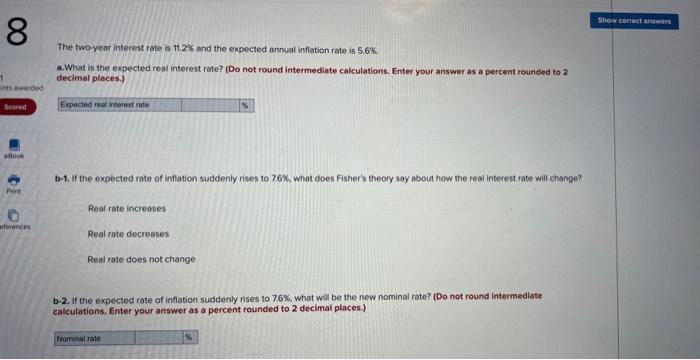

Calculate the durations and volatiities of secuities A, B, and C. Thelr cash flows are shown below. The interest rate is 10%. (Do not round intermediate calculations. Pound "Duration" to 4 decimal places and "Volatility" to 2 decimal places.) Fxplenation. Suppose that you buy a two-year 7.4% bond at its face value. a-1. What will be your total nominal retum over the two years if intiation is 2.4% in the first year and 4.4% in the second? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) A-2. What wir be your total real return? (Do not round intermediate calculations. Enter your anwwer as a percent rounded to 2 decimal pleces) b. Now suppase that the bond is a TIPS. What wil be your total 2 -year real and nominal returns? (Do not round intermediate caiculations. Enter your answers as a percent rounded to 2 decimal places.) The one-year spot interest rate is r1=6.3%, and the two-year rate is r2=7. 3\%, If the expectations theory is correct, what is the expected one-year interest rate in one year's time? (Do not round intermediate calculations, Enter your answer as a percent rounded to 2 decimal places.) fixplanation 1 -year rate in 1 year =1.0732,1.0631 1 -year rate in 1 year =0.0831, or 8.31% The fwo-year interest rate is 11.2% and the expected annual inflation rate is 5.6%. a.What is the expected real interest rate? (Do not round intermediate caiculations. Enter your answer as a percent rounded to 2 decimal places.) b-1. If the expected rate of inflation suddenly rises to 76%, what does fisher's theory say about how the real interest rate will change? Real rate increases Real rate decreases Real rate does not change b-2. If the expected rate of inflation suddenly rises to 7.6%, what will be the new nominal rate? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started