Question

Hello, Help please with 10 questions Part II. Exercise Exercise 1. Statement of financial position amounts as a December 31, 2017 for Lori's tutoring service

Hello, Help please with 10 questions

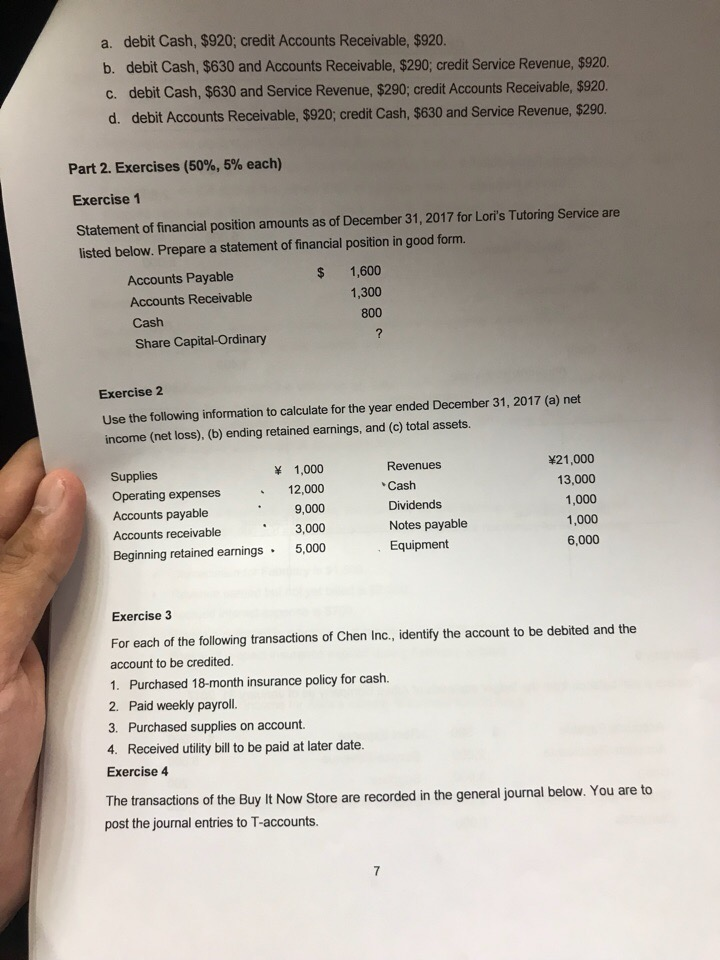

Part II. Exercise

Exercise 1. Statement of financial position amounts as a December 31, 2017 for Lori's tutoring service are listed below. Prepare a statement of financial position is good form.

Accounts Payable $ 1 600

Accounts Receivable 1 300

Cash 800

Share Capital-Ordinary ?

2. Use the following information to calculate for the year ended December 31, 2017 (a) net income (net loss), (b) ending retained earnings, and (c) total assets.

Supplies $ 1 000 Revenue $ 21 000

Operating expenses 12 000 Cash 13 000

Accounts Receivable 3 000 Notes payable 1 000

Begining retained earnings 5 000 Equipment 6 000

ex. 3. For each of the following transactions of Chen. In.? identify the accounts to be debited and the account to be credited.

