Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hello, I need detailed exploration on this problem please. thank you PROBLEM IY Merry Music Company manufactures drums. In February, the two production deparmen budgeted

hello, I need detailed exploration on this problem please. thank you

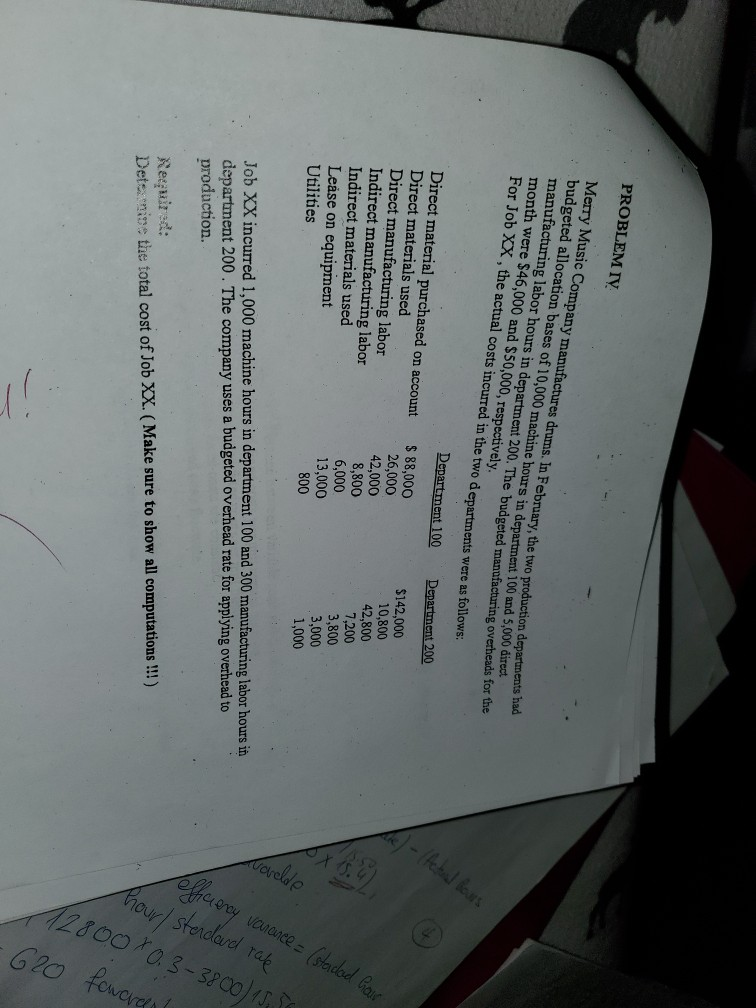

PROBLEM IY Merry Music Company manufactures drums. In February, the two production deparmen budgeted allocation bases of 10,000 machine hours in department 100 and 5,000 am manufacturing labor hours in department 200. The budgeted manufacturing overhea month were $46,000 and $50,000, respectively. For Job XX, the actual costs incurred in the two departments were as follows: lours Department 200 - le Direct material purchased on account Direct materials used Direct manufacturing labor Indirect manufacturing labor Indirect materials used Lease on equipment Utilities Department 100 $ 88,000 26,000 42,000 8,800 6,000 13,000 800 $142,000 10,800 42,800 7,200 3,800 3,000 1,000 Nordde Gary Varance = (stadad for Job XX incurred 1,000 machine hours in department 100 and 300 manufacturing labor hours in department 200. The company uses a budgeted overhead rate for applying overhead to production. hour/ stendard rale Required: Detsmise the total cost of Job XX. Make sure to show all computations !!!) 128000.3 -3800)15, feveren -620Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started