Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hello can someone look at this again , is there a way to shorten the answer ? .if not what I have will work .

hello can someone look at this again , is there a way to shorten the answer ? .if not what I have will work . thanks for your help

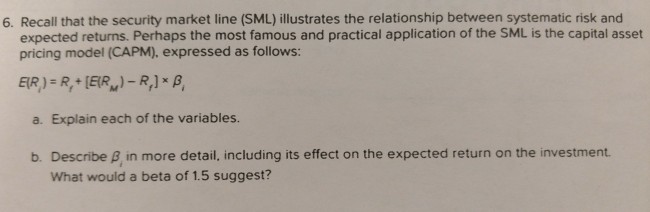

6. Recall that the security market line (SML) illustrates the relationship between systematic risk and expected returns. Perhaps the most famous and practical application of the SML is the capital asset pricing model (CAPM), expressed as follows: a. Explain each of the variables. b. Describe , in more detail, including its effect on the expected return on the investment What would a beta of 1.5 suggestStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started