Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello Dear, Can you help in this assignment, please provide forms and explanation that I have good understanding. thanks December 315t, The bank statements also

Hello Dear, Can you help in this assignment, please provide forms and explanation that I have good understanding.

thanks

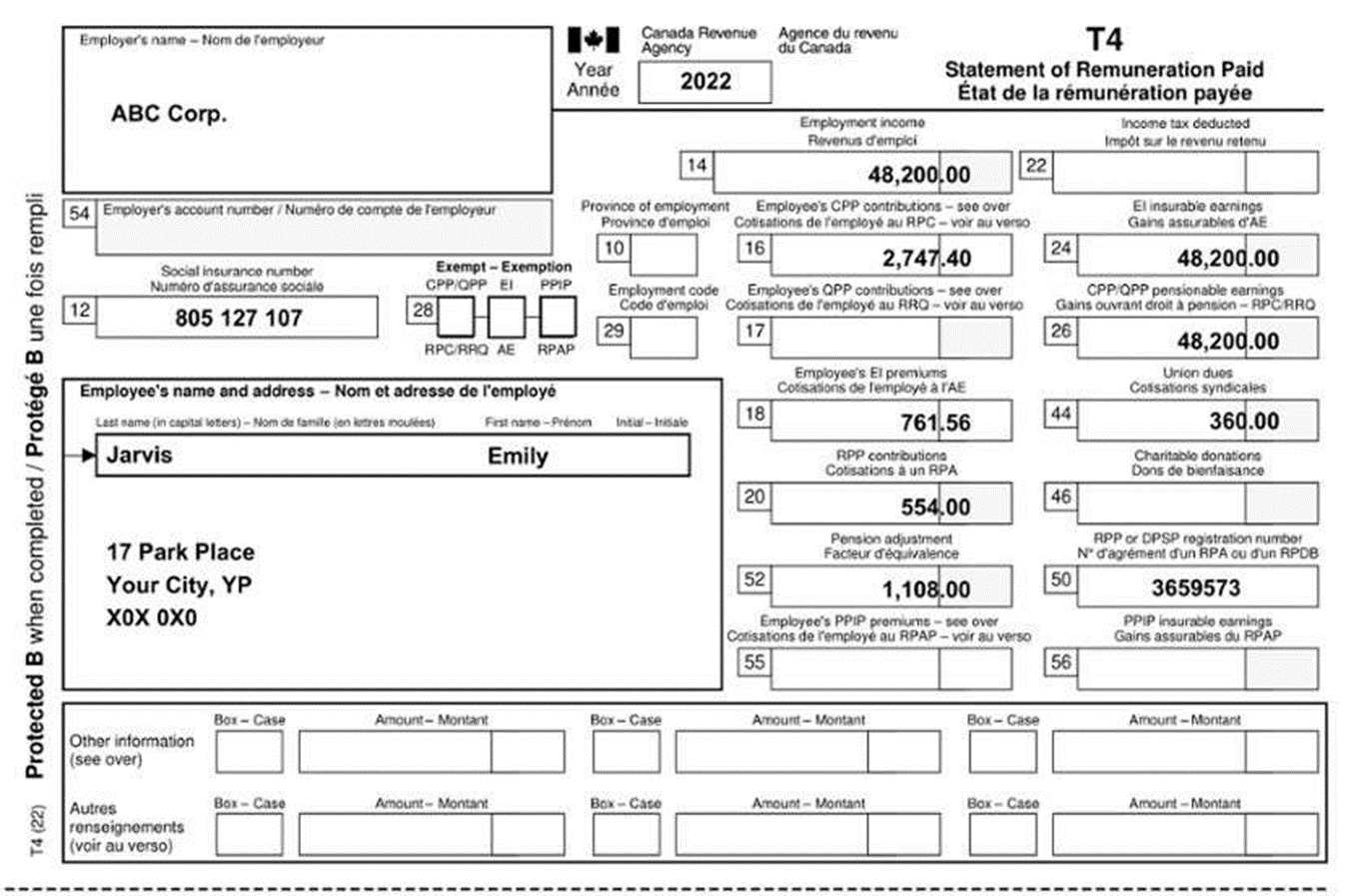

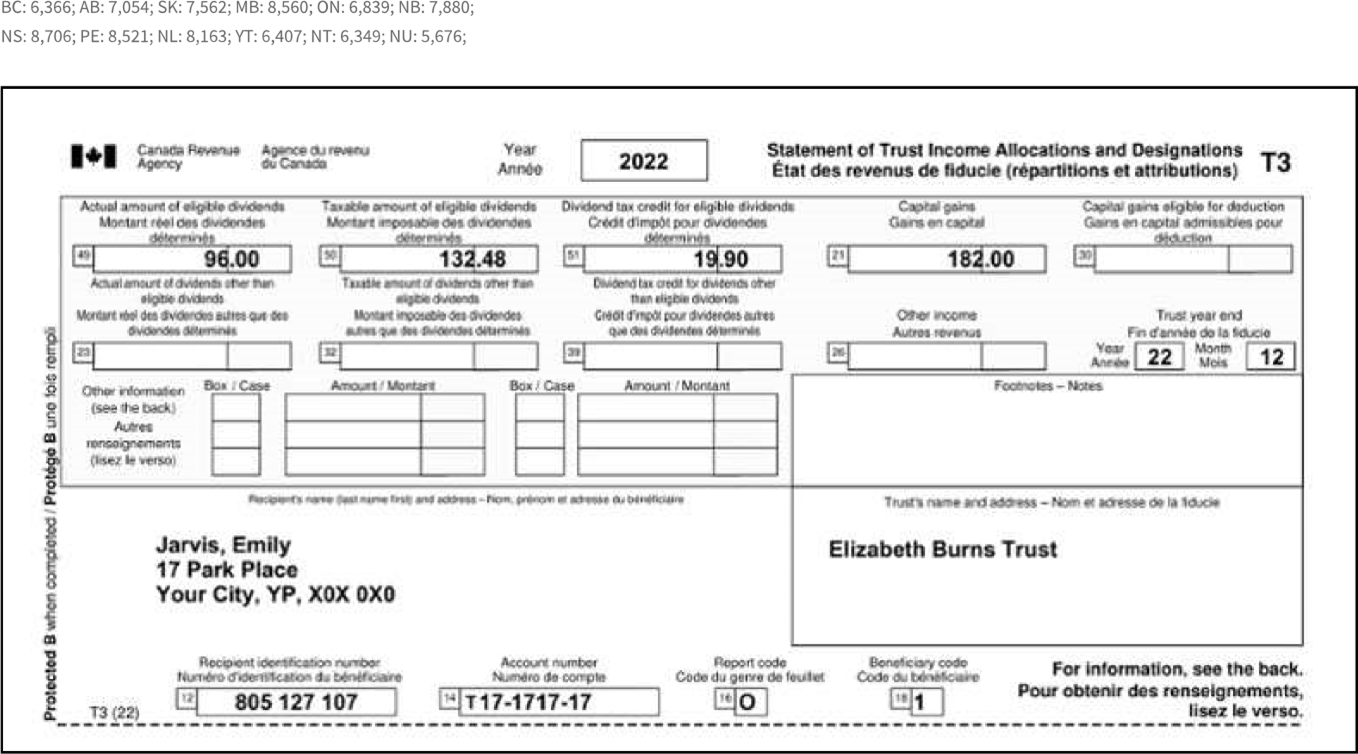

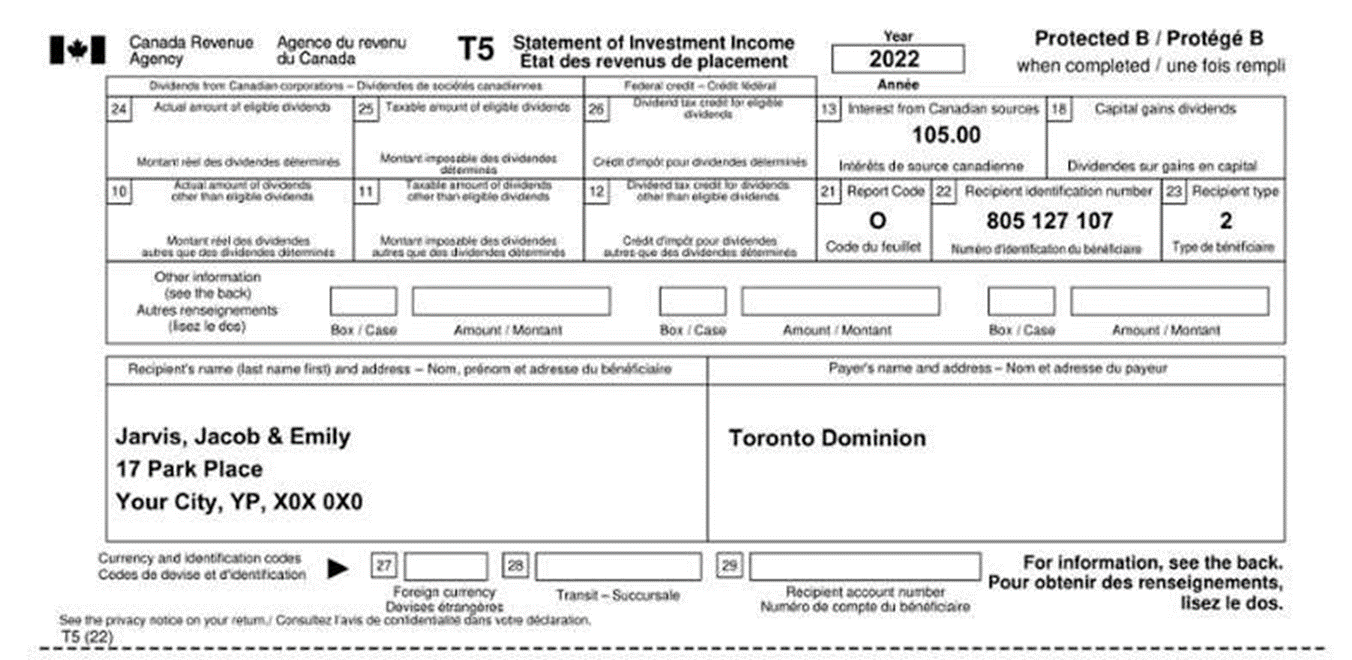

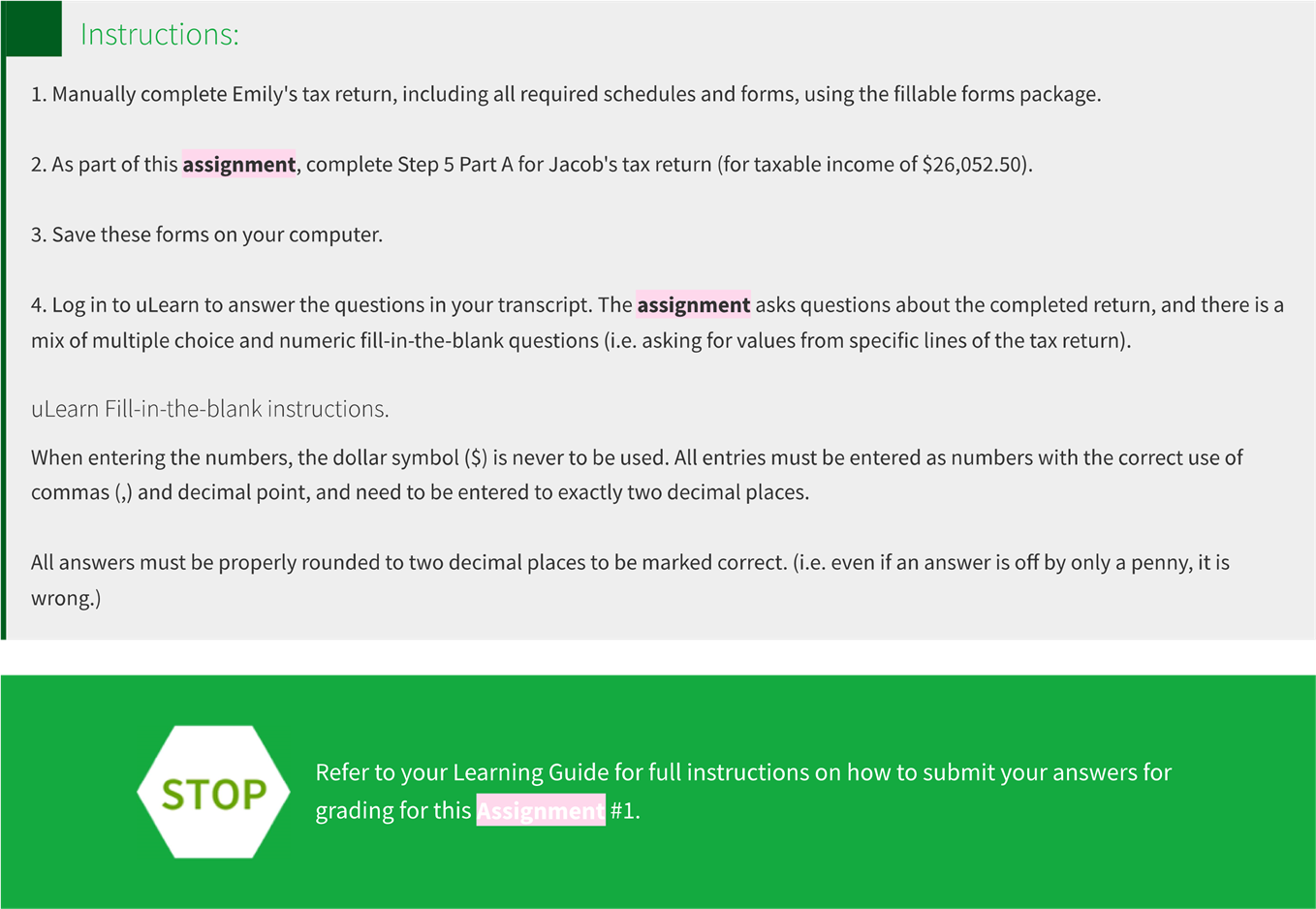

December 315t, The bank statements also show that the only credits in this account are for monthly interest payments. For 2022 , the annual average exchange rate was 1.3013 . Emily is not a US Citizen, and is not required to file a US returm. I late 2021, Emily bought 10 shares of Metro Inc. Emily received four dividend payments in 2022, each payment being $2.75, for a total of 11,00 in the year. She did not receive a slip for this income, and Metro Inc, issues eligible dividends. Emily still has these shares and does not olanning on selling them in the near future. She also has a $25 receipt for management fees. Emily always donates $500 each Christmas to the local Soup Kitchen. She want to claim the donation each year; as she is certain she would nisplace the receipt. She has the official receipt and would like to claim it on her return this year to avoid the inconvenience of keeping it for a iture year. Emily also has an official \$100 political contribution receipt to the federal Conservative Party, which she also wants to claim on he return. Emily'5 T4 and other information slips are reproduced below. Last year Emily received a tax refund of $900 on July 7, 2022, which included 3.25 refund interest. Emily is a Canadian citizen, lives outside of a CMA, and wants to answer "Yes" to the Elections Canada question. She has signed up for My Account, and would like to register for