Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help pretty please!! Diane was recently hired by Jackson Solar Corp. as a junior budget analyst. She is working for the Venture Capital Division and

help pretty please!!

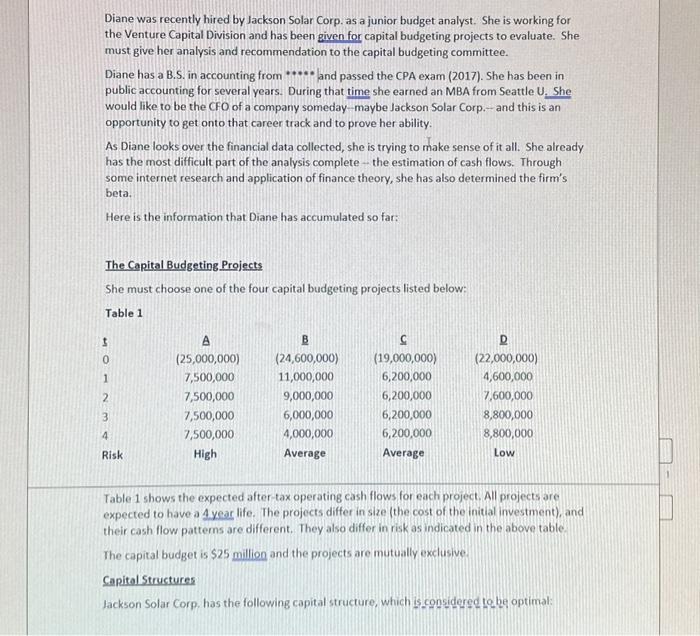

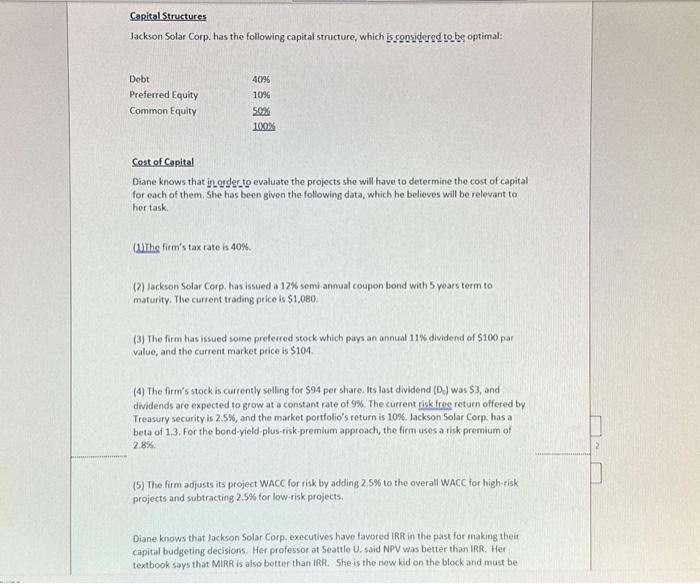

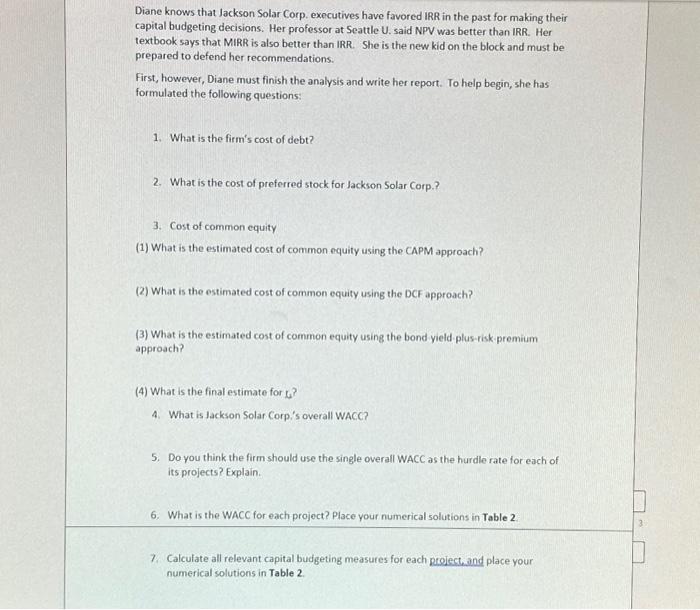

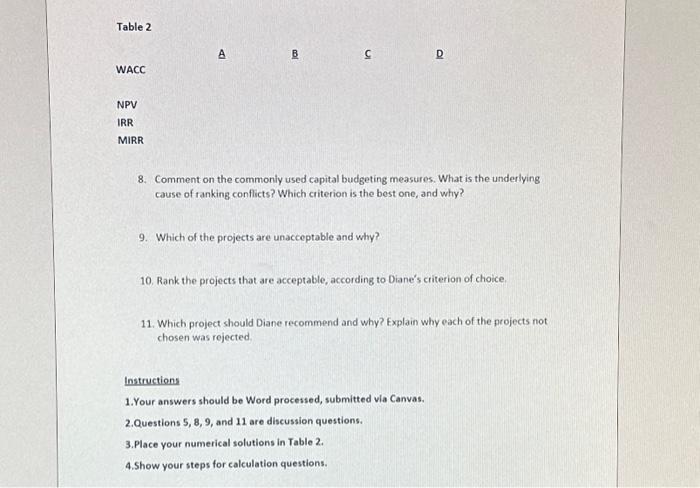

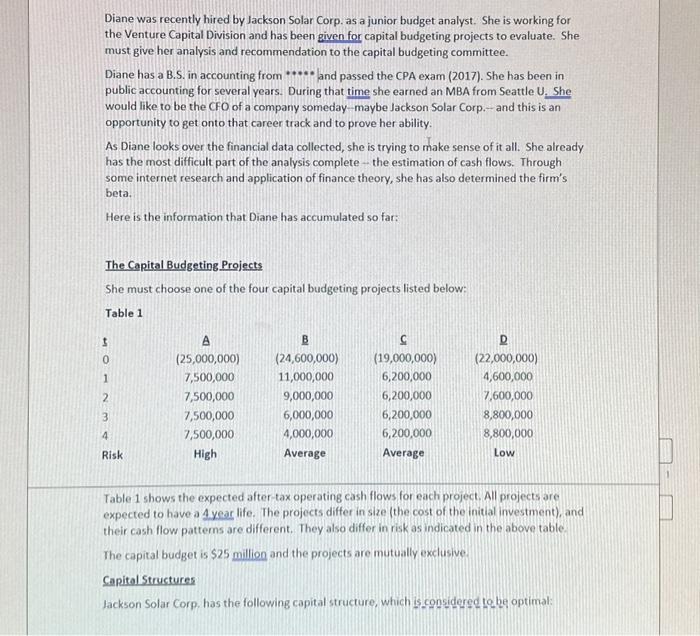

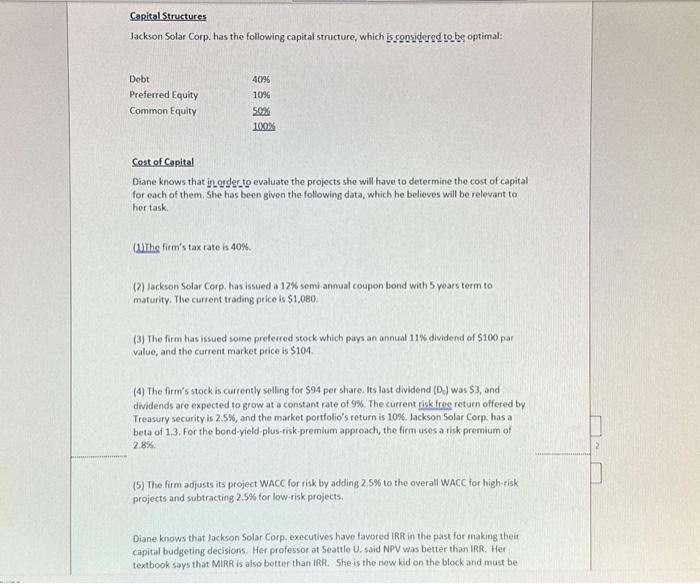

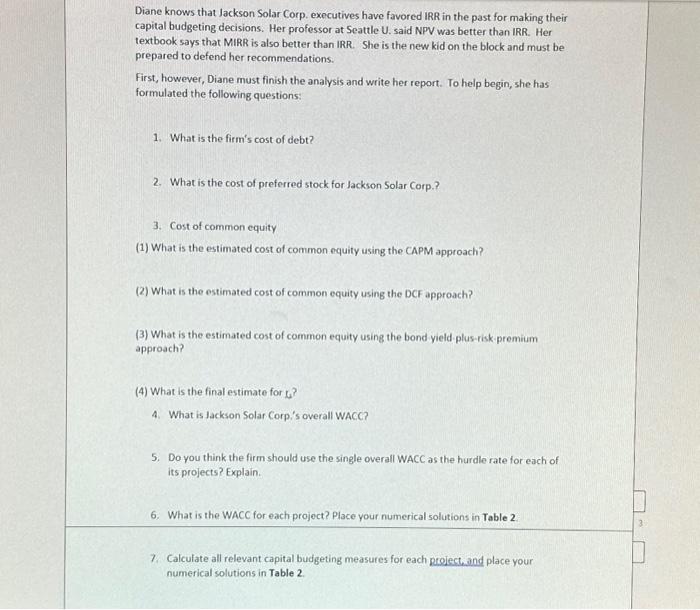

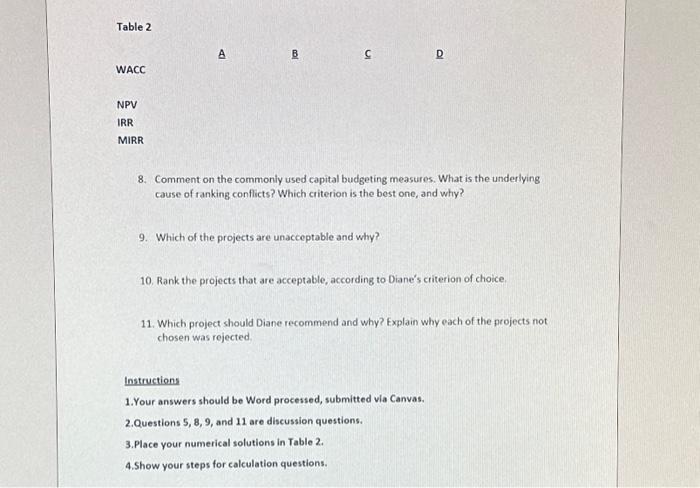

Diane was recently hired by Jackson Solar Corp. as a junior budget analyst. She is working for the Venture Capital Division and has been given for capital budgeting projects to evaluate. She must give her analysis and recommendation to the capital budgeting committee. Diane has a B.S. in accounting from *** and passed the CPA exam (2017). She has been in public accounting for several years. During that time she earned an MBA from Seattle U. She would like to be the CFO of a company someday-maybe Jackson Solar Corp.-- and this is an opportunity to get onto that career track and to prove her ability. As Diane looks over the financial data collected, she is trying to make sense of it all. She already has the most difficult part of the analysis complete - the estimation of cash flows. Through some internet research and application of finance theory, she has also determined the firm's beta. Here is the information that Diane has accumulated so far: The Capital Budgeting Projects She must choose one of the four capital budgeting projects listed below: Table 1 Table 1 shows the expected after-tax operating cash flows for each project. All projects are expected to have a 4 year life. The projects differ in size (the cost of the initial