Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello, I only need help with questions 2 and 5 please! Mergers, Acquisitions, and Other Restructuring Activities Mergers, Acquisitions, and Other Restructuring Activities for NGC's

Hello,

I only need help with questions 2 and 5 please!

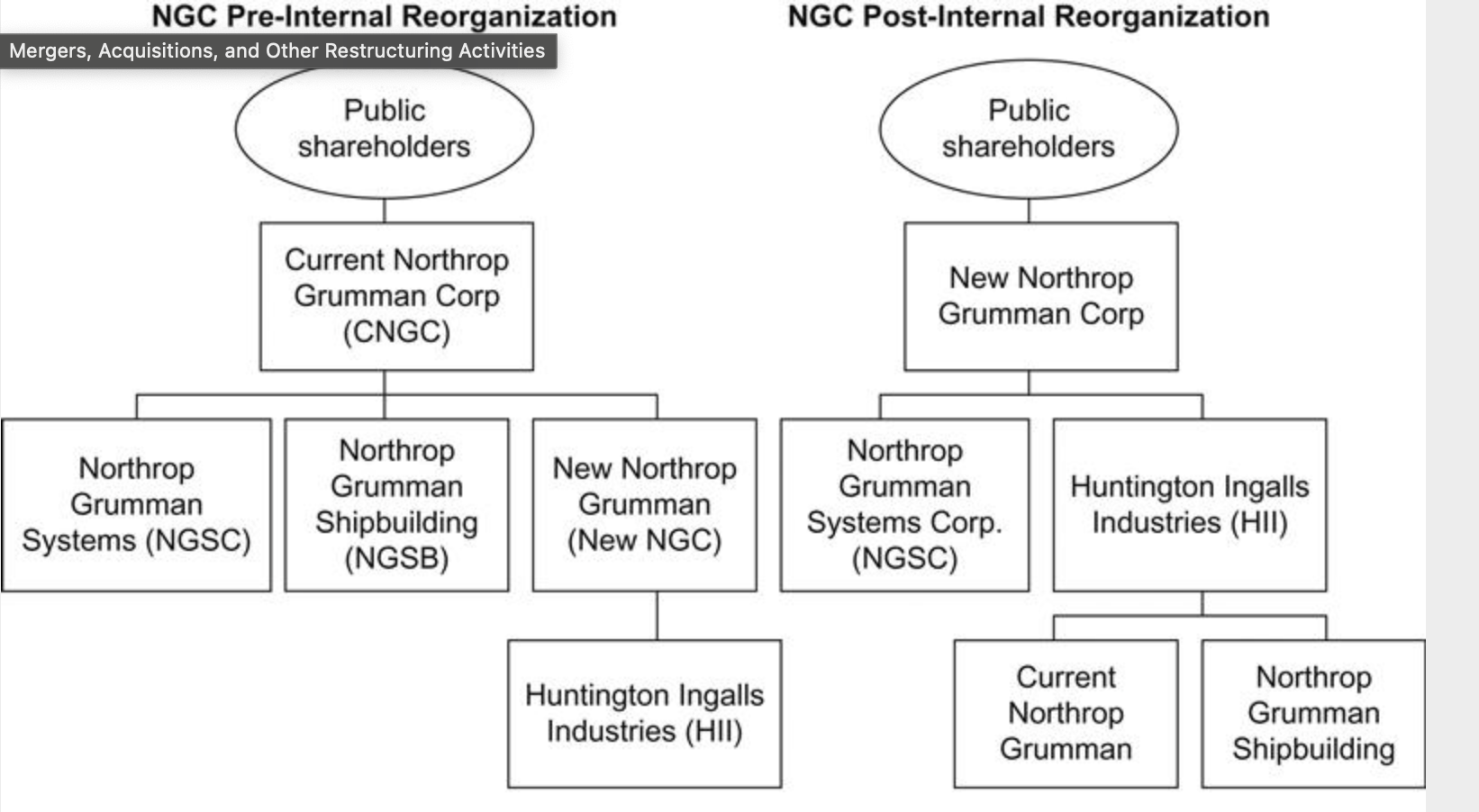

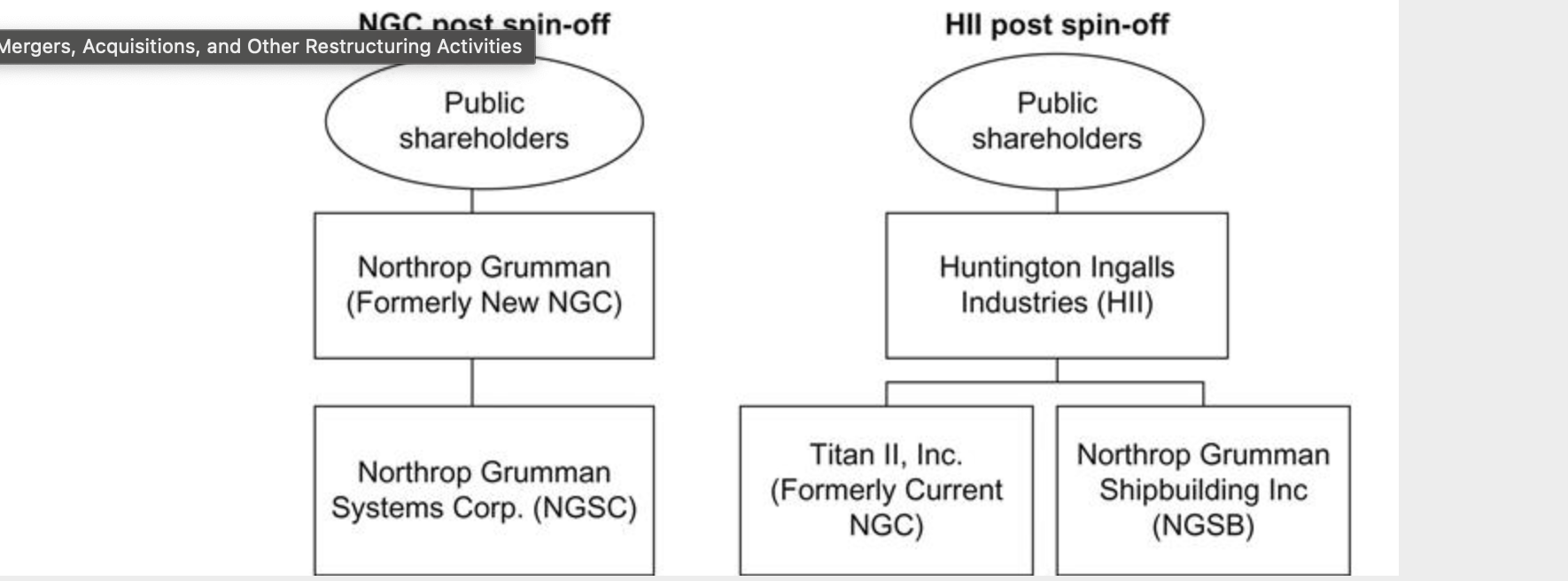

Mergers, Acquisitions, and Other Restructuring Activities Mergers, Acquisitions, and Other Restructuring Activities for NGC's shipbuilding business, which had been previously known as Northrop Grumman Shipbuilding (NGSB). NGSB's name was changed to Huntington Ingalls followed by the distribution of HII stock to NGC's common shareholders. changed its name to Northrop Grumman Corporation. The board of directors remained the same following the reorganization. reflecting the loss of HII's cash flows. of the spin-off. Consequently, HII put in place certain takeover defenses to make takeovers difficult. Discussion Questions restructuring strategies? 2. What is the likely impact of the spin-off on Northrop Grumman's share price immediately following the spin-off of Huntington Ingalls, assuming no other factors offset it? 3. Why do businesses that have been spun off from their parent often immediately put antitakeover defenses in place? 4. Why would the U.S. Internal Revenue Service be concerned about a change of control of the spun-off business? 5. Describe how you as an analyst would estimate the potential impact of the HII spin-off on the long-term value of Northrop Grumman's share price. Solutions to these questions are found in the Online Instructor's Manual available for instructors using this book. NGC Pre-Internal Reorganization Mergers, Acquisitions, and Other Restructuring Activities NGC Post-Internal Reorganization Northrop Grumman Shipbuilding In an effort to focus on more attractive growth markets, Northrop Grumman Corporation (NGC), a global leader in aerospace, communications, defense, and security systems, announced that it would exit its mature shipbuilding business on October 15, 2010. Huntington Ingalls Industries (HII), the largest military US shipbuilder and a Mergers, Acquisitions, and Other Restructuring Activities from the U.S. Navy. Nor did the outlook for the shipbuilding industry look like it would improve any time soon. Given the limited synergy between shipbuilding and NGC's other businesses, HII's operations were largely independent of NGC's other units. NGC's management and board argued that their decision to separate from the shipbuilding business would enable both NGC and HII to focus on those areas they knew best. Moreover, given the shipbuilding business's greater ongoing capital requirements, HII would find it easier to tap capital markets directly rather than to compete with other NGC operations for financing. Finally, investors would be better able to value businesses (NGC and HII) whose operations were more focused. After reviewing a range of options from outright sale to spin-off, NGC pursued a spin-off as the most efficient way to separate itself from its shipbuilding operations. If properly structured, spin-offs are tax free to shareholders. Furthermore, management argued that they could be completed in a timelier manner and were less disruptive to current operations than an outright