online mail. 3 Emily and Jacob met in universiby and married in 2021. and found employment full-dime at ABC Corp. in the fall of 2021. She conthues to work for ABC Corp. and was promoted to Assistant Manager in the summer of 2022 lacob did not continue his education aiver the onset of the pandemic in 2020. However, he was able to retain full-time employment at a local restrurant in 2022. He earned $17,000 in employment income (box 14 on hits T4), \$9,000 in tips, and some interest income from a joint bank account with Emily, Jacob has no other Inncome, and has already filed his retum, with net/faxable income of $26,052,50 reported. Jacob orres the CrA $1,200.00, which he has notyet paid. In April of 2022, Emily and Jacob boughit a home at 17 Park Place in Your Cfy for $225,000. Up until then, they lived in a small apartment. The diftance from their old apartuent to the new house is 25km. Emily and Jacob have never owned a home, They are excited about theit new homs, and have provided the following reseipts as part of their purchases - $12,500 in legal and real estrite fees; - $5,000 in new fumiture; and - $2,000 in moving expenses. Ihey would the to wite-ofit the above expenses, and would the to equally split any tox credf for the purchase of the home. Emily has a bank account with Koho which pays her interest. She did not receive anything from Koho, but was able to total up $31.11 in interest receivet throughout 2022. Also, Emily reselved income on a T3 slip from a tust that was set up by her paremits. At the onset of the pandemic in 2020, Emily and Jacob cpened a joint bank account at Toronto Dominion. They agreed to deposit S10. each weekly, which they have continues since then. They received a t5 with interest income. Just before Emily graduated in 2021, she inherted a bank account in the US with a balance of \$120,000 USD from her grandmother. At that ime, the exchange rate was 1.253 . She neither contributed, nor withdrew any amotnts from this account, and wants to save this money for Instructions: 1. Manually complete Emily's tax return, including all required schedules and forms, using the fillable forms package. 