Hello, I do not understand the answer to responses a to h. Could you give me some explain to me which columns of the table will allow me to answer to the questions please ?

Hello, I do not understand the answer to responses a to h. Could you give me some explain to me which columns of the table will allow me to answer to the questions please ?

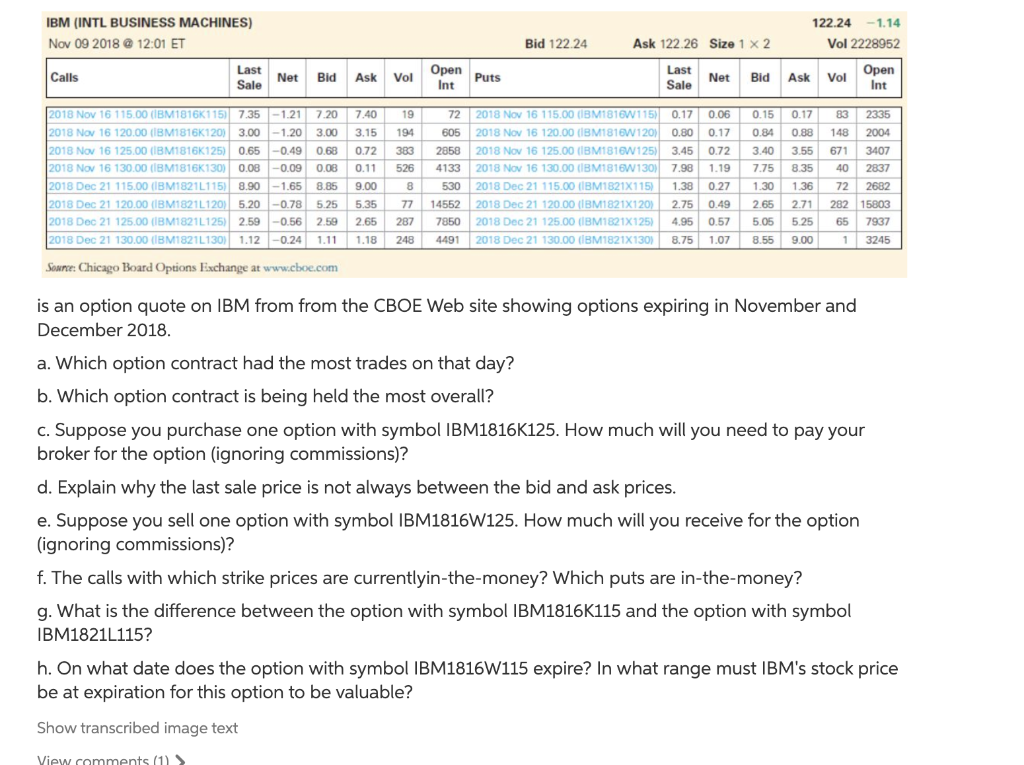

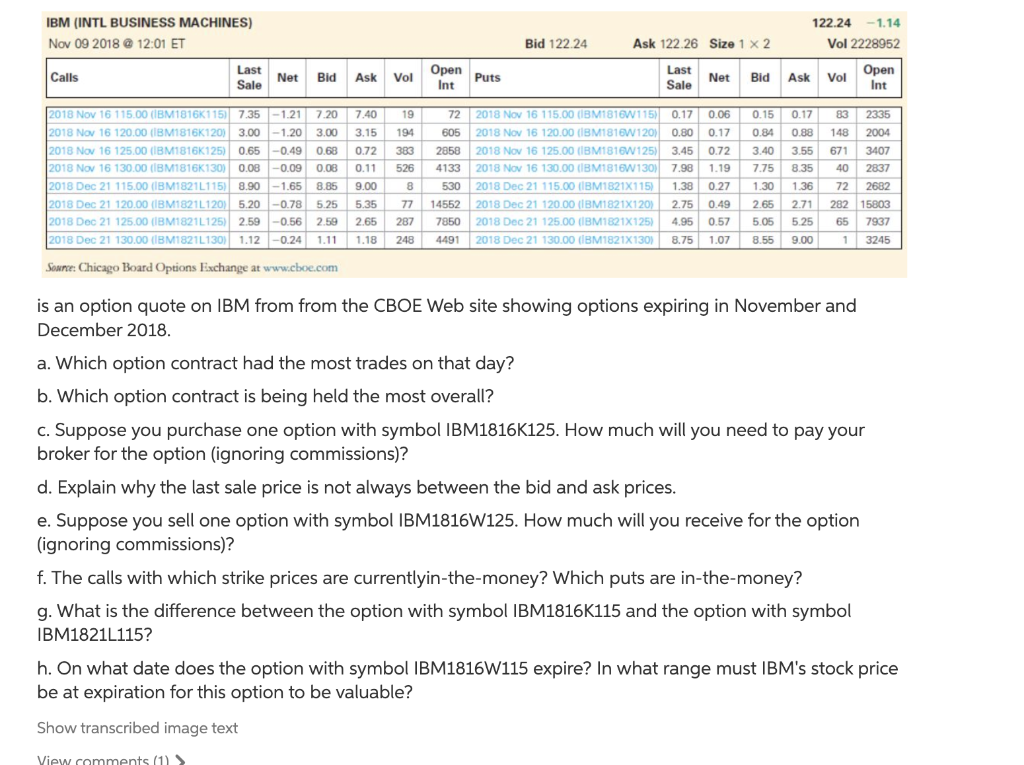

IBM (INTL BUSINESS MACHINES) Nov 09 2018 @ 12:01 ET Bid 122.24 122.24 -1.14 Ask 122.26 Size 1 x 2 1 Vol 2228952 Last Open Vol Net Bid Ask Sale Int Calls Last Sale Net Bid Ask Vol Open Int Puts 19 0.15 0.17 83 194 148 0.84 3.40 7.75 0.88 3.55 2335 2004 3407 2837 383 671 8.35 40 2018 Nov 16 115.00 (BM1816K115) 7.35 -1.21 7.20 7.40 2018 Nov 16 120.00 (IBM1816K120) 3.00 -1.20 3.00 3.15 2018 Nov 16 125.00 (BM1816K125) 0.65 -0.49 0.65 -0.49 0.68 0.72 2018 Nov 16 130.00 (BM1816K130) 0.08 -0.09 0.08 0.11 2018 Dec 21 115.00 (BM1821L115) 8.90-1.65 8.85 9.00 2018 Dec 21 120.00 (IBM1821L120) 5.20 -0.78 5.25 5.35 2018 Dec 21 125.00 (BM1821L125) 2.59-0.56 2.59 2.65 2018 Dec 21 130.00 (BM1821L130) 1.12 -0.24 1.11 ) 1.18 526 8 8 72 2018 Nov 16 115.00 (IBM1816W 115) 0.17 0.06 605 2018 Nov 16 120.00 (BM1816W120) 0.80 0.17 2858 2018 Nov 16 125.00 (BM1816W 125) 3.45 0.72 4133 2018 Nov 16 130.00 (BM1816W130) 7.98 1.19 530 2018 Dec 21 115.00 (IBM1821X115) 1.38 0.27 14552 2018 Dec 21 120,00 (IBM1821X120) 2.75 0.49 7850 2018 Dec 21 125.00 (BM1821X125) ) 4.95 0.57 4491 2018 Dec 21 130.00 (BM1821X130) 8.75 1.07 77 287 1.30 2.65 5.05 1.36 2.71 5.25 72 2682 282 15803 65 7937 1 3245 248 8.55 9.00 Source: Chicago Board Options Exchange at www.cboe.com is an option quote on IBM from from the CBOE Web site showing