Hello, can you look over my work please. Something may be wrong plz check

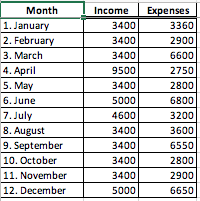

DATA

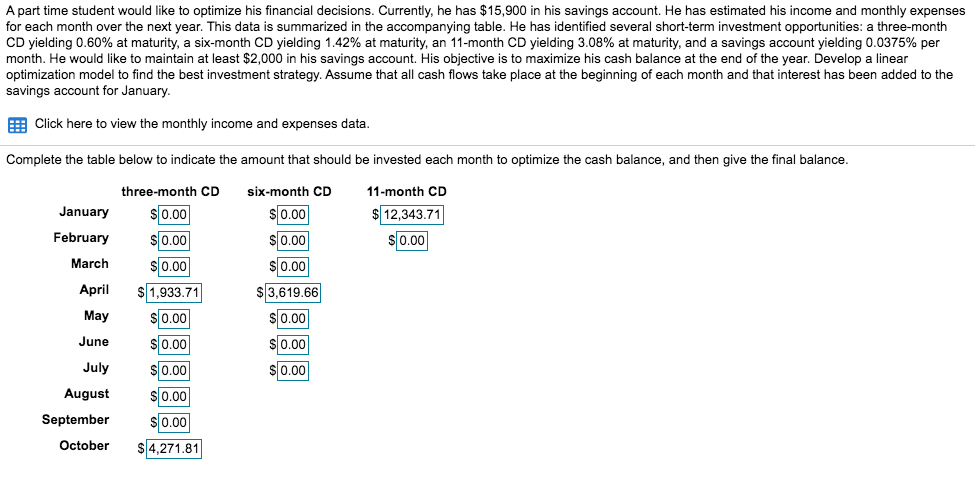

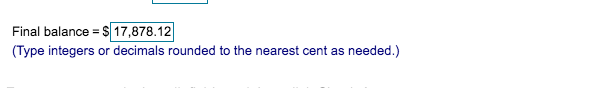

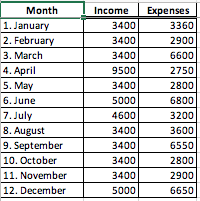

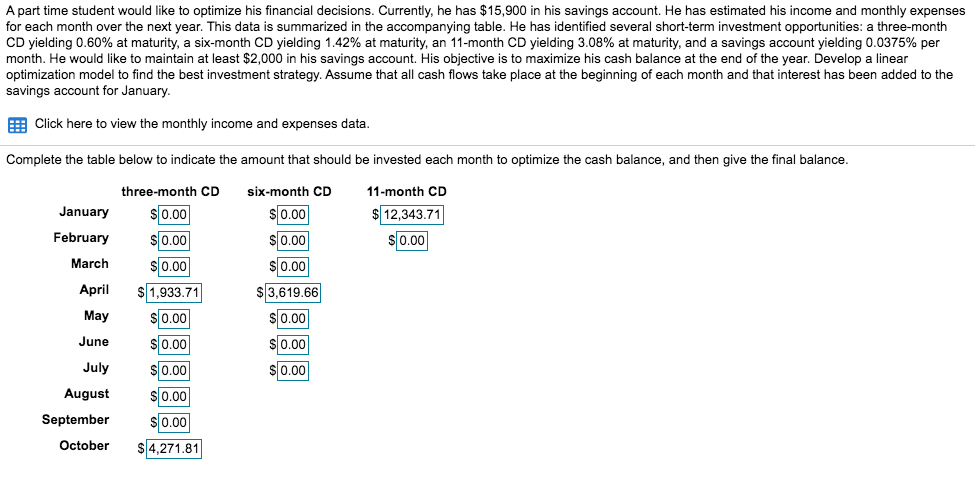

A part time student would like to optimize his financial decisions. Currently, he has $15,900 in his savings account. He has estimated his income and monthly expenses for each month over the next year. This data is summarized in the accompanying table. He has identified several short-term investment opportunities: a three-month CD yielding 0.60% at maturity, a six-month CD yielding 1.42% at maturity, an 11-month CD yielding 3.08% at maturity, and a savings account yielding 0.0375% per month. He would like to maintain at least $2,000 in his savings account. His objective is to maximize his cash balance at the end of the year. Develop a linear optimization model to find the best investment strategy. Assume that all cash flows take place at the beginning of each month and that interest has been added to the savings account for January. PE Click here to view the monthly income and expenses data. Complete the table below to indicate the amount that should be invested each month to optimize the cash balance, and then give the final balance. 11-month CD $ 12,343.71 $ 0.00 three-month CD January $0.00 February $0.00 March $0.00 April $1,933.71 May $0.00 June $ 0.00 July $ 0.00 August $ 0.00 September tember $0.00 October $4,271.81 six-month CD $ 0.00 $ 0.00 $ 0.00 $ 3,619.66 $ 0.00 $0.00 $ 0.00 Final balance = $ 17,878.12 (Type integers or decimals rounded to the nearest cent as needed.) Month 1. January 2. February 3. March 4. April 5. May 6. June 7. July 8. August 9. September 10. October 11. November 12. December Income Expenses 3400 3360 3400 2900 3400 6600 9500 2750 3400 2800 5000 6800 4600 3200 3400 3600 34001 6550 3400 2800 3400 5000 6650 2900 A part time student would like to optimize his financial decisions. Currently, he has $15,900 in his savings account. He has estimated his income and monthly expenses for each month over the next year. This data is summarized in the accompanying table. He has identified several short-term investment opportunities: a three-month CD yielding 0.60% at maturity, a six-month CD yielding 1.42% at maturity, an 11-month CD yielding 3.08% at maturity, and a savings account yielding 0.0375% per month. He would like to maintain at least $2,000 in his savings account. His objective is to maximize his cash balance at the end of the year. Develop a linear optimization model to find the best investment strategy. Assume that all cash flows take place at the beginning of each month and that interest has been added to the savings account for January. PE Click here to view the monthly income and expenses data. Complete the table below to indicate the amount that should be invested each month to optimize the cash balance, and then give the final balance. 11-month CD $ 12,343.71 $ 0.00 three-month CD January $0.00 February $0.00 March $0.00 April $1,933.71 May $0.00 June $ 0.00 July $ 0.00 August $ 0.00 September tember $0.00 October $4,271.81 six-month CD $ 0.00 $ 0.00 $ 0.00 $ 3,619.66 $ 0.00 $0.00 $ 0.00 Final balance = $ 17,878.12 (Type integers or decimals rounded to the nearest cent as needed.) Month 1. January 2. February 3. March 4. April 5. May 6. June 7. July 8. August 9. September 10. October 11. November 12. December Income Expenses 3400 3360 3400 2900 3400 6600 9500 2750 3400 2800 5000 6800 4600 3200 3400 3600 34001 6550 3400 2800 3400 5000 6650 2900