2. As part of this assignment, complete Step 5 Part A for Jacob's tax return (for taxable income of $26,052.50 ). 3. Save these forms on your computer. 4. Log in to uLearn to answer the questions in your transcript. The assignment asks questions about the completed return, and there is a mix of multiple choice and numeric fill-in-the-blank questions (i.e. asking for values from specific lines of the tax return). uLearn Fill-in-the-blank instructions. When entering the numbers, the dollar symbol (\$) is never to be used. All entries must be entered as numbers with the correct use of commas (,) and decimal point, and need to be entered to exactly two decimal places. All answers must be properly rounded to two decimal places to be marked correct. (i.e. even if an answer is off by only a penny, it is wrong.) Refer to your Learning Guide for full instructions on how to submit your answers for grading for this \#1. December 315t, The bank statements also show that the only credits in this account are for monthly interest payments. For 2022 , the annual average exchange rate was 1.3013 . Emily is not a US Citizen, and is not required to file a US returm. I late 2021, Emily bought 10 shares of Metro Inc. Emily received four dividend payments in 2022, each payment being $2.75, for a total of 11,00 in the year. She did not receive a slip for this income, and Metro Inc, issues eligible dividends. Emily still has these shares and does not olanning on selling them in the near future. She also has a $25 receipt for management fees. Emily always donates $500 each Christmas to the local Soup Kitchen. She want to claim the donation each year; as