1. Purchased 18-month insurance policy for cash.

2. Paid weekly payroll.

3. Purchased supplies on account.

4. Received utility bill to be paid at later date.

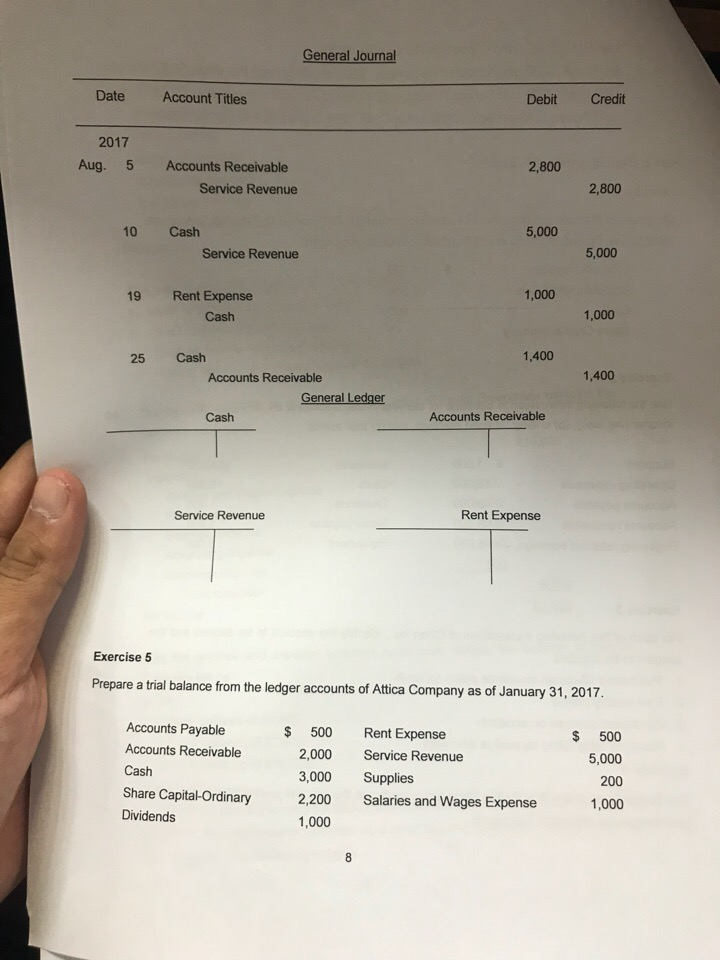

ex. 4/ The transactions of the Buy It Now Store are recorded in the general journal below. You are to post the journal entries to T-accounts.

ex. 5. Prepare a trial Balance from the ledger accounts of Attita Company as a of January 31, 2017.

Accounts Payable $ 500 Rent Expense $ 500

Accounts Receivable 2 000 Service Revenue 5 000

Cash 3 000 Supplies 200

Share Capital-Ordinary 2 200 Salaries and Wages Expense 1 000

Dividends 1 000

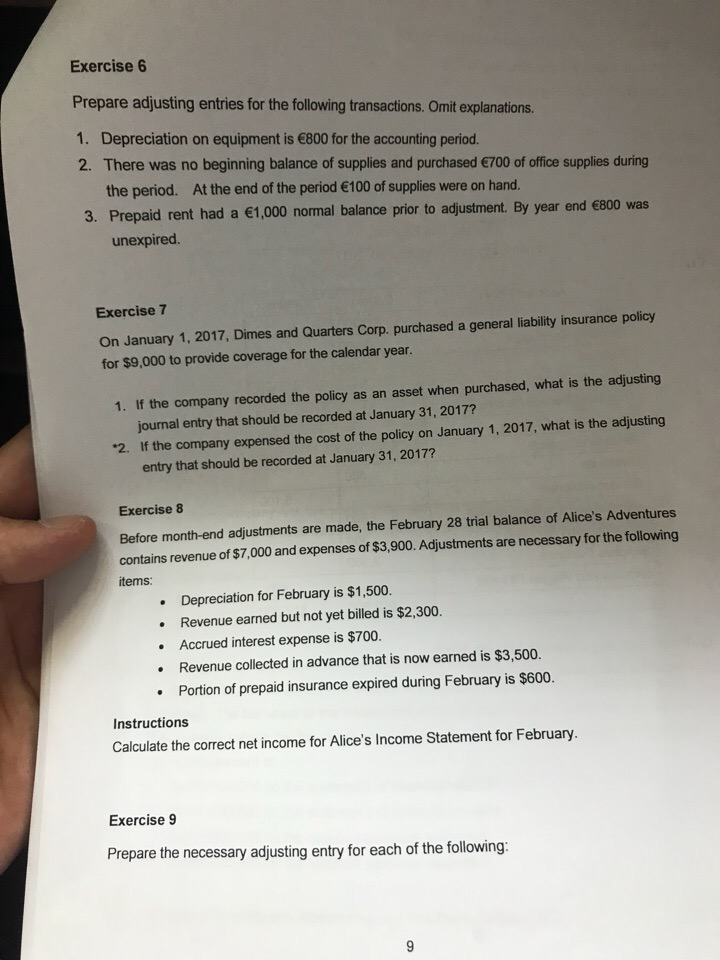

ex. 6. Prepare adjusting entries for the following transactions. Omit explanations.

