Hello,

I have a study case due Tomorrow marked by 10 grades that I gathered the answers for from Course Hero, please double check my homework and tell me if there's anything i need to add or of any mistakes.

Answers are below.

Thank you.

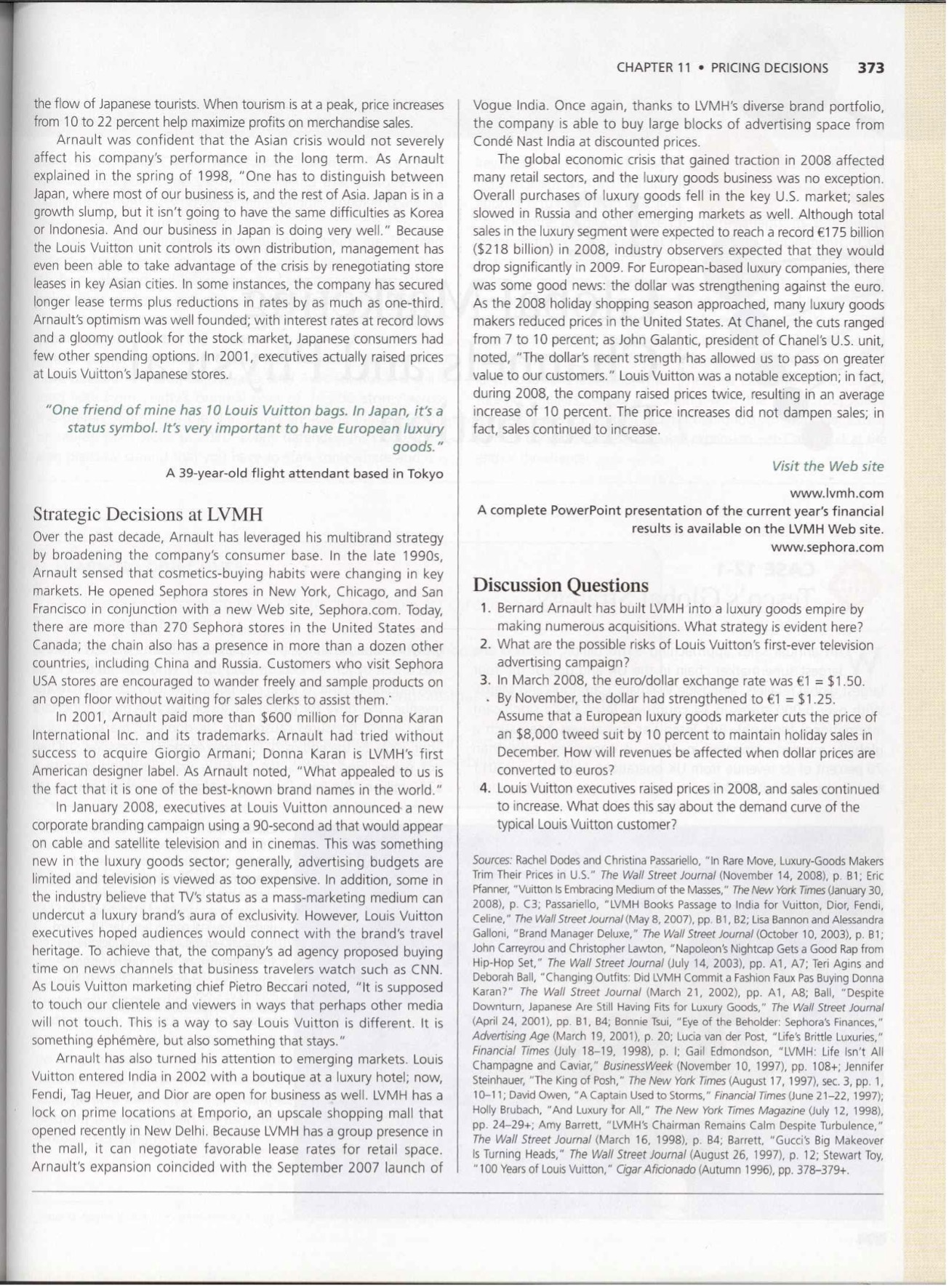

372 PART 4 . THE GLOBAL MARKETING MIX CASE 11-2 LVMH and Luxury Goods Marketing L VMH Moet Hennessy-Louis Vuitton SA is the world's largest marketer of luxury products and brands. Chairman Bernard Arnault has assembled a diverse empire of more than 60 brands, sales of which totaled $28 billion (620.3 billion) in 2010 (see Figure 1). LOUIS VUITTON Arnault, whom some refer to as "the pope of high fashion," recently summed up the luxury business as follows: "We are here to sell dreams. When you see a couture show on TV around the world, you dream. When you enter a Dior boutique and buy your lipstick, you buy something affordable, but it has the dream in it." Decades ago, the companies that today comprise LVMH were family-run enterprises focused more on prestige than on profit. Fendi, Pucci, and others sold mainly to a niche market comprised of very rich clientele. However, as markets began to globalize, the small luxury players struggled to compete. When Arnault set about acquiring smaller luxury brands, he had three goals in mind. First, he hoped that the portfolio approach would reduce the risk exposure to fashion cycles. According to this logic, if demand for watches or jewelry declined, clothing or accessory sales would offset any losses. Second, Source: Landov Media. he intended to cut costs by eliminating redundancies in sourcing and manufacturing. Third, he hoped that LVMH's stable of brands would margins associated with Vuitton handbags, gun cases, and luggage dis- translate into a stronger bargaining position when managers negotia playing the distinctive beige-on-brown latticework LV monogram. Louis ated leases for retail space or bought advertising. Vuitton SA spends $10 million annually battling counterfeiters in Turkey, Sales of luggage and leather fashion goods, including the 158-year- Thailand, China, Morocco, South Korea, and Italy. Some of the money is old Louis Vuitton brand, account for 35 percent of revenues (see Figure 1). spent on lobbyists who represent the company's interests in meetings The company's specialty group includes Duty Free Shoppers (DFS) and with foreign government officials. Yves Carcelle, chairman of Louis Sephora. DFS operates stores in international airports around the world; Vuitton SA, recently explained, "Almost every month, we get a govern- Sephora, which LVMH acquired in 1997, is Europe's second-largest ment somewhere in the world to destroy canvas, or finished products." chain of perfume and cosmetics stores. Driven by such well-known Another problem is a flourishing gray market. Givenchy and brands as Christian Dior, Givenchy, and Kenzo, perfumes and cosmetics Christian Dior's Dune fragrance are just two of the luxury perfume generate nearly 20 percent of LVMH's revenues. LVMH's wine and spirits brands that are sometimes diverted from authorized channels for sale at unit includes such prestigious Champagne brands as Dom Perignon, mass-market retail outlets. LVMH and other luxury goods marketers