she is certain she would nisplace the receipt. She has the official receipt and would like to claim it on her return this year to avoid the inconvenience of keeping it for a iture year. Emily also has an official \$100 political contribution receipt to the federal Conservative Party, which she also wants to claim on he return. Emily'5 T4 and other information slips are reproduced below. Last year Emily received a tax refund of $900 on July 7, 2022, which included 3.25 refund interest. Emily is a Canadian citizen, lives outside of a CMA, and wants to answer "Yes" to the Elections Canada question. She has signed up for My Account, and would like to register for online mail. 3 Emily and Jacob met in universiby and married in 2021. and found employment full-dime at ABC Corp. in the fall of 2021. She conthues to work for ABC Corp. and was promoted to Assistant Manager in the summer of 2022 lacob did not continue his education aiver the onset of the pandemic in 2020. However, he was able to retain full-time employment at a local restrurant in 2022. He earned $17,000 in employment income (box 14 on hits T4), \$9,000 in tips, and some interest income from a joint bank account with Emily, Jacob has no other Inncome, and has already filed his retum, with net/faxable income of $26,052,50 reported. Jacob orres the CrA $1,200.00, which he has notyet paid. In April of 2022, Emily and Jacob boughit a home at 17 Park Place in Your Cfy for $225,000. Up until then, they lived in a small apartment. The diftance from their old apartuent to the new house is 25km. Emily and Jacob have never owned a home, They are excited about theit new homs, and have provided the following reseipts as part of their purchases - $12,500 in legal and real estrite fees; - $5,000 in new fumiture; and - $2,000 in moving expenses. Ihey would the to wite-ofit the above expenses, and would the to equally split any