Hello Experts,

I need help with this assignment, please. I will appreciate your help. Thank You !!

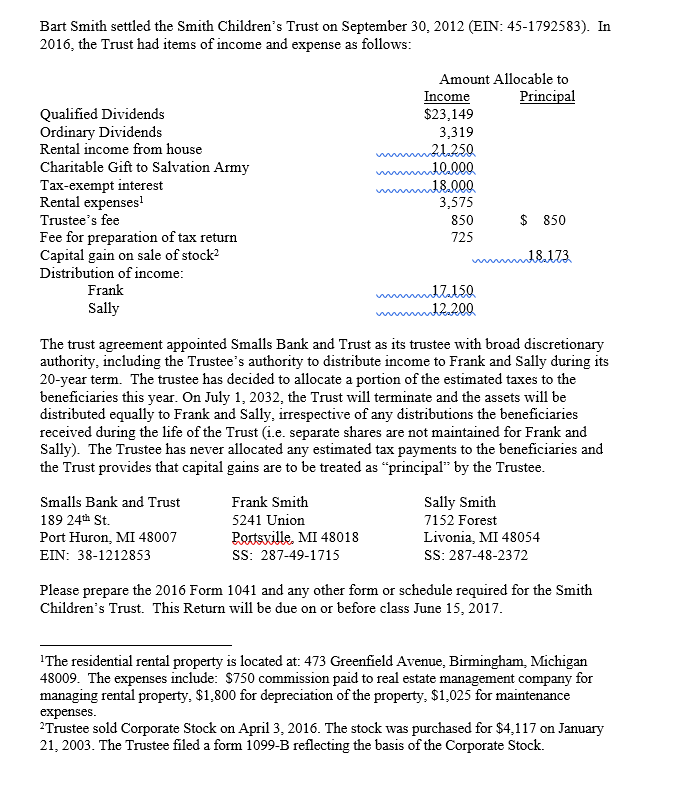

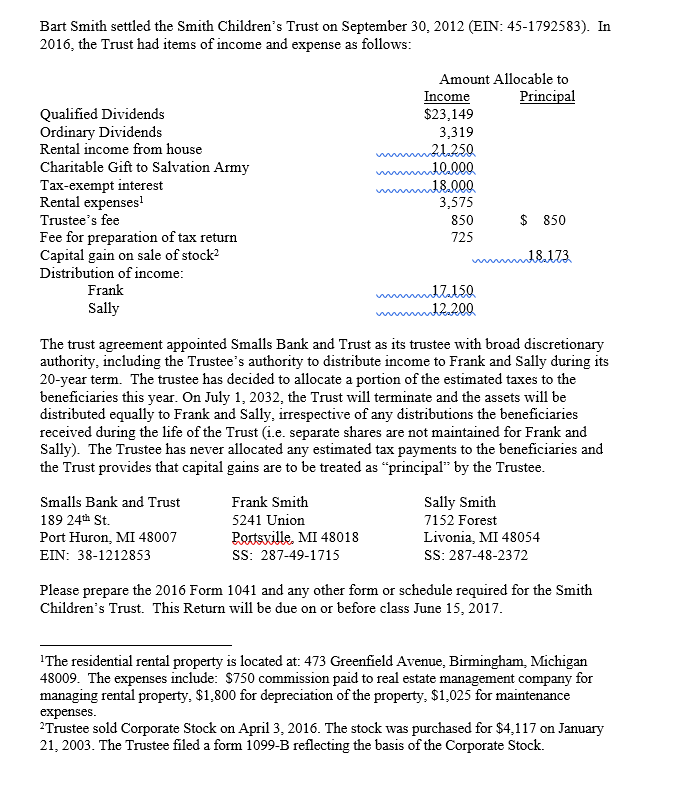

Bart Smith settled the Smith Children's Trust on September 30, 2012 (EIN: 45-1792583). In 2016, the trust had items of income and expense as follows: The trust agreement appointed Smalls Bank and Trust as its trustee with broad discretionary authority, including the Trustee's authority to distribute income to Frank and Sally during its 20-year term. The trustee has decided to allocate a portion of the estimated taxes to the beneficiaries this year. On July 1, 2032, the Trust will terminate and the assets will be distributed equally to Frank and Sally, irrespective of any distributions the beneficiaries received during the life of the Trust (i.e. separate shares are not maintained for Frank and Sally). The Trustee has never allocated any estimated tax payments to the beneficiaries and the Trust provides that capital gains are to be treated as "principal" by the Trustee. Please prepare the 2016 Form 1041 and any other form or schedule required for the Smith Children's Trust. This Return will be due o or before class June 15, 2017. The residential rental property is located at 473 Greenfield Avenue, Birmingham, Michigan 48009. The expenses include: exist750 commission paid to real estate management company for managing rental property, exist1, 800 for depreciation of the property, exist1, 025 for maintenance expenses Trustee sold Corporate Stock on April 3, 2016. The stock was purchased for exist4, 117 on January 21, 2003. The Trustee filed a form 1099-B reflecting the basis of the Corporate Stock. Bart Smith settled the Smith Children's Trust on September 30, 2012 (EIN: 45-1792583). In 2016, the trust had items of income and expense as follows: The trust agreement appointed Smalls Bank and Trust as its trustee with broad discretionary authority, including the Trustee's authority to distribute income to Frank and Sally during its 20-year term. The trustee has decided to allocate a portion of the estimated taxes to the beneficiaries this year. On July 1, 2032, the Trust will terminate and the assets will be distributed equally to Frank and Sally, irrespective of any distributions the beneficiaries received during the life of the Trust (i.e. separate shares are not maintained for Frank and Sally). The Trustee has never allocated any estimated tax payments to the beneficiaries and the Trust provides that capital gains are to be treated as "principal" by the Trustee. Please prepare the 2016 Form 1041 and any other form or schedule required for the Smith Children's Trust. This Return will be due o or before class June 15, 2017. The residential rental property is located at 473 Greenfield Avenue, Birmingham, Michigan 48009. The expenses include: exist750 commission paid to real estate management company for managing rental property, exist1, 800 for depreciation of the property, exist1, 025 for maintenance expenses Trustee sold Corporate Stock on April 3, 2016. The stock was purchased for exist4, 117 on January 21, 2003. The Trustee filed a form 1099-B reflecting the basis of the Corporate Stock