Moet & Chandon, and Veuve Clicquot. recently found a new way to combat gray market imports into the United Despite the high expenses associated with operating elegant stores States. In March 1995, the U.S. Supreme Court let stand an appeals and purchasing advertising space in upscale magazines, the premium court ruling prohibiting a discount drugstore chain from selling Givenchy retail prices that luxury goods command translate into handsome profits. perfume without permission. Parfums Givenchy USA had claimed that its The Louis Vuitton brand alone accounts for about 60 percent of LVMH's distinctive packaging should be protected under U.S. copyright law. The operating profit. Unscrupulous operators have taken note of the high ruling means that Costco, Walmart, and other discounters cannot sell some imported fragrances without authorization. Opportunities and Challenges in Asia Wine and Asia-particularly Japan-is a key region for LVMH and its competi- Spirits tors. The financial turmoil of the late 1990s and the subsequent Selective 16% Retailing currency devaluations and weakening of the yen translated into lower 26% demand for luxury goods. Because price perceptions are a critical component of luxury goods' appeal, LMVH executives made a number of adjustments in response to changing business conditions. For example, Patrick Choel, president of the perfume and cosmetics Watches and Fashion and division, raised wholesale prices in individual Asian markets. The goal Jewelry Perfume and Leather was to discourage discount retailers from stocking up on designer 5% Cosmetics Goods products and then selling them to down-market consumers. Also, 15% 37% expenditures on perfume and cosmetics advertising were reduced to maintain profitability in the face of a possible sales decline. Louis Vuitton chairman Yves Carcelle also made adjustments. He canceled plans for a new store in Indonesia, and group managers raised FIGURE 1 prices to counteract the effect of currency devaluations. Because the DFS chain depends on Japanese tourists in Asia and Hawaii for 75 percent of LVMH Operating Units by 2010 Net Sales sales, Louis Vuitton managers also work with tour operators to predictCHAPTER 11 . PRICING DECISIONS 373 the flow of Japanese tourists. When tourism is at a peak, price increases Vogue India. Once again, thanks to LVMH's diverse brand portfolio, from 10 to 22 percent help maximize profits on merchandise sales. the company is able to buy large blocks of advertising space from Arnault was confident that the Asian crisis would not severely Conde Nast India at discounted prices. affect his company's performance in the long term. As Arnault The global economic crisis that gained traction in 2008 affected explained in the spring of 1998, "One has to distinguish between many retail sectors, and the luxury goods business was no exception. Japan, where most of our business is, and the rest of Asia. Japan is in a Overall purchases of luxury goods fell in the key U.S. market; sales growth slump, but it isn't going to have the same difficulties as Korea slowed in Russia and other emerging markets as well. Although total or Indonesia. And our business in Japan is doing very well." Because sales in the luxury segment were expected to reach a