investment), and their cash flow pattems are different. They also differ in risk as indicated in the above table. The capital budget is $25 million and the projects are mutually exclusive. Capital Structures Jackson Solar Corp. has the following capital structure, which is considered to he optimal: Capital Structures Jackson Solar Corp. has the following capital structure, which is considered to be optimal: Cost of Capital Oane knows that ingogder.to evaluate the projects she will have to determine the cost of capital for each of them. She has been given the following data, which he believes will be relevant to her task. (1)The firm's tax rate is 40%. (2) Jackson Solar Corp. has issued a 12\% semi annual coupon bond with 5 years term to maturity. The current trading peice is $1,080. (3) The firm has issued some preferred stock which pays an annual 11% dividend of $100 par value, and the current market price is $104. (4) The firm's stock is currently selling for $94 per share. Its last dividend ( D ) was $3, and dwidends are expected to grow at a constant rate of 9. The current riskfroe return offered by Treasury security is 2.5%, and the market portfolio's return is 10%. Jackson Solar Corp. has a beta of 1,3. For the bond-yield-plus-risk-premium approach, the firm uses a risk premium of 2.8% (5) The firm adjusts its project WACC for risk by adding 2.5% to the overall WACC for high risk projects and subtracting 2.5% for low-risk projects. Diane knows that lackson Solar Corp. executives have favored IRR in the past for making their capital budgeting decisions. Her professor at Seattle U. said NPV was better than IRR. Her textbook says that MIRR is also better than IRR. She is the new kid on the block and must be Diane knows that Jackson Solar Corp. executives have favored IRR in the