Question

Hello, Can someone help with solving for the rest of the missed questions. I would also love it if you can share the steps on

Hello,

Can someone help with solving for the rest of the missed questions. I would also love it if you can share the steps on how to find the answers.

Translation of financial statements and consolidation of a foreign subsidiary (no amortization of AAP)

Assume that your company owns a subsidiary operating in Great Britain. The subsidiary maintains its books in the British pound (GBP) as its functional currency.

The relevant exchange rates for the $US value of the British pound (GBP) are as follows:

| BOY rate | $1.42 |

| EOY rate | $1.49 |

| Avg. rate | $1.45 |

| PPE purchase date rate | $1.46 |

| LTD borrowing date rate | $1.46 |

| Dividend rate | $1.47 |

| Historical rate (common stock and APIC) | $1.07 |

HINT: For all parts of this problem, use a negative sign with your answers to indicate a reduction.

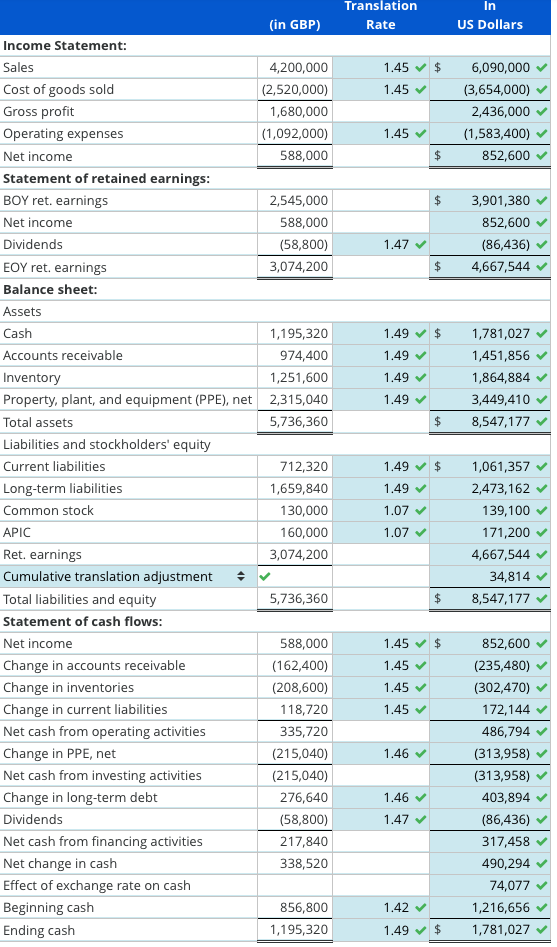

a. Translate the subsidiarys income statement, statement of retained earnings, balance sheet, and statement of cash flows from British pounds (GBP) into $US (assume that the BOY Retained Earnings for the subsidiary is $3,901,380).

Round answers in the "In US Dollars" column to the nearest whole number.

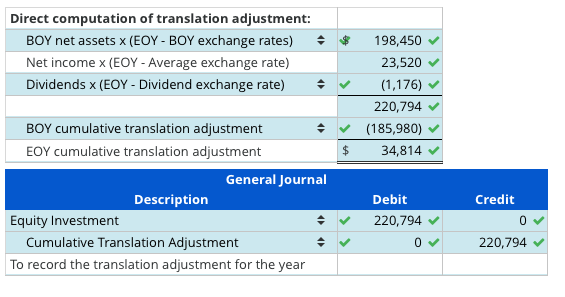

b. Compute the ending Cumulative Translation Adjustment directly, assuming a BOY balance of $(185,980). What journal entry did the parent company make as a result of this computation?

Round all answers to the nearest whole number.

