Question

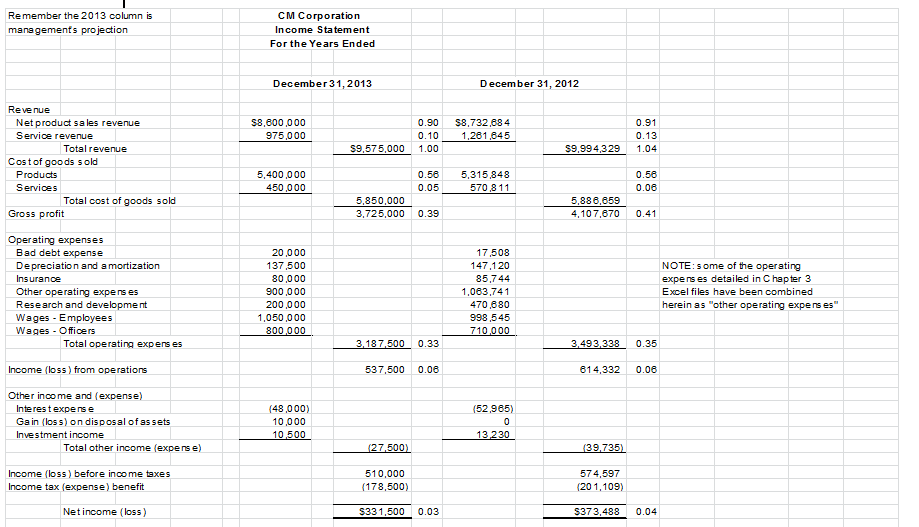

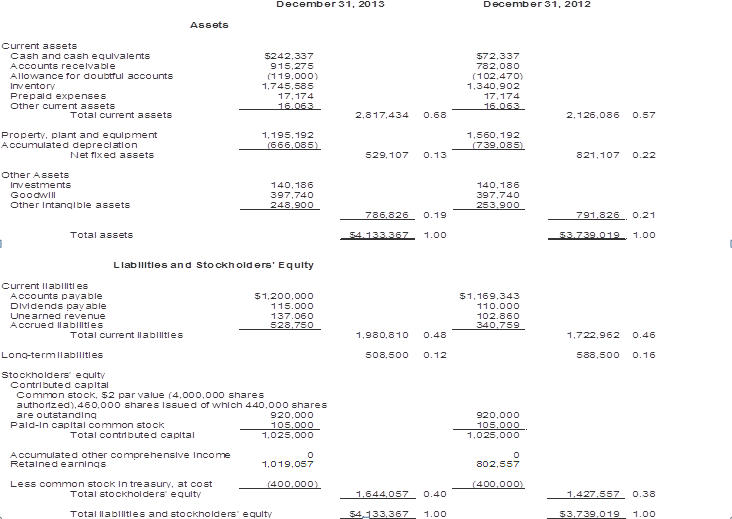

Hello, I need help with this assignment. I have copied the balance sheet and income statement for the years ended 2012 and 2013. Thank you.

Hello, I need help with this assignment. I have copied the balance sheet and income statement for the years ended 2012 and 2013. Thank you.

Chapter 6

Time Value of Money: CM2 (Refer to original file 4a, used for Chapter 5 Case)

The CM2 management team is discussing how it can take control of things before they get out of hand. For example, they realize that most of their current assets are not readily liquid (they are not quick assets), so they are considering a number of options to pay back their debt, all of it. They also need to plan towards some capital expenditures.

Part I

1. Assume, for the years 2012 and 2013 projections, that all the reported interest relate to the reported longterm debt as of the end of those years, and that the interest incurred will be the amount paid for in the year. Calculate the interest rates (round your calculation to the nearest percentage point, e.g. 6% for 6.33% and 5.876%), for

a. 2012 and

b. 2013

2. How much does CM2 need to raise to pay for its total reported liabilities on the

a. 12/312012 balance sheet if it were to pay on 01/01/2013?

b. 12/312013 balance sheet if it were to pay on 01/01/2014 (ignoring 2a)?

Part II

Assuming that on January 1, 2014, CM2 borrows from Chase bank at 10% and uses this to pay off the reported total liabilities at 12/31/2013 (the amount in 2b above). Answer the questions under each of the various terms below:

3. Chase requires the borrowed amount along with interests to be repaid all in one lumpsum after three years.

a. What time value of money concept is this?

b. How much would CM2 pay Chase for the 12/31/2013 liabilities and at what date?

4. Chase requires the borrowed amount along with interests to be repaid in equal annual installments over three years beginning on 1/1/2014.

a. What time value of money concept is this?

b. How much would CM2 pay Chase each year?

5. Chase requires the borrowed amount along with interests to be repaid in equal annual installments over three years beginning on 12/31/2014.

a. What time value of money concept is this?

b. How much would CM2 pay each year?

6. Chase requires the borrowed amount along with interests to be repaid in equal annual installments over three years, beginning on 12/31/2017.

a. What time value of money concept is this?

b. How much would CM2 pay each year?

7. CM2 wishes to deposit equal annual amounts at the end of each year from 2014 through 2017 to pay back the money as stipulated in 6 above. The deposits would be made into a Chase sinking fund account that pays interest at 8% up to 12/31/2017.

a. What time value of money concept is this?

b. How much equal installment would CM2 have to deposit into the Chase Sinking Fund account each year?

Part III

8. CM2 is trying to determine the amount to set aside in order to have enough money on hand in 4 years to overhaul the engines on its vintage trucks. While there is some uncertainty about the cost of engine overhauls in 4 years, after conducting some research online, CM2 has developed the following estimates.

Engine Overhaul Probability

Estimated Cash Outflow Assessment

$ 50,000 10%

120,000 25%

200,000 50%

250,000 15%

Instructions:

a. How much should CM2 deposit today in a bank account earning 8%, compounded quarterly, so as to have enough money on hand in 4 years to pay for the overhaul?

b. What is the yield or effective rate of this bank account?

9. CM2 wishes to expand into manufacturing ice tea and would like to increase its market share in the North. In order to do so, CM2 has decided to locate a new factory in the Tea Lovers Haven area. CM2 will either buy or lease a site depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following three buildings:

Building A: Purchase for a cash price of $1,500,000, useful life 25 years.

Building B: Lease for 25 years with annual lease payments of $125,000 being made at the beginning of the year.

Building C: Purchase for $1,750,000 cash. This building is larger than needed; however, the excess space can be sublet for 25 years at a net annual rental of $21,000. Rental payments will be received at the end of each year. CM2 Inc. has no aversion to being a landlord.

Instructions:

In which building would you recommend that CM2 Inc. locate, assuming that an 8% cost of funds will be provided by CITIBANK?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started