record 6175 billion the Louis Vuitton unit controls its own distribution, management has ($218 billion) in 2008, industry observers expected that they would even been able to take advantage of the crisis by renegotiating store drop significantly in 2009. For European-based luxury companies, there leases in key Asian cities. In some instances, the company has secured was some good news: the dollar was strengthening against the euro. longer lease terms plus reductions in rates by as much as one-third. As the 2008 holiday shopping season approached, many luxury goods Arnault's optimism was well founded; with interest rates at record lows makers reduced prices in the United States. At Chanel, the cuts ranged and a gloomy outlook for the stock market, Japanese consumers had from 7 to 10 percent; as John Galantic, president of Chanel's U.S. unit, few other spending options. In 2001, executives actually raised prices noted, "The dollar's recent strength has allowed us to pass on greater at Louis Vuitton's Japanese stores. value to our customers." Louis Vuitton was a notable exception; in fact, during 2008, the company raised prices twice, resulting in an average "One friend of mine has 10 Louis Vuitton bags. In Japan, it's a increase of 10 percent. The price increases did not dampen sales; in status symbol. It's very important to have European luxury fact, sales continued to increase. goods. " A 39-year-old flight attendant based in Tokyo Visit the Web site www.lvmh.com Strategic Decisions at LVMH A complete PowerPoint presentation of the current year's financial Over the past decade, Arnault has leveraged his multibrand strategy results is available on the LVMH Web site. by broadening the company's consumer base. In the late 1990s, www.sephora.com Arnault sensed that cosmetics-buying habits were changing in key markets. He opened Sephora stores in New York, Chicago, and San Discussion Questions Francisco in conjunction with a new Web site, Sephora.com. Today, 1. Bernard Arnault has built LVMH into a luxury goods empire by there are more than 270 Sephora stores in the United States and making numerous acquisitions. What strategy is evident here? Canada; the chain also has a presence in more than a dozen other 2. What are the possible risks of Louis Vuitton's first-ever television countries, including China and Russia. Customers who visit Sephora advertising campaign? USA stores are encouraged to wander freely and sample products on 3. In March 2008, the euro/dollar exchange rate was 61 = $1.50. an open floor without waiting for sales clerks to assist them. By November, the dollar had strengthened to (1 = $1.25. In 2001, Arnault paid more than $600 million for Donna Karan Assume that a European luxury goods marketer cuts the price of International Inc. and its trademarks. Arnault had tried without an $8,000 tweed suit by 10 percent to maintain holiday sales in success to acquire Giorgio Armani; Donna Karan is LVMH's first December. How will revenues be affected when dollar prices are American designer label. As Arnault noted, "What appealed to us is converted to euros? the fact that it is one of the best-known brand names in the world." 