sale of the business. The sale of the HII could have required a lengthy marketing period to potential buyers as well as a highly intrusive due diligence process by interested parties to any bidding process. The spin-off represented about one-sixth of NGC's \$36 billion in 2010 revenue. Effective March 31, 2011, all of the outstanding stock of HII was spun off to NGC shareholders through a pro rata distribution to shareholders of record on March 30, 2011. Each NGC shareholder received one HII common share for every six shares of NGC common stock held. 67 The spin-off process involved an internal reorganization of NGC businesses, a Separation and Distribution Agreement, and finally the actual distribution of HII shares to NGC shareholders. The internal reorganization and subsequent spin-off is illustrated in Figure 16.3. NGC (referred to as Current Northrop Grumman Corporation) first reorganized its businesses such that the firm would become a holding company whose primary investments would include HII and Northrop Grumman Systems Corporation (i.e., all other non-shipbuilding operations). Mergers, Acquisitions, and Other Restructuring Activities Mergers, Acquisitions, and Other Restructuring Activities for NGC's shipbuilding business, which had been previously known as Northrop Grumman Shipbuilding (NGSB). NGSB's name was changed to Huntington Ingalls followed by the distribution of HII stock to NGC's common shareholders. changed its name to Northrop Grumman Corporation. The board of directors remained the same following the reorganization. reflecting the loss of HII's cash flows. of the spin-off. Consequently, HII put in place certain takeover defenses to make takeovers difficult. Discussion Questions restructuring strategies? 2. What is the likely impact of the spin-off on Northrop Grumman's share price immediately following the spin-off of Huntington Ingalls, assuming no other factors offset it? 3. Why do businesses that have been spun off from their parent often immediately put antitakeover defenses in place? 4. Why would the U.S. Internal Revenue Service be concerned about a change of control of the spun-off business? 5. Describe how you as an analyst would estimate the potential impact of the HII spin-off on the long-term value of Northrop Grumman's share price. Solutions to these questions are found in the Online Instructor's Manual available for instructors using this book. NGC Pre-Internal Reorganization Mergers, Acquisitions, and Other Restructuring Activities NGC Post-Internal Reorganization Northrop Grumman Shipbuilding In an effort to focus on more attractive growth markets, Northrop Grumman Corporation (NGC), a global leader in aerospace, communications, defense, and security systems, announced that it would exit its mature shipbuilding business on October 15, 2010. Huntington Ingalls Industries (HII), the largest military US shipbuilder and a Mergers, Acquisitions, and Other Restructuring Activities from the U.S. Navy. Nor did the outlook for the shipbuilding industry look like it would improve any time soon. Given the limited synergy between shipbuilding and NGC's other businesses, HII's operations were largely independent of NGC's other units. NGC's management and board argued that their decision to separate from the shipbuilding business would enable both NGC and HII to