Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello, I need some help with Dividend Discount Models. In pretty sure i use the Cash Dividend Disclunt model here but I'm unsure if the

Hello, I need some help with Dividend Discount Models. In pretty sure i use the Cash Dividend Disclunt model here but I'm unsure if the 1 year target price of 93.77 matters in this problem or not. So I would appreciate work being shown, thank you

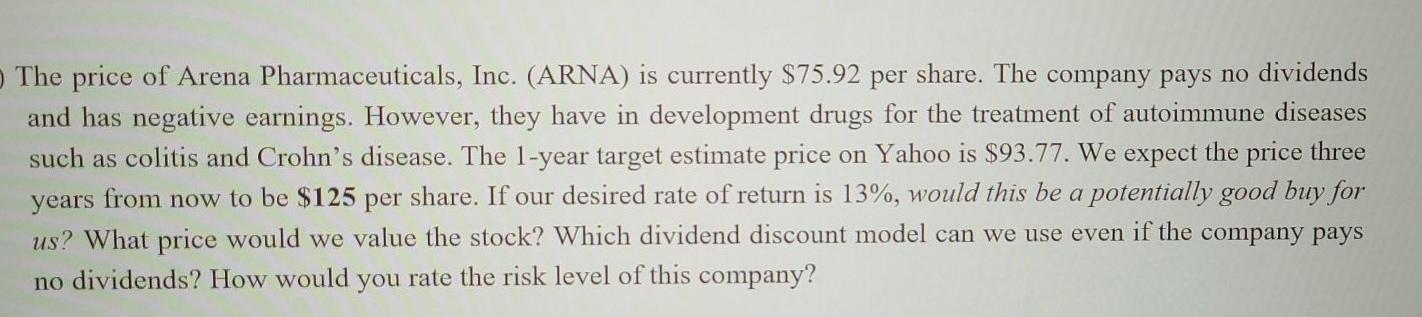

The price of Arena Pharmaceuticals, Inc. (ARNA) is currently $75.92 per share. The company pays no dividends and has negative earnings. However, they have in development drugs for the treatment of autoimmune diseases such as colitis and Crohn's disease. The 1-year target estimate price on Yahoo is $93.77. We expect the price three years from now to be $125 per share. If our desired rate of return is 13%, would this be a potentially good buy for us? What price would we value the stock? Which dividend discount model can we use even if the company pays no dividends? How would you rate the risk level of this company

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started