options expiring in November and December 2018. a. Which option contract had the most trades on that day? b. Which option contract is being held the most overall? c. Suppose you purchase one option with symbol IBM1816K125. How much will you need to pay your broker for the option (ignoring commissions)? d. Explain why the last sale price is not always between the bid and ask prices. e. Suppose you sell one option with symbol IBM1816W125. How much will you receive for the option (ignoring commissions)? f. The calls with which strike prices are currentlyin-the-money? Which puts are in-the-money? g. What is the difference between the option with symbol IBM1816K115 and the option with symbol IBM1821L115? h. On what date does the option with symbol IBM1816W115 expire? In what range must IBM's stock price be at expiration for this option to be valuable? Show transcribed image text View comments (1) IBM (INTL BUSINESS MACHINES) Nov 09 2018 @ 12:01 ET Bid 122.24 122.24 -1.14 Ask 122.26 Size 1 x 2 1 Vol 2228952 Last Open Vol Net Bid Ask Sale Int Calls Last Sale Net Bid Ask Vol Open Int Puts 19 0.15 0.17 83 194 148 0.84 3.40 7.75 0.88 3.55 2335 2004 3407 2837 383 671 8.35 40 2018 Nov 16 115.00 (BM1816K115) 7.35 -1.21 7.20 7.40 2018 Nov 16 120.00 (IBM1816K120) 3.00 -1.20 3.00 3.15 2018 Nov 16 125.00 (BM1816K125) 0.65 -0.49 0.65 -0.49 0.68 0.72 2018 Nov 16 130.00 (BM1816K130) 0.08 -0.09 0.08 0.11 2018 Dec 21 115.00 (BM1821L115) 8.90-1.65 8.85 9.00 2018 Dec 21 120.00 (IBM1821L120) 5.20 -0.78 5.25 5.35 2018 Dec 21 125.00 (BM1821L125) 2.59-0.56 2.59 2.65 2018 Dec 21 130.00 (BM1821L130) 1.12 -0.24 1.11 ) 1.18 526 8 8 72 2018 Nov 16 115.00 (IBM1816W 115) 0.17 0.06 605 2018 Nov 16 120.00 (BM1816W120) 0.80 0.17 2858 2018 