tox credf for the purchase of the home. Emily has a bank account with Koho which pays her interest. She did not receive anything from Koho, but was able to total up $31.11 in interest receivet throughout 2022. Also, Emily reselved income on a T3 slip from a tust that was set up by her paremits. At the onset of the pandemic in 2020, Emily and Jacob cpened a joint bank account at Toronto Dominion. They agreed to deposit S10. each weekly, which they have continues since then. They received a t5 with interest income. Just before Emily graduated in 2021, she inherted a bank account in the US with a balance of \$120,000 USD from her grandmother. At that ime, the exchange rate was 1.253 . She neither contributed, nor withdrew any amotnts from this account, and wants to save this money for Instructions: 1. Manually complete Emily's tax return, including all required schedules and forms, using the fillable forms package. 2. As part of this assignment, complete Step 5 Part A for Jacob's tax return (for taxable income of $26,052.50 ). 3. Save these forms on your computer. 4. Log in to uLearn to answer the questions in your transcript. The assignment asks questions about the completed return, and there is a mix of multiple choice and numeric fill-in-the-blank questions (i.e. asking for values from specific lines of the tax return). uLearn Fill-in-the-blank instructions. When entering the numbers, the dollar symbol (\$) is never to be used. All entries must be entered as numbers with the correct use of commas (,) and decimal point, and need to be entered to exactly two decimal places. All answers must be properly rounded to two decimal places to be marked correct. (i.e. even if an answer is off by only a penny, it is wrong.) Refer to your Learning Guide for full instructions on how to submit your answers for grading for this \#1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started