Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello, I am experiencing difficulty to resolve this exercise. Please provide detail explanation of the answer so I can learn how to write this in

Hello, I am experiencing difficulty to resolve this exercise. Please provide detail explanation of the answer so I can learn how to write this in future, thank you.

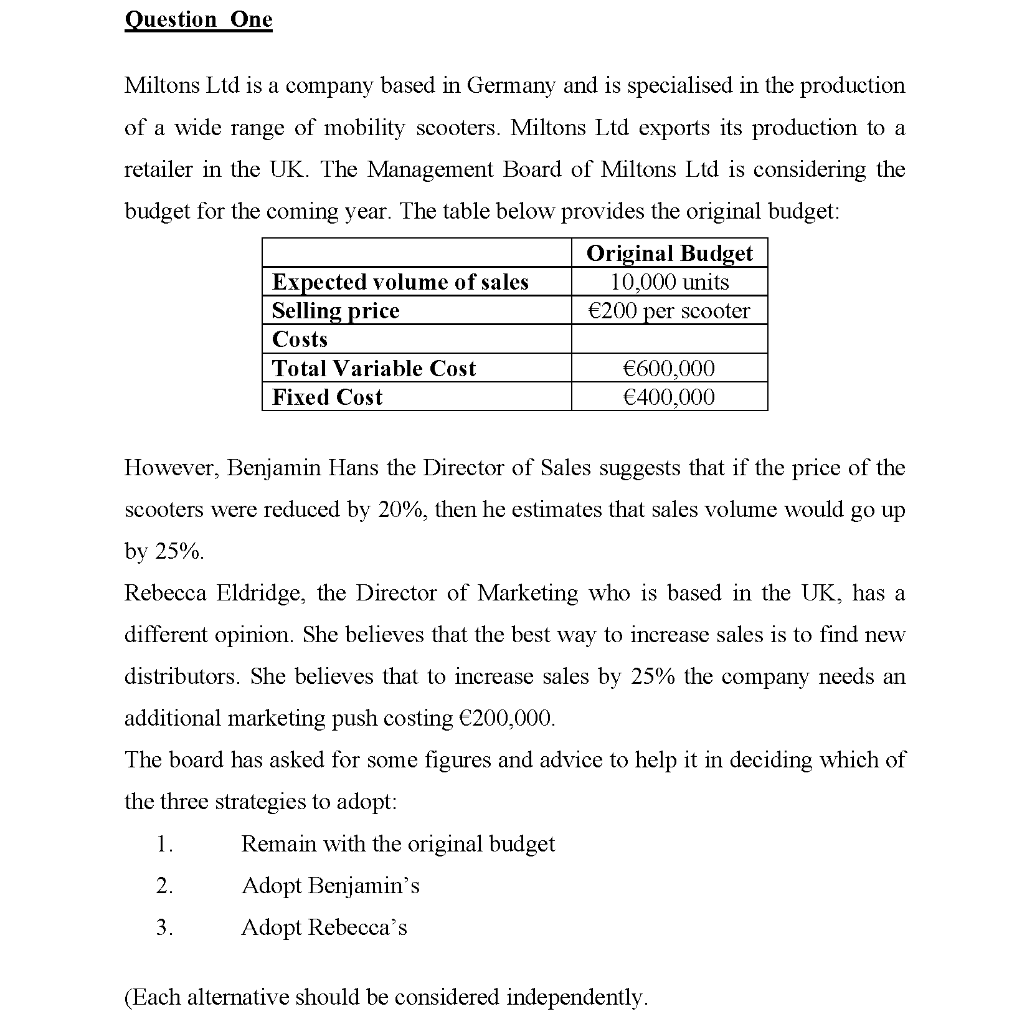

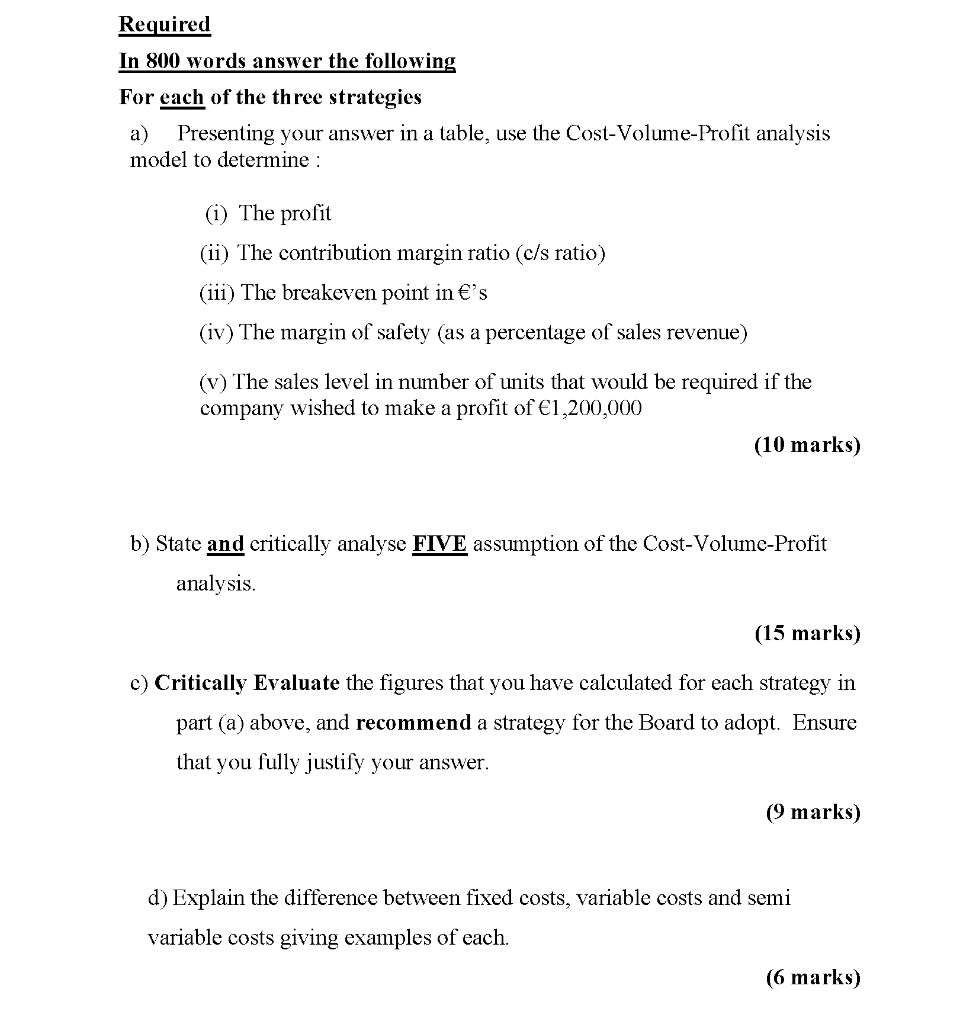

Question One Miltons Ltd is a company based in Germany and is specialised in the production of a wide range of mobility scooters. Miltons Ltd exports its production to a retailer in the UK. The Management Board of Miltons Ltd is considering the budget for the coming year. The table below provides the original budget: Original Budget Expected volume of sales 10,000 units Selling price 200 per scooter Costs Total Variable Cost 600,000 Fixed Cost 400,000 However, Benjamin Hans the Director of Sales suggests that if the price of the scooters were reduced by 20%, then he estimates that sales volume would go up by 25% Rebecca Eldridge, the Director of Marketing who is based in the UK, has a different opinion. She believes that the best way to increase sales is to find new distributors. She believes that to increase sales by 25% the company needs an additional marketing push costing 200,000. The board has asked for some figures and advice to help it in deciding which of the three strategies to adopt: Remain with the original budget 2. Adopt Benjamin's 3. Adopt Rebecca's 1. (Each alternative should be considered independently. Required In 800 words answer the following For each of the three strategies a) Presenting your answer in a table, use the Cost-Volume-Profit analysis model to determine : (i) The profit (ii) The contribution margin ratio (c/s ratio) (111) The breakeven point in 's (iv) The margin of safety (as a percentage of sales revenue) (v) The sales level in number of units that would be required if the company wished to make a profit of 1,200,000 (10 marks) b) State and critically analyse FIVE assumption of the Cost-Volume-Profit analysis. (15 marks) c) Critically Evaluate the figures that you have calculated for each strategy in part (a) above, and recommend a strategy for the Board to adopt. Ensure that you fully justify your answer. (9 marks) d) Explain the difference between fixed costs, variable costs and semi variable costs giving examples of each. (6 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started