focus on those areas they knew best. Moreover, given the shipbuilding business's greater ongoing capital requirements, HII would find it easier to tap capital markets directly rather than to compete with other NGC operations for financing. Finally, investors would be better able to value businesses (NGC and HII) whose operations were more focused. After reviewing a range of options from outright sale to spin-off, NGC pursued a spin-off as the most efficient way to separate itself from its shipbuilding operations. If properly structured, spin-offs are tax free to shareholders. Furthermore, management argued that they could be completed in a timelier manner and were less disruptive to current operations than an outright sale of the business. The sale of the HII could have required a lengthy marketing period to potential buyers as well as a highly intrusive due diligence process by interested parties to any bidding process. The spin-off represented about one-sixth of NGC's \$36 billion in 2010 revenue. Effective March 31, 2011, all of the outstanding stock of HII was spun off to NGC shareholders through a pro rata distribution to shareholders of record on March 30, 2011. Each NGC shareholder received one HII common share for every six shares of NGC common stock held. 67 The spin-off process involved an internal reorganization of NGC businesses, a Separation and Distribution Agreement, and finally the actual distribution of HII shares to NGC shareholders. The internal reorganization and subsequent spin-off is illustrated in Figure 16.3. NGC (referred to as Current Northrop Grumman Corporation) first reorganized its businesses such that the firm would become a holding company whose primary investments would include HII and Northrop Grumman Systems Corporation (i.e., all other non-shipbuilding operations)

Mergers, Acquisitions, and Other Restructuring Activities Mergers, Acquisitions, and Other Restructuring Activities for NGC's shipbuilding business, which had been previously known as Northrop Grumman Shipbuilding (NGSB). NGSB's name was changed to Huntington Ingalls followed by the distribution of HII stock to NGC's common shareholders. changed its name to Northrop Grumman Corporation. The board of directors remained the same following the reorganization. reflecting the loss of HII's cash flows. of the spin-off. Consequently, HII put in place certain takeover defenses to make takeovers difficult. Discussion Questions restructuring strategies? 2. What is the likely impact of the spin-off on Northrop Grumman's share price immediately following the spin-off of Huntington Ingalls, assuming no other factors offset it? 3. Why do businesses that have been spun off from their parent often immediately put antitakeover defenses in place? 4. Why would the U.S. Internal Revenue Service be concerned about a change of control of the spun-off business? 