Question

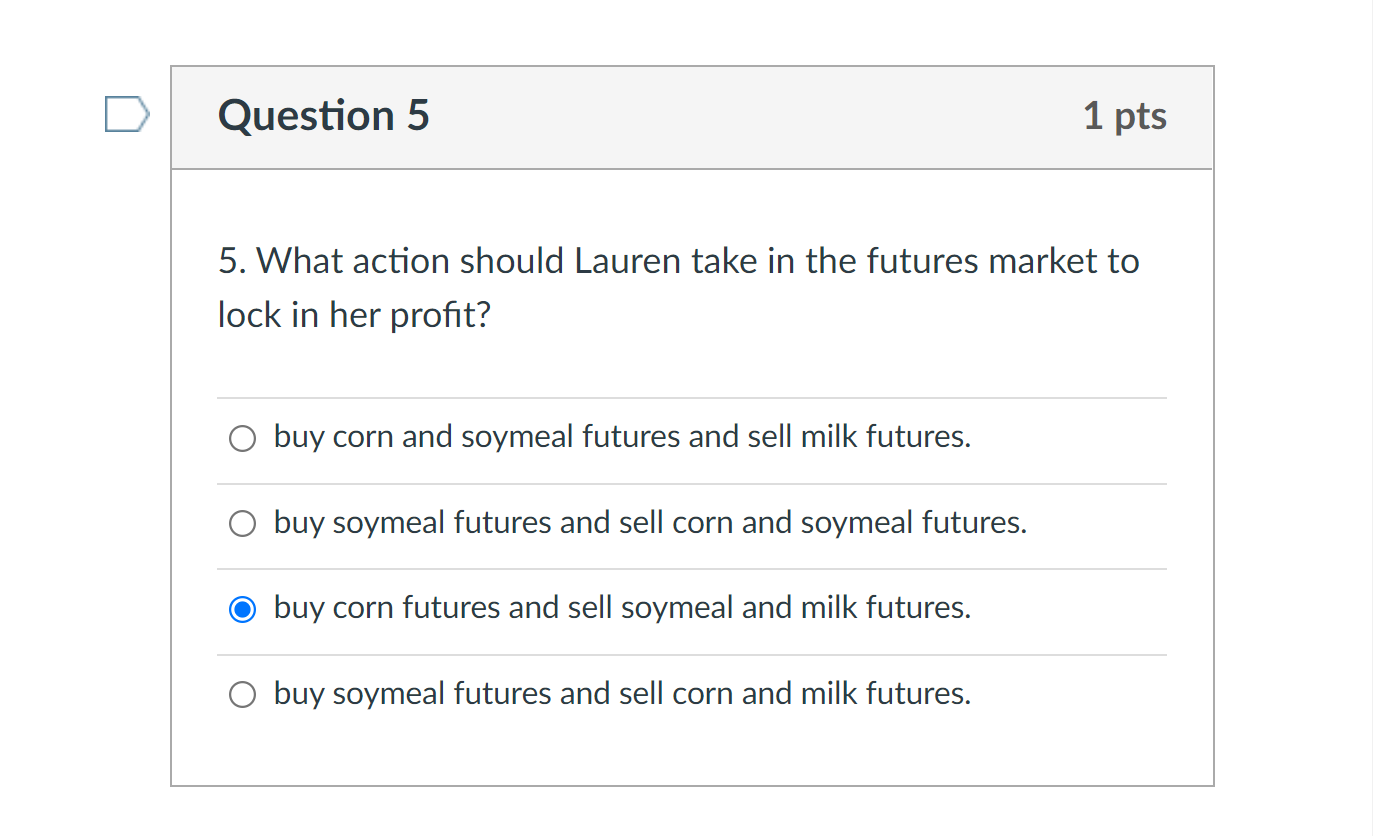

Hello I have an agriculture economics based question and I am having trouble figuring out the answer? I have provided an image of the question

Hello I have an agriculture economics based question and I am having trouble figuring out the answer? I have provided an image of the question below with more info apart of the question.

Part of the Question: Lauren is a dairy farmer in the Central Valley. She has a 3000 cow dairy with average annual production of 25,000 pounds per cow. It is November 1 and times are tough but she sees an opportunity to possibly lock in some profit using class III milk futures for 3 months worth of production through January of next year. She calculates that her local milk basis is +2.00. December futures are trading at $20.50 per hundredweight, with January at $21.00. She has locked in some of her feed with forward contracts, but still is open for her corn and soy meal. December corn futures are trading at $3.80 and March at $3.92. The corn basis is +$1.25, and the soymeal basis is + $55. December soymeal futures are $370 and March is $385. She is feeding 16 lbs. per day of rolled corn and 4 lbs. per day of soy meal per cow.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started