4. Louis Vuitton executives raised prices in 2008, and sales continued In January 2008, executives at Louis Vuitton announced a new to increase. What does this say about the demand curve of the corporate branding campaign using a 90-second ad that would appear typical Louis Vuitton customer? on cable and satellite television and in cinemas. This was something new in the luxury goods sector; generally, advertising budgets are Sources: Rachel Dodes and Christina Passariello, "In Rare Move, Luxury-Goods Makers limited and television is viewed as too expensive. In addition, some in Trim Their Prices in U.S." The Wall Street Journal (November 14, 2008), p. B1; Eric the industry believe that TV's status as a mass-marketing medium can Pfanner, "Vuitton Is Embracing Medium of the Masses," The New York Times (January 30, 2008), p. C3; Passariello, "LVMH Books Passage to India for Vuitton, Dior, Fendi, undercut a luxury brand's aura of exclusivity. However, Louis Vuitton Celine," The Wall Street Journal (May 8, 2007), pp. B1, B2; Lisa Bannon and Alessandra executives hoped audiences would connect with the brand's travel Galloni, "Brand Manager Deluxe," The Wall Street Journal (October 10, 2003), p. B1; heritage. To achieve that, the company's ad agency proposed buying John Carreyrou and Christopher Lawton, "Napoleon's Nightcap Gets a Good Rap from time on news channels that business travelers watch such as CNN. Hip-Hop Set," The Wall Street Journal (July 14, 2003), pp. A1, A7; Teri Agins and As Louis Vuitton marketing chief Pietro Beccari noted, "It is supposed Deborah Ball, "Changing Outfits: Did LVMH Commit a Fashion Faux Pas Buying Donna Karan?" The Wall Street Journal (March 21, 2002), pp. A1, A8; Ball, "Despite to touch our clientele and viewers in ways that perhaps other media Downturn, Japanese Are Still Having Fits for Luxury Goods," The Wall Street Journal will not touch. This is a way to say Louis Vuitton is different. It is (April 24, 2001), pp. B1, B4; Bonnie Tsui, "Eye of the Beholder: Sephora's Finances," something ephemere, but also something that stays." Advertising Age (March 19, 2001), p. 20; Lucia van der Post, "Life's Brittle Luxuries," Arnault has also turned his attention to emerging markets. Louis Financial Times (July 18-19, 1998), p. I: Gail Edmondson, "LVMH: Life Isn't All Champagne and Caviar," BusinessWeek (November 10, 1997), pp. 108+; Jennifer Vuitton entered India in 2002 with a boutique at a luxury hotel; now, Steinhauer, "The King of Posh," The New York Times (August 17, 1997), sec. 3, pp. 1, Fendi, Tag Heuer, and Dior are open for business as well. LVMH has a 10-11; David Owen, "A Captain Used to Storms," Financial Times (June 21-22, 1997); lock on prime locations at Emporio, an upscale shopping mall that Holly Brubach, "And Luxury for All," The New York Times Magazine (July 12, 1998), opened recently in New Delhi. Because LVMH has a group presence in pp. 24-29+; Amy Barrett, "LVMH's Chairman Remains Calm Despite Turbulence," The Wall Street Journal (March 16, 1998), p. B4; Barrett, "Gucci's Big Makeover the mall, it can negotiate favorable lease rates for retail space. Is Turning Heads," The Wall Street Journal (August 26, 1997), p. 12; Stewart Toy, Arnault's expansion coincided with the September 2007 launch of "100 Years of Louis Vuitton, " Cigar Aficionado (Autumn 1996), pp. 378-379+