Nov 16 125.00 (BM1816W 125) 3.45 0.72 4133 2018 Nov 16 130.00 (BM1816W130) 7.98 1.19 530 2018 Dec 21 115.00 (IBM1821X115) 1.38 0.27 14552 2018 Dec 21 120,00 (IBM1821X120) 2.75 0.49 7850 2018 Dec 21 125.00 (BM1821X125) ) 4.95 0.57 4491 2018 Dec 21 130.00 (BM1821X130) 8.75 1.07 77 287 1.30 2.65 5.05 1.36 2.71 5.25 72 2682 282 15803 65 7937 1 3245 248 8.55 9.00 Source: Chicago Board Options Exchange at www.cboe.com is an option quote on IBM from from the CBOE Web site showing options expiring in November and December 2018. a. Which option contract had the most trades on that day? b. Which option contract is being held the most overall? c. Suppose you purchase one option with symbol IBM1816K125. How much will you need to pay your broker for the option (ignoring commissions)? d. Explain why the last sale price is not always between the bid and ask prices. e. Suppose you sell one option with symbol IBM1816W125. How much will you receive for the option (ignoring commissions)? f. The calls with which strike prices are currentlyin-the-money? Which puts are in-the-money? g. What is the difference between the option with symbol IBM1816K115 and the option with symbol IBM1821L115? h. On what date does the option with symbol IBM1816W115 expire? In what range must IBM's stock price be at expiration for this option to be valuable? Show transcribed image text View comments (1)

Hello, I do not understand the answer to responses a to h. Could you give me some explain to me which columns of the table will allow me to answer to the questions please ?

Hello, I do not understand the answer to responses a to h. Could you give me some explain to me which columns of the table will allow me to answer to the questions please ?