past for making their capital budgeting decisions. Her professor at Seattle U. said NPV was better than IRR. Her textbook says that MIRR is also better than IRR. She is the new kid on the block and must be prepared to defend her recommendations. First, however, Diane must finish the analysis and write her report. To help begin, she has formulated the following questions: 1. What is the firm's cost of debt? 2. What is the cost of preferred stock for Jackson Solar Corp? 3. Cost of common equity (1) What is the estimated cost of common equity using the CAPM approach? (2) What is the estimated cost of common equity using the DCF approach? (3) What is the estimated cost of common equity using the bond yield plus-risk-premium approach? (4) What is the final estimate for G ? 4. What is Jackson Solar Corp.'s overall WACC? 5. Do you think the firm should use the single overall WACC as the hurdle rate for each of its projects? Explain. 6. What is the WACC for each project? Place your numerical solutions in Table 2 7. Calculate all relevant capital budgeting measures for each project, and place your numerical solutions in Table 2. 8. Comment on the commonly used capital budgeting measures. What is the underlying cause of ranking conflicts? Which criterion is the best one, and why? 9. Which of the projects are unacceptable and why? 10. Rank the projects that are acceptable, according to Diane's criterion of choice. 11. Which project should Diane recommend and why? Explain why each of the projects not chosen was rejected Instructions 1.Your answers should be Word processed, submitted via Canvas. 2.Questions 5,8,9, and 11 are discussion questions. 3.Place your numerical solutions in Table 2. 4.Show your steps for calculation questions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started