Question

Hello, I have this Finance problem that I can not figure out. I've copied the answer below but I am unsure where they are getting

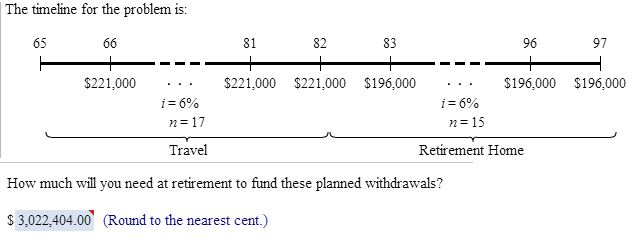

Hello, I have this Finance problem that I can not figure out. I've copied the answer below but I am unsure where they are getting this number. I've taken the present value of both Travel and Retirement Home sections. $2,315,474.39 and $1,903,600.80 respectively and am lost on what to do next. Can anyone shed some light on this problem? Could you please provide steps to get the answer, not just the answer, please? Thank you!

You are trying to decide how much money you will need at retirement. You expect to retire at age 65. You hope to travel extensively while you are healthy enough. To finance your travels (and cover your basic living expenses) you think you will need income of $221,000 per year (at the end of each year). You will make your first withdrawal on your 66th birthday. You expect to stay healthy enough for travel for the first 17 years after retirement and thus make a withdrawal of $221,000 at the end of each of those 17 years. Once your active travel years are over you will settle down into a retirement home. During your retirement home years, you will only need $196,000 in income per year. You expect to live in the retirement home for 15 years. You will make the first retirement home withdrawal 18 years after retirement and all subsequent withdrawals will continue to be at year-end. If retirement savings will earn a return of 6%, then how much will you need at retirement to fund these planned withdrawals?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started