5. Describe how you as an analyst would estimate the potential impact of the HII spin-off on the long-term value of Northrop Grumman's share price. Solutions to these questions are found in the Online Instructor's Manual available for instructors using this book. NGC Pre-Internal Reorganization Mergers, Acquisitions, and Other Restructuring Activities NGC Post-Internal Reorganization Northrop Grumman Shipbuilding In an effort to focus on more attractive growth markets, Northrop Grumman Corporation (NGC), a global leader in aerospace, communications, defense, and security systems, announced that it would exit its mature shipbuilding business on October 15, 2010. Huntington Ingalls Industries (HII), the largest military US shipbuilder and a Mergers, Acquisitions, and Other Restructuring Activities from the U.S. Navy. Nor did the outlook for the shipbuilding industry look like it would improve any time soon. Given the limited synergy between shipbuilding and NGC's other businesses, HII's operations were largely independent of NGC's other units. NGC's management and board argued that their decision to separate from the shipbuilding business would enable both NGC and HII to focus on those areas they knew best. Moreover, given the shipbuilding business's greater ongoing capital requirements, HII would find it easier to tap capital markets directly rather than to compete with other NGC operations for financing. Finally, investors would be better able to value businesses (NGC and HII) whose operations were more focused. After reviewing a range of options from outright sale to spin-off, NGC pursued a spin-off as the most efficient way to separate itself from its shipbuilding operations. If properly structured, spin-offs are tax free to shareholders. Furthermore, management argued that they could be completed in a timelier manner and were less disruptive to current operations than an outright sale of the business. The sale of the HII could have required a lengthy marketing period to potential buyers as well as a highly intrusive due diligence process by interested parties to any bidding process. The spin-off represented about one-sixth of NGC's \$36 billion in 2010 revenue. Effective March 31, 2011, all of the outstanding stock of HII was spun off to NGC shareholders through a pro rata distribution to shareholders of record on March 30, 2011. Each NGC shareholder received one HII common share for every six shares of NGC common stock held. 67 The spin-off process involved an internal reorganization of NGC businesses, a Separation and Distribution Agreement, and finally the actual distribution of HII shares to NGC shareholders. The internal reorganization and subsequent spin-off is illustrated in Figure 16.3. NGC (referred to as Current Northrop Grumman Corporation) first reorganized its businesses such that the firm would become a holding company whose primary investments would include HII and Northrop Grumman Systems Corporation (i.e., all other non-shipbuilding operations). Mergers, Acquisitions, and Other Restructuring Activities Mergers, Acquisitions, and Other Restructuring Activities for NGC's shipbuilding business, which had been previously known as Northrop Grumman Shipbuilding (NGSB). NGSB's name was changed to Huntington Ingalls followed by the distribution of HII stock to NGC's common shareholders. changed its name to Northrop Grumman Corporation. The board of directors remained the same following the reorganization. reflecting the loss of HII's cash flows. of the spin-off. Consequently, HII put in place certain takeover defenses to make takeovers difficult. Discussion Questions restructuring strategies? 