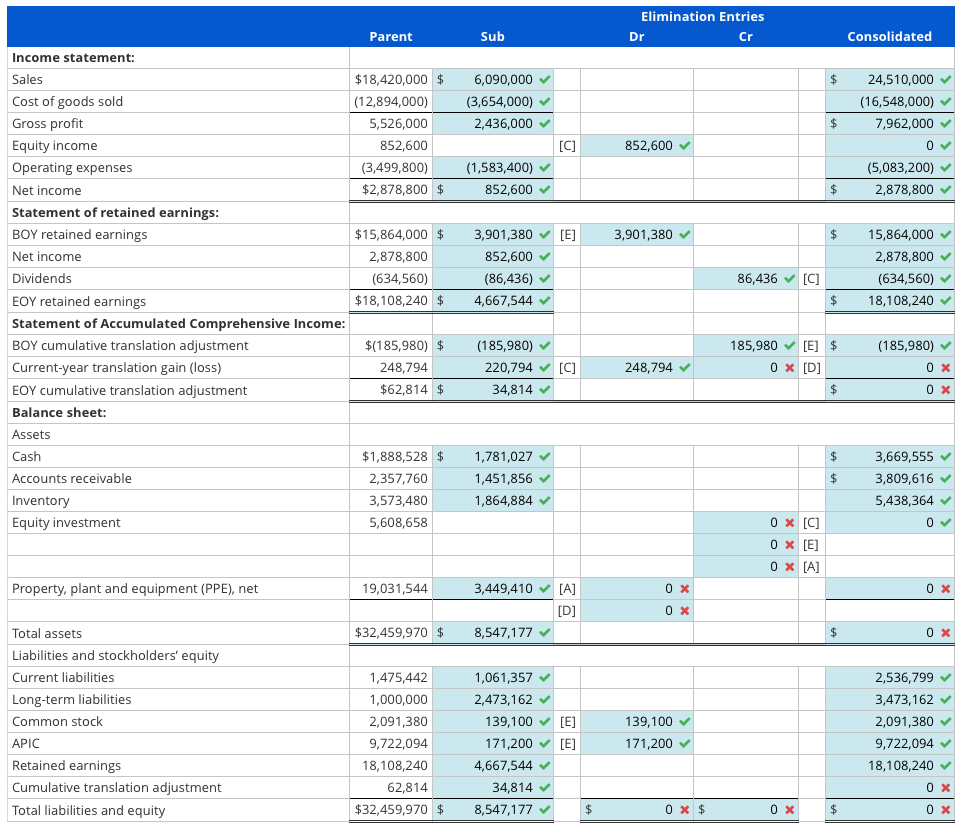

c. Following are selected financial statement accounts for the parent:

| Income statement: | Balance sheet: | |||

| Sales | $18,420,000 | Assets | ||

| Cost of goods sold | (12,894,000) | Cash | $1,888,528 | |

| Gross profit | 5,526,000 | Accounts receivable | 2,357,760 | |

| Equity income | 852,600 | Inventory | 3,573,480 | |

| Operating expenses | (3,499,800) | Equity investment | 5,608,658 | |

| Net income | $2,878,800 | Property, plant, and equipment (PPE), net | 19,031,544 | |

| $32,459,970 | ||||

| Statement of retained earnings: | ||||

| BOY retained earnings | $15,864,000 | Liabilities and stockholders equity | ||

| Net income | 2,878,800 | Current liabilities | $1,475,442 | |

| Dividends | (634,560) | Long-term liabilities | 1,000,000 | |

| Ending retained earnings | $18,108,240 | Common stock | 2,091,380 | |

| APIC | 9,722,094 | |||

| Statement of accum. comp. income: | Retained earnings | 18,108,240 | ||

| BOY cumulative translation adjustment | $(185,980) | Cumulative translation adjustment | 62,814 | |

| Current-year translation gain (loss) | 248,794 | $32,459,970 | ||

| EOY cumulative translation adjustment | $62,814 |

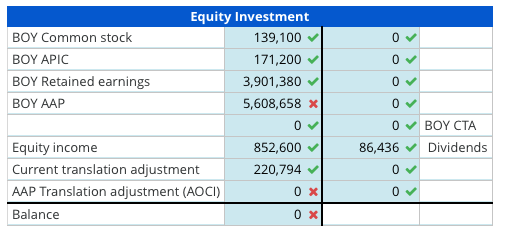

Assume the following information: The purchase price for the subsidiary included an AAP asset relating to Land that the parent estimated was worth GBP400,000 more than its book value on the subsidiarys balance sheet. Confirm the balance of the Equity Investment account of $5,608,658 on the parents balance sheet.

d. Using your translated subsidiary financial statements from Part a and the parents financial data provided in Part c, prepare the consolidation spreadsheet for the year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started