1. Depreciation on equipment is $ 800 for the accounting period.

2. Therewas no beginning balance of supplies and purchased $ 700 of office supplies during the period. At the end of period $ 100 of supplies were on hand.

3.Prepaid rent had a $ 1000 normal balance prior to adjustment. By year end $800 was unexpired.

ex7. On January 1, 2017, Dimes and Quarters Corp. purchased a general liability insurance policy for $9 000 to provide coverage for the calendar year.

1. If the company recorded the policy as an asset when purchased, what is the adjusting journal entry that should be rerorded at January 31, 2017 ?

*2. If the Company expensed the cost of the policy on January 1, 2017, what is the adjusting entry that should be recorded at January 31, 2017?

EX8 Before month-end adjustment s are made, the February 28 trial balance of Alice's Adventures contains revenue of $7 000 and expenses of $ 3 900. Adjustments are necessary for the following items: - Depreciation for February is $ 1500.

-Revenue earned but not yet billed is $2 300.

-Accrued collected in Advance that is now earned is $3500.

-Portion of prepaid insurance expired during Febraury is $600.

Instructions: Calculate the correct net income for Alice's Income Statemnet for February.

9ex. Prepare the necessary adjusting entry for each of the following:

1: Service provided but unrecorded totaled $900.

2. Accrued salaries at year-end are $1000.

3. Depreciation for the year is $ 600.

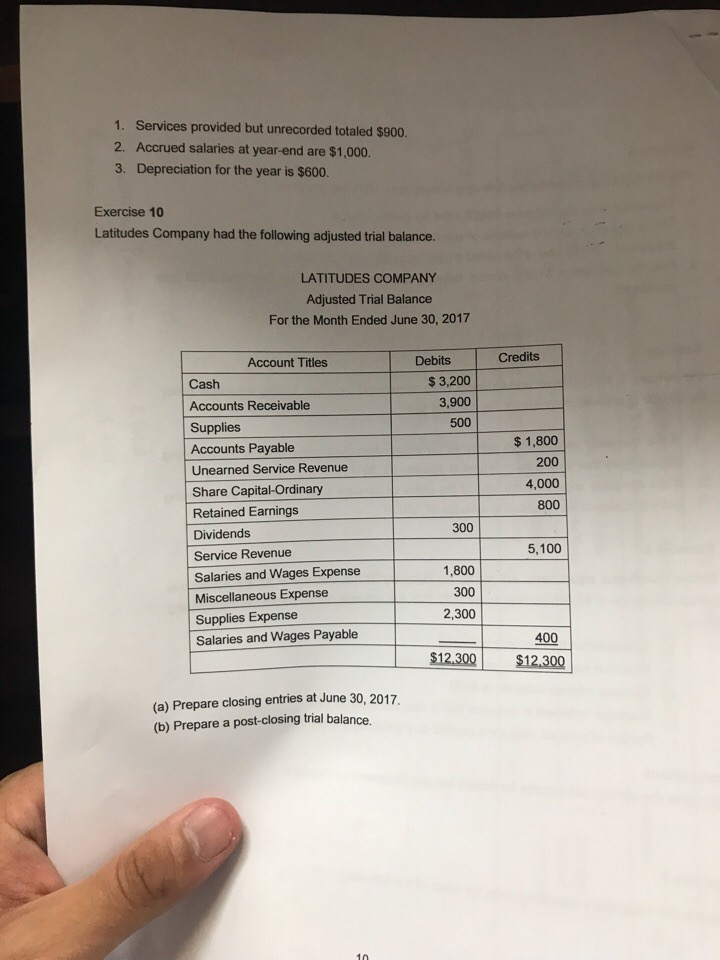

EX.10. Latitudes Company had the following adjusted trial balance.

a) Prepare closing entries at June 30, 2017

b) Prepare a post-closing trial balance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started