2. What is the likely impact of the spin-off on Northrop Grumman's share price immediately following the spin-off of Huntington Ingalls, assuming no other factors offset it? 3. Why do businesses that have been spun off from their parent often immediately put antitakeover defenses in place? 4. Why would the U.S. Internal Revenue Service be concerned about a change of control of the spun-off business? 5. Describe how you as an analyst would estimate the potential impact of the HII spin-off on the long-term value of Northrop Grumman's share price. Solutions to these questions are found in the Online Instructor's Manual available for instructors using this book. NGC Pre-Internal Reorganization Mergers, Acquisitions, and Other Restructuring Activities NGC Post-Internal Reorganization Northrop Grumman Shipbuilding In an effort to focus on more attractive growth markets, Northrop Grumman Corporation (NGC), a global leader in aerospace, communications, defense, and security systems, announced that it would exit its mature shipbuilding business on October 15, 2010. Huntington Ingalls Industries (HII), the largest military US shipbuilder and a Mergers, Acquisitions, and Other Restructuring Activities from the U.S. Navy. Nor did the outlook for the shipbuilding industry look like it would improve any time soon. Given the limited synergy between shipbuilding and NGC's other businesses, HII's operations were largely independent of NGC's other units. NGC's management and board argued that their decision to separate from the shipbuilding business would enable both NGC and HII to focus on those areas they knew best. Moreover, given the shipbuilding business's greater ongoing capital requirements, HII would find it easier to tap capital markets directly rather than to compete with other NGC operations for financing. Finally, investors would be better able to value businesses (NGC and HII) whose operations were more focused. After reviewing a range of options from outright sale to spin-off, NGC pursued a spin-off as the most efficient way to separate itself from its shipbuilding operations. If properly structured, spin-offs are tax free to shareholders. Furthermore, management argued that they could be completed in a timelier manner and were less disruptive to current operations than an outright sale of the business. The sale of the HII could have required a lengthy marketing period to potential buyers as well as a highly intrusive due diligence process by interested parties to any bidding process. The spin-off represented about one-sixth of NGC's \$36 billion in 2010 revenue. Effective March 31, 2011, all of the outstanding stock of HII was spun off to NGC shareholders through a pro rata distribution to shareholders of record on March 30, 2011. Each NGC shareholder received one HII common share for every six shares of NGC common stock held. 67 The spin-off process involved an internal reorganization of NGC businesses, a Separation and Distribution Agreement, and finally the actual distribution of HII shares to NGC shareholders. The internal reorganization and subsequent spin-off is illustrated in Figure 16.3. NGC (referred to as Current Northrop Grumman Corporation) first reorganized its businesses such that the firm would become a holding company whose primary investments would include HII and Northrop Grumman Systems Corporation (i.e., all other non-shipbuilding operations) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started